Vodafone 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

Vodafone Group Plc Annual Report 2010 111

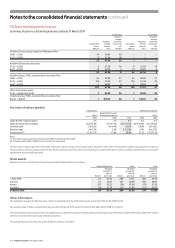

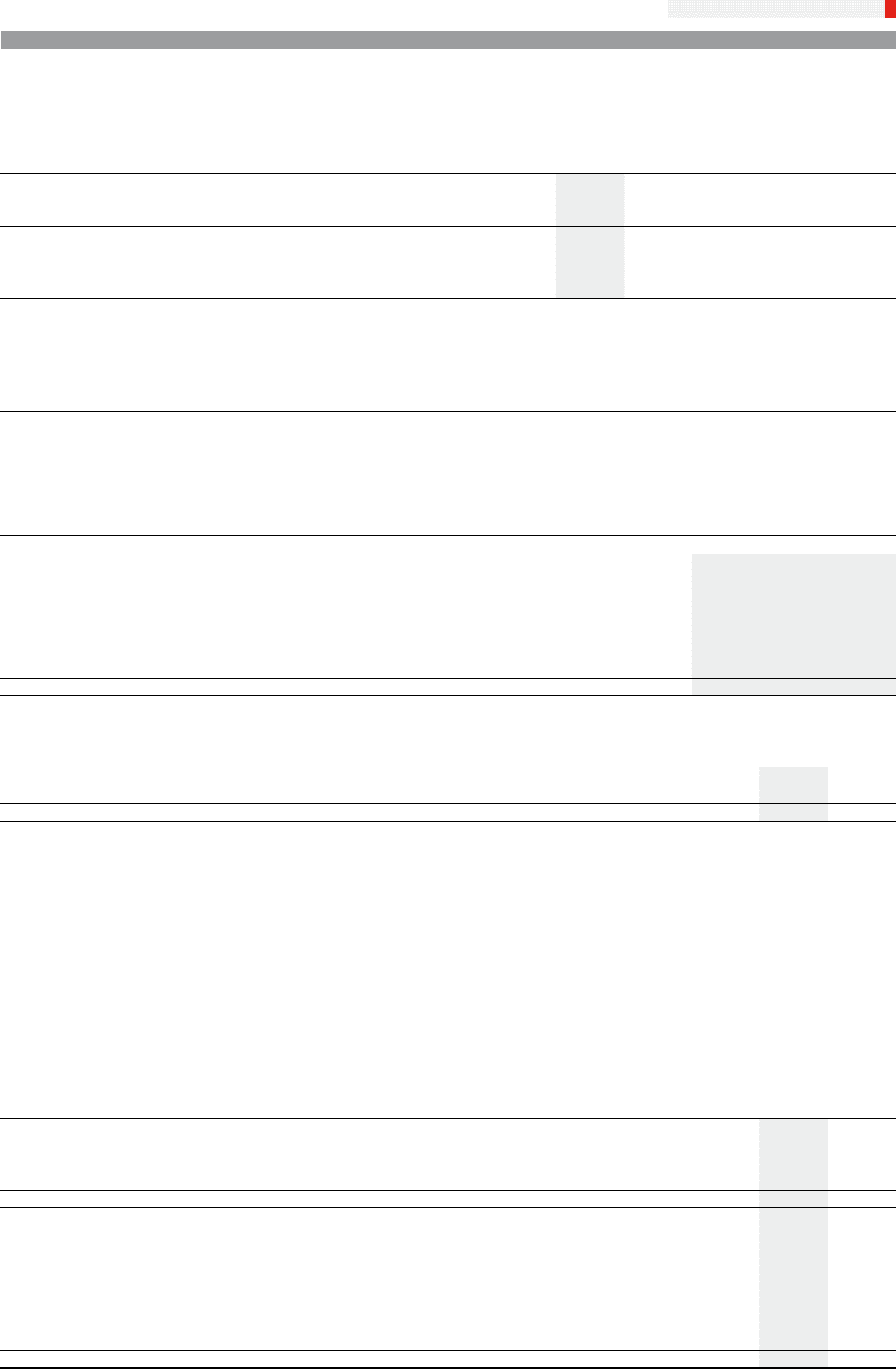

History of experience adjustments

2010 2009 2008 2007 2006

£m £m £m £m £m

Experience adjustments on pension liabilities:

Amount 8 6 (5) (2) (4)

Percentage of pension liabilities −−−−−

Experience adjustments on pension assets:

Amount 286 (381) (176) 26 121

Percentage of pension assets 19% (35%) (14%) 2% 11%

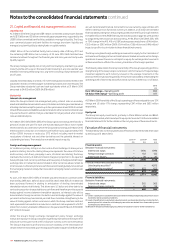

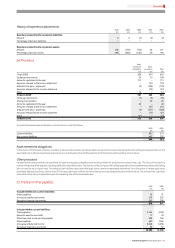

24. Provisions

Asset

retirement Other

obligations provisions Total

£m £m £m

1 April 2008 208 454 662

Exchange movements 34 75 109

Amounts capitalised in the year 111 –111

Amounts charged to the income statement – 194 194

Utilised in the year − payments (4) (106) (110)

Amounts released to the income statement – (72) (72)

Other 12 –12

31 March 2009 361 545 906

Exchange movements (7) (6) (13)

Arising on acquisition –20 20

Amounts capitalised in the year 40 –40

Amounts charged to the income statement – 259 259

Utilised in the year − payments (3) (157) (160)

Amounts released to the income statement – (37) (37)

Other (21) –(21)

31 March 2010 370 624 994

Provisions have been analysed between current and non-current as follows:

2010 2009

£m £m

Current liabilities 497 373

Non-current liabilities 497 533

994 906

Asset retirement obligations

In the course of the Group’s activities, a number of sites and other assets are utilised which are expected to have costs associated with exiting and ceasing their use. The

associated cash outflows are generally expected to occur at the dates of exit of the assets to which they relate, which are long-term in nature.

Other provisions

Included within other provisions are provisions for legal and regulatory disputes and amounts provided for property and restructuring costs. The Group is involved in a

number of legal and other disputes, including notification of possible claims. The directors of the Company, after taking legal advice, have established provisions after taking

into account the facts of each case. The timing of cash outflows associated with legal claims cannot be reasonably determined. For a discussion of certain legal issues

potentially affecting the Group, refer to note 29. The associated cash outflows for restructuring costs are substantially short-term in nature. The timing of the cash flows

associated with property is dependent upon the remaining term of the associated lease.

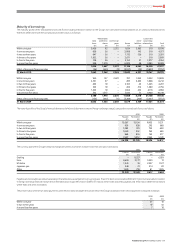

25. Trade and other payables

2010 2009

£m £m

Included within non-current liabilities:

Other payables 76 91

Accruals and deferred income 379 322

Derivative financial instruments 361 398

816 811

Included within current liabilities:

Trade payables 3,254 3,160

Amounts owed to associates 17 18

Other taxes and social security payable 998 762

Other payables 650 1,163

Accruals and deferred income 9,064 8,258

Derivative financial instruments 99 37

14,082 13,398