Vodafone 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Vodafone Group Plc Annual Report 2010

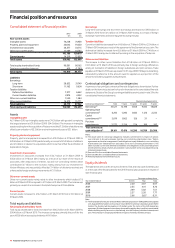

Consolidated statement of nancial position

2010 2009

£m £m

Non-current assets

Intangible assets 74,258 74,938

Property, plant and equipment 20,642 19,250

Investments in associates 36,377 34,715

Other non-current assets 11,489 10,767

142,766 139,670

Current assets 14,219 13,029

Total assets 156,985 152,699

Total equity shareholders’ funds 90,381 86,162

Total non-controlling interests 429 (1,385)

Total equity 90,810 84,777

Liabilities

Borrowings

Long-term 28,632 31,749

Short-term 11,163 9,624

Taxation liabilities

Deferred tax liabilities 7,377 6,642

Current taxation liabilities 2,874 4,552

Other non-current liabilities 1,550 1,584

Other current liabilities 14,579 13,771

Total liabilities 66,175 67,922

Total equity and liabilities 156,985 152,699

Assets

Intangible assets

At 31 March 2010 our intangible assets were £74.3 billion with goodwill comprising

the largest element at £51.8 billion (2009: £54.0 billion). The increase in intangible

assets resulting from the acquisition of Vodacom and the £1.5 billion of additions was

offset by amortisation of £3.5 billion and net impairment losses of £2.1 billion.

Property, plant and equipment

Property, plant and equipment increased from £19.3 billion at 31 March 2009 to

£20.6 billion at 31 March 2010 predominantly as a result of £5.0 billion of additions

and £1.6 billion in relation to acquisitions which more than offset the £4.5 billion of

depreciation charges.

Investments in associates

Investments in associates increased from £34.7 billion at 31 March 2009 to

£36.4 billion at 31 March 2010 mainly as a result of our share of the results of

associates, after deductions of interest, tax and non-controlling interest which

contributed £4.7 billion to the increase, mainly arising from our investment in

Verizon Wireless, and was partially offset by £1.4 billion of dividends received and

unfavourable foreign exchange movements of £1.1 billion.

Other non-current assets

Other non-current assets mainly relate to other investments which totalled £7.6

billion at 31 March 2010 compared to £7.1 billion at 31 March 2009. The increase was

primarily as a result of an increase in the listed share price of China Mobile.

Current assets

Current assets increased to £14.2 billion at 31 March 2010 from £13.0 billion at

31 March 2009.

Total equity and liabilities

Total equity shareholders’ funds

Total equity shareholders’ funds increased from £86.2 billion at 31 March 2009 to

£90.4 billion at 31 March 2010. The increase comprises primarily the profit for the

year of £8.6 billion less equity dividends of £4.1 billion.

Borrowings

Long-term borrowings and short-term borrowings decreased to £39.8 billion at

31 March 2010 from £41.4 billion at 31 March 2009 mainly as a result of foreign

exchange movements and bond repayments during the year.

Taxation liabilities

Current tax liabilities decreased from £4.6 billion at 31 March 2009 to £2.9 billion at

31 March 2010 mainly as a result of the agreement of the German tax loss claim. The

deferred tax liability increased from £6.6 billion at 31 March 2009 to £7.4 billion at

31 March 2010 mainly due to deferred tax arising on the acquisition of Vodacom.

Other current liabilities

The increase in other current liabilities from £13.8 billion at 31 March 2009 to

£14.6 billion at 31 March 2010 was primarily due to foreign exchange differences

arising on translation of liabilities in foreign subsidiaries and joint ventures. Trade

payables at 31 March 2010 were equivalent to 31 days (2009: 38 days) outstanding,

calculated by reference to the amount owed to suppliers as a proportion of the

amounts invoiced by suppliers during the year.

Contractual obligations and contingencies

A summary of our principal contractual financial obligations is shown below. Further

details on the items included can be found in the notes to the consolidated financial

statements. Details of the Group’s contingent liabilities are included in note 29 to the

consolidated financial statements.

Payments due by period £m

Contractual obligations(1) Total <1 year 1-3 years 3-5 years >5 years

Borrowings(2) 47,527 12,198 7, 858 9,443 18,028

Operating lease

commitments(3) 6,243 1,200 1,682 1,126 2,235

Capital

commitments(3)(4) 2,019 1,862 126 31 –

Purchase

commitments 3,372 2,216 724 189 243

Total contractual

cash obligations(1) 59,161 17,476 10,390 10,789 20,506

Notes:

(1) The above table of contractual obligations excludes commitments in respect of options

over interests in Group businesses held by non-controlling shareholders (see “Option

agreements and similar arrangements”) and obligations to pay dividends to non-controlling

shareholders (see “Dividends from associates and to non-controlling shareholders”). The

table excludes current and deferred tax liabilities and obligations under post employment

benefit schemes, details of which are provided in notes 6 and 23 to the consolidated financial

statements respectively.

(2) See note 22 to the consolidated financial statements.

(3) See note 28 to the consolidated financial statements.

(4) Primarily related to network infrastructure.

Equity dividends

The table below sets out the amounts of interim, final and total cash dividends paid

or, in the case of the final dividend for the 2010 financial year, proposed, in respect of

each financial year.

Pence per ordinary share

Year ended 31 March Interim Final Total

2006 2.20 3.87 6.07

2007 2.35 4.41 6.76

2008 2.49 5.02 7.51

2009 2.57 5.20 7.77

2010 2.66 5.65(1) 8.31

Note:

(1) The final dividend for the year ended 31 March 2010 was propos ed on 18 May 2010 and is payable

on 6 August 2010 to holders on record as of 4 June 2010. For american depositary share (‘ADS’)

holders the dividend will be payable in US dollars under the terms of the ADS depositary

agreement. Dividend payments on ordinary shares will be paid by direct credit into a nominated

bank or building society account or, alternatively, into the Company’s dividend reinvestment

plan. The Company no longer pays dividends in respect of ordinary shares by cheque.

Financial position and resources