Vodafone 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance

Vodafone Group Plc Annual Report 2010 27

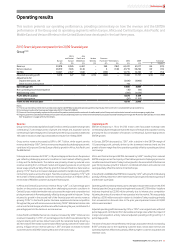

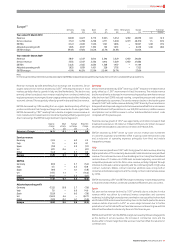

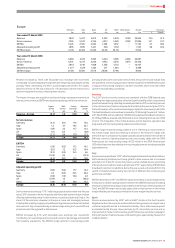

Europe(1)

Germany Italy Spain UK Other Eliminations Europe % change

£m £m £m £m £m £m £m £Organic

Year ended 31 March 2010

Revenue 8,008 6,027 5,713 5,025 5,354 (249) 29,878 0.8 (4.1)

Service revenue 7,722 5,780 5,298 4,711 5,046 (247) 28,310 1.5 (3.5)

EBITDA 3,122 2,843 1,956 1,141 1,865 – 10,927 (2.0) (7. 3)

Adjusted operating profit 1,695 2,107 1,310 155 1,651 – 6,918 (2.9) (8.9)

EBITDA margin 39.0% 47.2% 34.2% 22.7% 34.8% 36.6%

Year ended 31 March 2009

Revenue 7,847 5,547 5,812 5,392 5,329 (293) 29,634

Service revenue 7,535 5,347 5,356 4,912 5,029 (293) 27,886

EBITDA 3,225 2,565 2,034 1,368 1,957 – 11,149

Adjusted operating profit 1,835 1,839 1,421 328 1,702 – 7,125

EBITDA margin 41.1% 46.2% 35.0% 25.4% 36.7% 37.6%

Note:

(1) The Group revised how it determines and discloses segmental EBITDA and adjusted operating profit during the year. See note 3 to the consolidated financial statements.

Revenue increased by 0.8% benefiting from exchange rate movements. On an

organic basis service revenue declined by 3.5%(*) reflecting reductions in most

markets partially offset by growth in Italy and the Netherlands. The decline was

primarily driven by reduced voice revenue resulting from continued market and

regulatory pressure on pricing and slower usage growth as a result of the challenging

economic climate. This was partially offset by growth in data and fixed line revenue.

EBITDA decreased by 2.0% resulting from an organic decline partially offset by a

positive contribution from foreign exchange rate movements. On an organic basis,

EBITDA decreased by 7.3%(*) resulting from a decline in organic service revenue in

most markets and increased customer investment partially offset by operating and

direct cost savings. The EBITDA margin declined 1.0 percentage point.

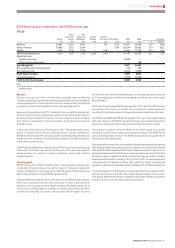

Organic M&A Foreign Reported

change activity exchange change

%pps pps %

Revenue – Europe (4.1) 0.1 4.8 0.8

Service revenue

Germany (3.5) – 6.0 2.5

Italy 1.9 – 6.2 8.1

Spain (7.0) – 5.9 (1.1)

UK (4.7) 0.6 – (4.1)

Other (5.4) – 5.7 0.3

Europe (3.5) 0.1 4.9 1.5

EBITDA

Germany (8.9) – 5.7 (3.2)

Italy 4.3 – 6.5 10.8

Spain (9.9) – 6.1 (3.8)

UK (17.7) 1.1 – (16.6)

Other (10.2) – 5.5 (4.7)

Europe (7.3) 0.1 5.2 (2.0)

Adjusted operating profit

Germany (13.2) (0.1) 5.7 (7.6)

Italy 7.8 – 6.8 14.6

Spain (13.8) – 6.0 (7.8)

UK (58.3) 5.6 – (52.7)

Other (9.3) 0.2 6.1 (3.0)

Europe (8.9) 0.2 5.8 (2.9)

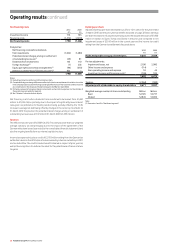

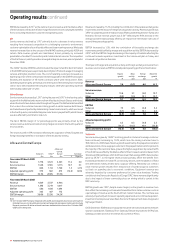

Germany

Service revenue declined by 3.5%(*) driven by a 5.0%(*) reduction in mobile revenue

partly offset by a 1.3%(*) improvement in fixed line revenue. The mobile revenue

decline was driven by a decrease in voice revenue impacted by a termination rate cut

effective from April 2009, reduced roaming, competitive pressure and continued

tariff optimisation by customers. The service revenue decline in the fourth quarter

slowed to 1.6%(*) with mobile revenue declining 1.8%(*) driven by the acceleration in

data growth and improved usage trends. Data revenue benefited from an increase in

Superflat Internet tariff penetration to over 500,000 customers, a 46% increase in

smartphones and an 85% increase in active Vodafone Mobile Connect cards

compared with the previous year.

Fixed line revenue growth of 1.3%(*) was supported by a 0.4 million increase in fixed

broadband customers to 3.5 million at 31 March 2010 and a 0.2 million increase in

wholesale fixed broadband customers to 0.4 million at 31 March 2010.

EBITDA declined by 8.9%(*) driven by lower service revenue and investment

in customer acquisition and retention offset in part by lower interconnect costs

and a reduction of operating expenses principally from fixed and mobile

integration synergies.

Italy

Service revenue growth was 1.9%(*) with strong growth in data revenue, driven by

higher penetration of PC connectivity devices and mobile internet services, and fixed

revenue. The continued success of dual branding led to a closing fixed broadband

customer base of 1.3 million on a 100% basis. Increased regulatory, economic and

competitive pressures led to the fall in voice revenue partially mitigated through

initiatives to stimulate customer spending and the continued growth in high value

contract customers. Mobile contract customer additions were strong both in

consumer and enterprise segments and the closing contract customer base was up

by 14.5%.

EBITDA increased by 4.3%(*) and EBITDA margin increased by 1.0 percentage point as

a result of increased revenue, continued operational efficiencies and cost control.

Spain

Full year service revenue declined by 7.0%(*) primarily due to a decline in voice

revenue which was driven by continued intense competition and economic

weakness, including high unemployment, termination rate cuts effective from April

and October 2009 and increased involuntary churn. In the fourth quarter the service

revenue decline improved to 6.2%(*) as voice usage increased due to further

penetration of our flat rate tariffs and fixed line revenue continued to grow with 0.6

million fixed broadband customers by the end of the financial year.

EBITDA declined 9.9%(*) and the EBITDA margin decreased by 0.8 percentage points

as the decline in service revenue, the increase in commercial costs and the

dilutive effect of lower margin fixed line services more than offset the reduction in

overhead costs.