Vodafone 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance

Vodafone Group Plc Annual Report 2010 43

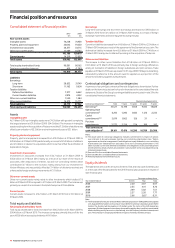

At 31 March 2010 we had £4,423 million of cash and cash equivalents which are held

in accordance with our treasury policy.

We hold cash and liquid investments in accordance with the counterparty and

settlement risk limits of the Board approved treasury policy. The main forms of liquid

investments at 31 March 2010 were money market funds, commercial paper and

bank deposits.

Net debt decreased by £907 million to £33,316 million primarily due to the impact of

foreign exchange rate movements which decreased net debt by £1,038 million. The

£7,241 million free cash flow generated during the year was primarily used to fund

£4,139 million of dividend payments to shareholders, the additional stake in Vodacom

purchased during the year as well spectrum purchases in Turkey, Egypt and Italy. Net

debt represented 41.6% of our market capitalisation at 31 March 2010 compared with

53.1% at 31 March 2009. Average net debt at month end accounting dates over the

12 month period ended 31 March 2010 was £32,280 million and ranged between

£30,363 million and £34,001 million during the year.

The cash received from collateral support agreements mainly reflects the value

of our interest rate swap portfolio which is substantially net present value positive.

See note 21 to the consolidated financial statements for further details on

these agreements.

Credit ratings

Consistent with the development of our strategy we target, on average, a low single

A long-term credit rating. As of 17 May 2010 the credit ratings were as follows:

Rating agency Rating date Type of debt Rating Outlook

Standard & Poor’s 30 May 2006 Short-term A-2

30 May 2006 Long-term A- Negative

Moody’s 30 May 2006 Short-term P-2

16 May 2007 Long-term Baa1 Stable

Fitch Ratings 30 May 2006 Short-term F2

30 May 2006 Long-term A- Negative

Our credit ratings enable us to have access to a wide range of debt finance including

commercial paper, bonds and committed bank facilities. Credit ratings are not a

recommendation to purchase, hold or sell securities in as much as ratings do not

comment on market price or suitability for a particular investor and are subject to

revision or withdrawal at any time by the assigning rating organisation. Each rating

should be evaluated independently.

Commercial paper programmes

We currently have US and euro commercial paper programmes of US$15 billion and

£5 billion respectively which are available to be used to meet short-term liquidity

requirements. At 31 March 2010 amounts external to the Group of €2,491 million

(£2,219 million), £161 million and US$33 million (£22 million) were drawn under the

euro commercial paper programme and US$245 million (£161 million) was drawn

down under the US commercial paper programme, with such funds being provided

by counterparties external to the Group. At 31 March 2009 US$1,412 million (£987

million) was drawn under the US commercial paper programme and €1,340 million

(£1,239 million), £357 million and US$108 million (£76 million) was drawn under the

euro commercial paper programme. The commercial paper facilities were supported

by US$9.1 billion (£6.4 billion) of committed bank facilities (see “Committed

facilities”), comprised of a US$4.1 billion revolving credit facility that matures on 28

July 2011 and a US$5 billion revolving credit facility that matures on 22 June 2012.

At 31 March 2010 and 31 March 2009 no amounts had been drawn under either

bank facility.

Bonds

We have a €30 billion euro medium-term note programme and a US shelf programme

which are used to meet medium to long-term funding requirements. At 31 March

2010 the total amounts in issue under these programmes split by currency were

US$13.2 billion, £2.6 billion, €11.8 billion and £0.2 billion sterling equivalent of

other currencies.

In the year ended 31 March 2010 bonds with a nominal value equivalent of £3.9 billion

at the relevant 31 March 2010 exchange rates were issued under the US shelf and the

euro medium-term note programme. The bonds issued during the year were:

Nominal Sterling

amount equivalent

Date of bond issue Maturity of bond Million Million

April 2009 November 2012 €250 229

June 2009 December 2017 £600 600

June 2009 June 2014 US$1,250 780

June 2009 June 2019 US$1,250 780

November 2009 November 2015 US$500 329

January 2010 January 2022 €1,250 1,113

At 31 March 2010 we had bonds outstanding with a nominal value of £21,963 million

(2009: £23,754 million).

Committed facilities

The following table summarises the committed bank facilities available to us at

31 March 2010.

Committed bank facilities Amounts drawn

29 July 2008

US$4.1 billion revolving credit

facility, maturing 28 July 2011

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and may

be used for general corporate purposes

including acquisitions.

24 June 2005

US$5 billion revolving credit

facility, maturing 22 June 2012

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and may

be used for general corporate purposes

including acquisitions.

21 December 2005

¥258.5 billion term credit facility,

maturing 16 March 2011, entered

into by Vodafone Finance K.K.

and guaranteed by the Company

The facility was drawn down in full on

21 December 2005. The facility is

available for general corporate purposes,

although amounts drawn must be on-lent

to the Company.

16 November 2006

€0.4 billion loan facility,

maturing 14 February 2014

The facility was drawn down in full on

14 February 2007. The facility is available

for financing capital expenditure in our

Turkish operating company.

28 July 2008

€0.4 billion loan facility,

maturing 12 August 2015

The facility was drawn down in full on

12 August 2008. The facility is available for

financing the roll out of converged fixed

mobile broadband telecommunications.

14 September 2009

€0.4 billion loan facility, available

for 18 months, repayment is the

seventh year anniversary of the

first advance drawn within

the availability period ending

March 2011

No drawings have been made against

this facility. The facility is available for

financing capital expenditure in our

German operations.

29 September 2009

US$0.7 billion export credit

agency loan facility, maturing

16 September 2018

No drawings have been made against this

facility. The facility is available for financing

eligible Swedish goods and services.