Vodafone 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 Vodafone Group Plc Annual Report 2010

In a challenging economic environment our nancial results exceeded our guidance on all

measures, we increased our commercial focus, delivered our cost reduction targets ahead of

schedule and maintained strong capital investment levels.

Chief Executive’s review

Financial review of the year

2010 financial results were ahead of guidance on all measures.

Increased revenue contribution from our targeted growth

areas in data, fixed line and emerging markets.

Free cash flow generation of £7.2 billion, up 26.5%.

We have made significant progress in implementing our strategy. We

now generate 33% of service revenue from products other than mobile

voice reflecting the shift of Vodafone to a total communications provider.

In particular, mobile data and fixed broadband services continue to grow

while we increased the contribution being made by our operations in

emerging economies, primarily by gaining market share. We have

reduced costs and working capital to manage better in the recessionary

environment while maintaining investment in our networks.

As a result, Vodafone’s financial results are ahead of the guidance

range we issued in May 2009 and the upgraded guidance we issued in

February 2010. The Group generated free cash flow of approximately

£1 billion ahead of our medium-term target established in November

2008 even after adjusting for beneficial foreign exchange.

The economic situation has remained challenging throughout the year

affecting our business in several ways. In our more mature European

and Central European operations, voice and messaging revenue

declined and roaming revenue fell due to lower business and leisure

travel. In addition, enterprise revenue declined in Europe as our business

customers reduced activity and headcount. However, results in Africa

and India remained robust driven by continued, albeit lower, GDP

growth and increasing market penetration. During the course of the

financial year t he impact of the global slowdown on the Group’s f inancial

performance has diminished somewhat with Group service revenue

declining in the fourth quarter by only 0.2%(*), better than the preceding

three quarters and the second successive quarterly improvement.

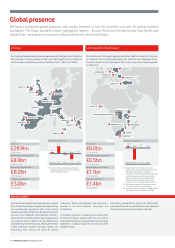

In the full year Group revenue increased by 8.4% to £44.5 billion,

declining 2.3%(*) after excluding benefits from foreign exchange and

acquisitions. The Group’s EBITDA margin declined by 2.2 percentage

points to 33.1%, in line with our expectations, primarily as a result of

lower revenue in Europe and the greater weight of lower margin

operations in emerging economies. Group adjusted operating profit

was £11.5 billion, with a growing contribution from Verizon Wireless and

foreign exchange benefits offsetting weaker performance in Europe.

Group free cash flow was £7.2 billion, up 26.5%, benefiting from

significant improvements in working capital management and a

deferred dividend from Verizon Wireless. This exceptional level of cash

flow was generated whilst maintaining capital investment, developing

fixed broadband services in Europe, funding the turnaround in Turkey

and Ghana, and expanding in India.

At the year end we had 341 million proportionate mobile customers

worldwide.

Europe service revenue declined by 3.5%(*). Data and fixed line

revenue growth was strong but this was more than offset by ongoing

voice price reduction and lower volume growth in our core voice

products. Europe’s EBITDA margin declined by 1.0 percentage point,

at about the same rate as the previous year, reflecting lower revenue,

increased commercial activity, reduced cost and the increased

contribution from lower margin fixed broadband. Operating free cash

flow was strong at £8.2 billion.

Africa and Central Europe service revenue declined by 1.2%(*), with

good revenue growth at Vodacom and a much stronger result in

Turkey being offset by the impact of weaker economies in Central

Europe. The EBITDA margin declined by around 2 percentage points,

due to lower profitability in Turkey where we have focused on

investment in the network, distribution, driving market share and

brand visibility.

Asia Pacific and Middle East service revenue increased by 9.8%(*),

reflecting another strong contribution from India where service

revenue grew by 14.7%(*). During the 2010 financial year we attracted

32 million customers in India and in March we exceeded the 100

million customer mark. In a very competitive pricing environment we

were pleased to have confirmed our number two position in the

market. Since Vodafone’s entry into India in 2007, our performance has

been strong. We have gained about 1 percentage point per annum in

revenue market share, added 72 million customers, moved the

business into operating free cash flow generation and launched Indus

Vittorio Colao Chief Executive

Free cash flow

£7.2bn

up 26.5%