Vodafone 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Vodafone Group Plc Annual Report 2010

Operating results continued

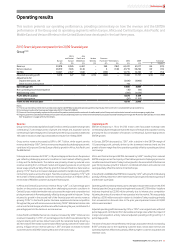

EBITDA decreased by 9.2%(*) as the decline in service revenue and the dilutive effect

of the increased contribution of lower margin fixed line services outweighed benefits

from cost cutting initiatives in customer and operating costs.

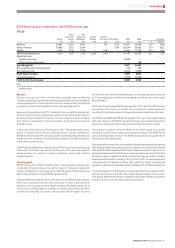

UK

Service revenue declined by 1.1%(*) primarily due to a decrease in voice revenue

resulting from increased competition in a challenging economic environment,

customer optimisation of out of bundle offers and lower roaming revenue. Wholesale

revenue increased due to the success of the MVNO business, principally ASDA and

Lebara. Data revenue growth was maintained, driven primarily by increased

penetration of mobile PC connectivity and mobile internet services. The acquisition

of Central Telecom, which provides converged enterprise services, was completed in

December 2008.

The 12.8%(*) decline in EBITDA , which included the impact of a £30 million VAT refund

in the 2008 financial year, was primarily due to higher off network usage in messaging

services and higher retention costs. The cost of retaining customers increased as a

higher proportion of the contract base received upgrades in the 2009 financial year

following the expiration of 18 month contracts which were introduced in 2006.

Operating expenses grew, primarily due to the impact of the sterling/euro exchange

rate on euro denominated intercompany charges; otherwise operating expenses

were broadly stable year-on-year.

Other Europe

Service revenue decreased by 1.2%(*) during the year and 5.0%(*) in the fourth quarter,

as growth in the Netherlands was more than offset by declines in Greece and Ireland,

where the trends have deteriorated throughout the year. The Netherlands benefited

from a rise in the customer base and strong growth in visitor revenue. Both Greece

and Ireland were impacted by deteriorating market environments, which worsened

in the fourth quarter, and substantial price reductions in prepaid tariffs, whilst Greece

was also affected by termination rate cuts.

The fall in EBITDA margin of 1.2 percentage points was primarily driven by the

service revenue decline and restructuring charges recorded in the fourth quarter in

most countries.

The share of profit in SFR increased, reflecting the acquisition of Neuf Cegetel and

foreign exchange benefits on translation of the results into sterling.

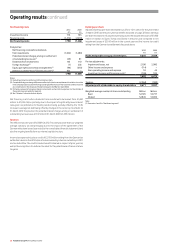

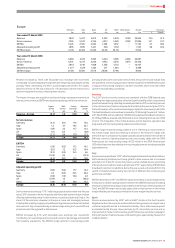

Africa and Central Europe

Africa and

Central

Vodacom Other(1) Europe % change

£m £m £m £Organic

Year ended 31 March 2009

Revenue 1,778 3,723 5,501 11.2 3.9

Service revenue 1,548 3,565 5,113 10.7 3.1

EBITDA 606 1,114 1,720 1.5 (2.3)

Adjusted operating profit 373 302 675 (12.6) (12.6)

EBITDA margin 34.1% 29.9% 31.3%

Year ended 31 March 2008

Revenue 1,609 3,337 4,946

Service revenue 1,398 3,219 4,617

EBITDA 586 1,108 1,694

Adjusted operating profit 365 407 772

EBITDA margin 36.4% 33.2% 34.2%

Note:

(1) On 1 October 2007 Romania rebased all of its tariffs and changed its functional currency from

US dollars to euros. In calculating all constant exchange rate and organic metrics which include

Romania, previous US dollar amounts have been translated into euros at the 1 October 2007

US$/euro exchange rate.

Revenue increased by 11.2%, including the contribution of favourable exchange rate

movements and the impact of merger and acquisition activity. Revenue growth was

3.9%(*) as sustained growth in Vodacom was offset by weakening trends in Turkey and

Romania. Service revenue growth was 3.1%(*) reflecting the 9.9% increase in the

average customer base partially offset by an impact from termination rate cuts of

around three percentage points.

EBITDA increased by 1.5%, with the contribution of favourable exchange rate

movements partially offset by merger and acquisition activity. EBITDA decreased by

2.3%(*), with the EBITDA margin decreasing in the majority of markets reflecting the

continued network expansion, investment in the turnaround plan in Turkey and

increased competition in Romania.

The impact of merger and acquisition activity and foreign exchange movements on

revenue, service revenue, EBITDA and adjusted operating profit are shown below:

Organic M&A Foreign Reported

growth activity exchange growth

%pps pps %

Revenue

Africa and Central Europe 3.9 (0.7) 8.0 11.2

Service revenue

Vodacom 13.8 2.1 (5.2) 10.7

Other (0.9) (1.5) 13.1 10.7

Africa and Central Europe 3.1 (0.6) 8.2 10.7

EBITDA

Vodacom 7.3 0.5 (4.4) 3.4

Other (6.7) (5.9) 13.1 0.5

Africa and Central Europe (2.3) (4.0) 7.8 1.5

Adjusted operating profit

Vodacom 6.3 0.3 (4.4) 2.2

Other (26.2) (10.5) 10.9 (25.8)

Africa and Central Europe (12.6) (5.6) 5.6 (12.6)

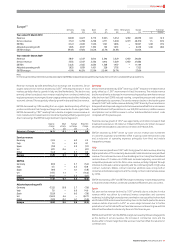

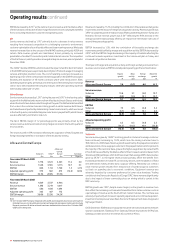

Vodacom

Service revenue grew by 13.8%(*) as strong growth in Vodacom’s average customer

base continued, increasing by 11.2%, which took the closing customer base to

39.6 million on a 100% basis. Revenue growth was driven by the prepaid voice market

and data services. Voice usage per customer in the prepaid market, which represents

the majority of the customer base, grew as the higher usage driven by revised tariffs

in South Africa was offset by the dilutive effect of the increased customer base in both

Tanzania and Mozambique, which both have lower than average ARPU. Data revenue

grew by 59.7%(*), as the higher revenue base partially offset the benefit from

increased penetration of mobile PC connectivity devices, with the absence of fixed

line alternatives making mobile data a popular offering. Relatively low contract

voice revenue growth resulted from reduced out of bundle usage as customers

cut back on spending due to economic conditions. Equipment revenue was

adversely impacted by consumer preference for lower value handsets. Trading

conditions in the Democratic Republic of Congo (‘DRC’) have worsened significantly

due to the impact of lower commodity prices on mining which is central to the

DRC’s economy.

EBITDA growth was 7.3%(*), despite lower margins, as the growth in revenue more

than offset the increasing cost base which benefited from stable customer costs as

a percentage of revenue as the South African market matures. The cost base was

adversely impacted by an increase in operating expenses due to continued expansion,

investment in enterprise services, Black Economic Empowerment share charges and

high wage inflation.

On 30 December 2008 Vodacom acquired the carrier services and business network

solutions subsidiaries (‘Gateway’) from Gateway Telecommunications SA (Pty) Ltd.

Gateway provides services in more than 40 countries in Africa.