Vodafone 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Vodafone Group Plc Annual Report 2010

Financial position and resources continued

distributions above the level of the tax distributions. However the Verizon Wireless

board has agreed that it will review distributions from Verizon Wireless on an annual

basis. When considering whether distributions will be made each year, the Verizon

Wireless board will take into account its debt position, the relationship between

debt levels and maturities and overall market conditions in the context of the five

year business plan. It is expected that Verizon Wireless’ free cash flow will be

deployed in servicing and reducing debt in the near term. The 2010 financial year

benefited from a US$250 million gross tax distribution deferred from the 2009

financial year to April 2009.

During the year ended 31 March 2010 cash dividends totalling £389 million (2009:

£303 million) were received from SFR. Following SFR’s purchase of Neuf Cegetel it

was agreed that SFR would partially fund debt repayments by a reduction in

dividends between 2009 and 2011 inclusive.

Verizon Communications Inc. has an indirect 23.1% shareholding in Vodafone Italy

and under the shareholders’ agreement the shareholders have agreed to take

steps to cause Vodafone Italy to pay dividends at least annually, provided that such

dividends will not impair the financial condition or prospects of Vodafone Italy

including, without limitation, its credit standing. During the 2010 financial year

Vodafone Italy paid dividends net of withholding tax totalling €626 million to

Verizon Communications Inc.

The Vodafone Essar shareholders’ agreement provides for the payment of dividends

to non-controlling partners under certain circumstances but not before May 2011.

Given Vodacom’s strong financial position and cash flow generation, the Vodacom

board has decided to increase its dividend payout ratio from 40% to approximately

60% of headline earnings for the year ended March 2011.

Acquisitions

We invested a net £1,777(1) million in acquisition activities during the year ended

31 March 2010. An analysis of the significant transactions in the 2010 financial year

including changes to our effective shareholding is shown in the table below.

Further details of the acquisitions are provided in note 26 to the consolidated

financial statements.

£m

Vodacom (15%) 1,577

Other net acquisitions and disposals, including investments 200

Total 1,777

Note:

(1) Amounts are shown net of cash and cash equivalents acquired or disposed.

On 20 April 2009 we acquired an additional 15.0% stake in Vodacom for cash

consideration of ZAR 20.6 billion (£1.6 billion). On 18 May 2009 Vodacom became a

subsidiary following the listing of its shares on the Johannesburg Stock Exchange and

concurrent termination of the shareholder agreement with Telkom SA Limited, the

seller and previous joint venture partner. During the period from 20 April 2009 to 18

May 2009 the Group continued to account for Vodacom as a joint venture,

proportionately consolidating 65% of the results of Vodacom.

On 10 May 2009 Vodafone Qatar completed a public offering of 40.0% of its

authorised share capital raising QAR3.4 billion (£0.6 billion). The shares were listed

on the Qatar Exchange on 22 July 2009. Qatar launched full services on its network

on 7 July 2009.

On 9 June 2009 Vodafone Australia completed its merger with Hutchison 3G Australia

to form a 50:50 joint venture, Vodafone Hutchison Australia Pty Limited, which, in due

course, will market its products and services solely under the Vodafone brand. To

equalise the value difference between the respective businesses Vodafone will

receive a deferred payment of AUS$500 million which is expected to be received in

the 2011 financial year. The combined business is proportionately consolidated as a

joint venture.

In December 2009 we acquired a 49% interest in each of two companies that hold

indirect equity interests in Vodafone Essar Limited following the partial exercise of

options which are described under “Option agreements and similar arrangements”

on page 44. As a result we increased our aggregate direct and indirect equity interest

in Vodafone Essar Limited from 51.58% to 57.59%.

Treasury shares

The Companies Act 2006 permits companies to purchase their own shares out of

distributable reserves and to hold shares in treasury. While held in treasury, no voting

rights or pre-emption rights accrue and no dividends are paid in respect of treasury

shares. Treasury shares may be sold for cash, transferred (in certain circumstances)

for the purposes of an employee share scheme or cancelled. If treasury shares are

sold, such sales are deemed to be a new issue of shares and will accordingly count

towards the 5% of share capital which the Company is permitted to issue on a non

pre-emptive basis in any one year as approved by its shareholders at the AGM. The

proceeds of any sale of treasury shares up to the amount of the original purchase

price, calculated on a weighted average price method, is attributed to distributable

profits which would not occur in the case of the sale of non-treasury shares. Any

excess above the original purchase price must be transferred to the share premium

account. The Company did not repurchase any of its own shares between 1 April

2009 and 31 March 2010.

Shares purchased are held in treasury in accordance with sections 724 to 732 of the

Companies Act 2006. The movement in treasury shares during the 2010 financial

year is shown below:

Number

Million £m

1 April 2009 5,322 8,036

Reissue of shares (149) (189)

Other (27) (37)

31 March 2010 5,146 7,810

Funding

We have maintained a robust liquidity position throughout the year thereby enabling

us to service shareholder returns, debt and expansion through capital investment.

This position has been achieved through continued delivery of strong operating cash

flows, the impact of the working capital reduction programme, issuances on short-

term and long-term debt markets and non-recourse borrowing assumed in respect

of the emerging market business. It has not been necessary for us to draw down on

our committed bank facilities during the year.

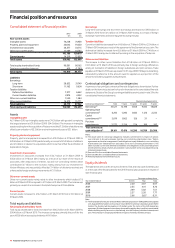

Net debt

Our consolidated net debt position at 31 March was as follows:

2010 2009

£m £m

Cash and cash equivalents(1) 4,423 4,878

Short-term borrowings:

Bonds (1,174) (5,025)

Commercial paper(2) (2,563) (2,659)

Put options over non-controlling interests (3,274) –

Bank loans (3,460) (893)

Other short-term borrowings(1) (692) (1,047)

(11,163) (9,624)

Long-term borrowings:

Put options over non-controlling interests (131) (3,606)

Bonds, loans and other long-term borrowings (28,501) (28,143)

(28,632) (31,749)

Other financial instruments(3) 2,056 2,272

Net debt (33,316) (34,223)

Notes:

(1) At 31 March 2010 the amount includes £604 million (2009: £691 million) in relation to collateral

support agreements.

(2) At 31 March 2010 US$245 million was drawn under the US commercial paper programme and

amounts of €2,491 million, £161 million and US$33 million were drawn under the euro

commercial paper programme.

(3) Comprises i) mark-to-market adjustments on derivative financial instruments which are included

as a component of trade and other receivables (2010: £2,128 million; 2009: £2,707 million) and

trade and other payables (2010: £460 million; 2009: £435 million) and ii) short-term investments

in index linked government bonds included as a component of other investments (2010: £388

million; 2009: £nil). These government bonds have less than six years to maturity, can be readily

converted into cash via the repurchase market and are held on an effective floating rate basis.