Vodafone 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance

Vodafone Group Plc Annual Report 2010 37

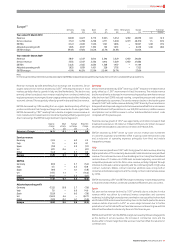

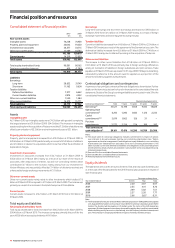

2011 nancial year and three year guidance

2010

actual 2011 Three year

performance guidance guidance

£bn £bn £bn

Adjusted operating profit 11.5 11.2 – 12.0 n/a

Free cash flow 7.2

In excess

of 6.5 6.0 – 7.0

2011 nancial year

We expect the Group to return to low levels of organic revenue growth during the

2011 financial year although this will be dependent upon the strength of the

economic environment and the level of unemployment within Europe. In contrast

revenue growth in emerging economies, in particular India and Africa, is expected to

continue as the Group drives penetration and data in these markets.

EBITDA margins are expected to decline but at a significantly lower rate than that

experienced in the previous year. Adjusted operating profit is expected to be in the

range of £11.2 billion to £12.0 billion. Total depreciation and amortisation charges are

expected to be slightly higher than the prior year, before the impact of licence and

spectrum purchases, if any, during the 2011 financial year.

Free cash flow is expected to be in excess of £6.5 billion reflecting a continued but

lower level of benefit from the working capital improvement programme launched

in the 2010 financial year. We intend to maintain capital expenditure at a similar level

to last year, adjusted for foreign exchange, ensuring that we continue to invest in high

speed data networks, enhancing our customer experience and increasing the

attractiveness of the Group’s data services.

The adjusted tax rate percentage is expected to be in the mid 20s for the 2011

financial year with the Group targeting a similar level in the medium-term. The Group

continues to seek resolution of the UK Controlled Foreign Company and India

tax cases.

Three year free cash ow and dividend per share

growth target

We expect that annual free cash flow will be between £6.0 billion and £7.0 billion, in

each of the financial years in the period ending 31 March 2013, underpinning a

dividend per share growth target of at least 7% per annum for each of these financial

years. We therefore expect that total dividends per share will be no less than 10.18p

for the 2013 financial year.

Assumptions

Guidance is based on our current assessment of the global economic outlook and

assumes foreign exchange rates of £1:€1.15 and £1:US$1.50 throughout this three

year period. It excludes the impact of licence and spectrum purchases, if any, material

one-off tax settlements and restructuring costs and assumes no material change to

the current structure of the Group.

With respect to the dividend growth target, as the Group’s free cash flow is

predominantly generated by companies operating within the euro currency zone,

we have assumed that the euro to sterling rate remains within 10% of the above

guidance exchange rate.

A 1% change in the euro to sterling exchange rate would impact adjusted

operating profit by approximately £70 million and free cash flow by approximately

£60 million.

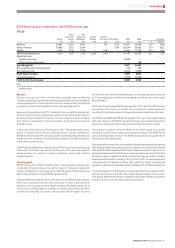

2010 nancial year

Adjusted

operating Free

profit cash flow

£bn £bn

Guidance – May 2009(1) 11.0 – 11.8 6.0 – 6.5

Guidance – February 2010(1) 11.4 – 11. 8 6.5 – 7.0

2010 actual performance 11.5 7.2

Foreign exchange 0.2 0.1

Alltel restructuring costs(2) 0.2 –

2010 performance on guidance basis 11.9 7.3

Notes:

(1) The Group’s guidance reflected assumptions for average for exchange rates for the 2010 financial

year of approximately £1:€1.12 and £1:US$1.50. Actual exchange rates were £1:€1.13 and

£1:US$1.60.

(2) The Group’s guidance did not include the impact of reorganisation costs arising from the Alltel

acquisition by Verizon Wireless.

Guidance