Vodafone 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 Vodafone Group Plc Annual Report 2010

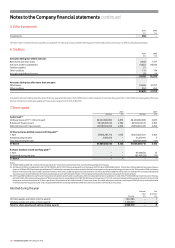

Notes to the Company nancial statements

1. Basis of preparation

The separate financial statements of the Company are drawn up in accordance with

the Companies Act 2006 and UK GAAP.

The preparation of Company financial statements in conformity with generally

accepted accounting principles requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the Company financial statements

and the reported amounts of revenue and expenses during the reporting period.

Actual results could differ from those estimates. The estimates and underlying

assumptions are reviewed on an ongoing basis. Revisions to accounting estimates

are recognised in the period in which the estimate is revised if the revision affects only

that period or in the period of the revision and future periods if the revision affects

both current and future periods.

As permitted by section 408(3) of the Companies Act 2006, the profit and loss

account of the Company is not presented in this annual report. These separate

financial statements are not intended to give a true and fair view of the profit or loss

or cash flows of the Company. The Company has not published its individual cash

flow statement as its liquidity, solvency and financial adaptability are dependent on

the Group rather than its own cash flows.

The Company has taken advantage of the exemption contained in FRS 8 “Related

Party Disclosures” and has not reported transactions with fellow Group undertakings.

The Company has taken advantage of the exemption contained in FRS 29 “Financial

Instruments: Disclosures” and has not produced any disclosures required by that

standard, as disclosures that comply with FRS 29 are available in the Vodafone Group

Plc annual report for the year ended 31 March 2010.

2. Signicant accounting policies

The Company’s significant accounting policies are described below.

Accounting convention

The Company financial statements are prepared under the historical cost convention

and in accordance with applicable accounting standards of the UK Accounting

Standards Board and pronouncements of the Urgent Issues Task Force.

Investments

Shares in Group undertakings are stated at cost less any provision for impairment.

The Company assesses investments for impairment whenever events or changes in

circumstances indicate that the carrying value of an investment may not be

recoverable. If any such indication of impairment exists, the Company makes an

estimate of the recoverable amount. If the recoverable amount of the cash-

generating unit is less than the value of the investment, the investment is considered

to be impaired and is written down to its recoverable amount. An impairment loss is

recognised immediately in the profit and loss account.

For available-for-sale investments, gains and losses arising from changes in fair value

are recognised directly in equity, until the investment is disposed of or is determined

to be impaired, at which time the cumulative gain or loss previously recognised in

equity, determined using the weighted average cost method, is included in the net

profit or loss for the period.

Foreign currencies

Transactions in foreign currencies are initially recorded at the rates of exchange

prevailing on the dates of the transactions. Monetary assets and liabilities

denominated in foreign currencies are retranslated into the Company’s functional

currency at the rates prevailing on the balance sheet date. Non-monetary items

carried at fair value that are denominated in foreign currencies are retranslated at the

rates prevailing on the initial transaction dates. Non-monetary items measured in

terms of historical cost in a foreign currency are not retranslated.

Exchange differences arising on the settlement of monetary items, and on the

retranslation of monetary items, are included in the profit and loss account for the

period. Exchange differences arising on the retranslation of non-monetary items

carried at fair value are included in the profit and loss account for the period.

Borrowing costs

All borrowing costs are recognised in the profit and loss account in the period in

which they are incurred.

Taxation

Current tax, including UK corporation tax and foreign tax, is provided at amounts

expected to be paid (or recovered) using the tax rates and laws that have been

enacted or substantively enacted by the balance sheet date.

Deferred tax is provided in full on timing differences that exist at the balance sheet

date and that result in an obligation to pay more tax, or a right to pay less tax in the

future. The deferred tax is measured at the rate expected to apply in the periods in

which the timing differences are expected to reverse, based on the tax rates and laws

that are enacted or substantively enacted at the balance sheet date. Timing

differences arise from the inclusion of items of income and expenditure in taxation

computations in periods different from those in which they are included in the

Company financial statements. Deferred tax assets are recognised to the extent that

it is regarded as more likely than not that they will be recovered. Deferred tax assets

and liabilities are not discounted.

Financial instruments

Financial assets and financial liabilities, in respect of financial instruments, are

recognised on the company balance sheet when the Company becomes a party to

the contractual provisions of the instrument.

Financial liabilities and equity instruments

Financial liabilities and equity instruments issued by the Company are classified

according to the substance of the contractual arrangements entered into and the

definitions of a financial liability and an equity instrument. An equity instrument is

any contract that evidences a residual interest in the assets of the Company after

deducting all of its liabilities and includes no obligation to deliver cash or other

financial assets. The accounting policies adopted for specific financial liabilities and

equity instruments are set out below.

Capital market and bank borrowings

Interest bearing loans and overdrafts are initially measured at fair value (which is

equal to cost at inception) and are subsequently measured at amortised cost using

the effective interest rate method, except where they are identified as a hedged item

in a fair value hedge. Any difference between the proceeds net of transaction

costs and the settlement or redemption of borrowings is recognised over the term of

the borrowing.

Equity instruments

Equity instruments issued by the Company are recorded at the proceeds received,

net of direct issuance costs.

Derivative financial instruments and hedge accounting

The Company’s activities expose it to the financial risks of changes in foreign

exchange rates and interest rates.

The use of financial derivatives is governed by the Group’s policies approved by the

Board of directors, which provide written principles on the use of financial derivatives

consistent with the Group’s risk management strategy.

Derivative financial instruments are initially measured at fair value on the contract

date and are subsequently remeasured to fair value at each reporting date. The

Company designates certain derivatives as hedges of the change of fair value of

recognised assets and liabilities (‘fair value hedges’). Hedge accounting is

discontinued when the hedging instrument expires or is sold, terminated or exercised,

no longer qualifies for hedge accounting or the Company chooses to end the

hedging relationship.