Vodafone 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

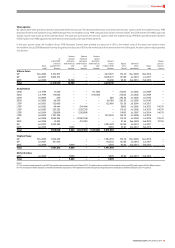

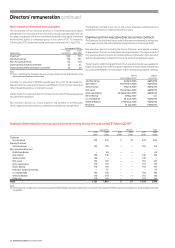

Governance

Vodafone Group Plc Annual Report 2010 63

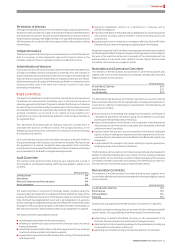

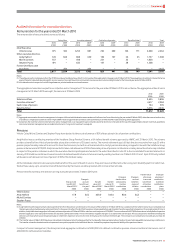

Audited information for executive directors

Remuneration for the year ended 31 March 2010

The remuneration of executive directors was as follows:

Salary/fees Incentive schemes(1) Cash in lieu of pension Benefits/other(2) Total

2010 2009 2010 2009 2010 2009 2010 2009 2010 2009

£’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000

Chief Executive

Vittorio Colao 975 932 1,255 881 292 280 146 171 2,668 2,264

Other executive directors

Andy Halford 674 666 868 650 169 167 26 25 1,737 1,508

Michel Combes 737 –818 –221 –52 –1,828 –

Stephen Pusey 491 –632 –147 –38 –1,308 –

Former Chief Executive

Arun Sarin –436 –434 – – – 553 –1,423

Total 2,877 2,034 3,573 1,965 829 447 262 749 7,541 5,195

Notes:

(1) These figures are the cash payouts from the 2010 financial year Vodafone Group Short-Term Incentive Plan applicable to the year ended 31 March 2010. These awards are in relation to the performance

against targets in adjusted operating profit, service revenue, free cash flow, total communications revenue and customer delight index for the financial year ended 31 March 2010.

(2) Includes amounts in respect of cost of living allowance, private healthcare and car allowance.

The aggregate remuneration we paid to our collective senior management(1) for services for the year ended 31 March 2010 is set out below. The aggregate number of senior

management at 31 March 2010 was eight, the same as at 31 March 2009.

2010 2009

£’000 £’000

Salaries and fees 3,655 3,896

Incentive schemes(2) 4,417 2,984

Cash in lieu of pension 164 399

Benefits/other 3,376 2,949

Total 11,612 10,228

Notes:

(1) Aggregate remuneration for senior management is in respect of those individuals who were members of the Executive Committee during the year ended 31 March 2010, other than executive directors,

and reflects compensation paid from either 1 April 2009 or date of appointment to the Executive Committee, to 31 March 2010 or date of leaving, where applicable.

(2) Comprises the incentive scheme information for senior management on an equivalent basis to that disclosed for directors in the table at the top of this page. Details of share incentives awarded to

directors and senior management are included in footnotes to “Long-term incentives” on page 64.

Pensions

Vittorio Colao, Michel Combes and Stephen Pusey have elected to take a cash allowance of 30% of base salary in lieu of pension contributions.

Andy Halford was a contributing member of the Vodafone Group Pension Scheme, a UK defined benefit scheme approved by HMRC until 31 March 2010. The scheme

provides a benefit of two-thirds of pensionable salary after a minimum of 20 years’ service. The normal retirement age is 60 but directors may retire from age 55 with a

pension proportionately reduced to account for their shorter service, but with no actuarial reduction. Andy’s pensionable salary is capped in line with the Vodafone Group

pension scheme rules at £110,000. Andy has elected to take a cash allowance of 30% of base salary in lieu of pension contributions on salary above the scheme cap. Liabilities

in respect of the pension schemes in which the executive directors participate are funded to the extent described in note 23 to the consolidated financial statements. In

January 2010 Vodafone confirmed it would close its UK defined benefit scheme to future accrual by existing members on 31 March 2010. From 1 April 2010 Andy Halford

will be paid a cash allowance in lieu of pension of 30% of his full basic salary.

All the individuals referred to above are provided benefits in the event of death in service. They also have an entitlement under a long-term disability plan from which two-

thirds of base salary, up to a maximum benefit determined by the insurer, would be provided until normal retirement date.

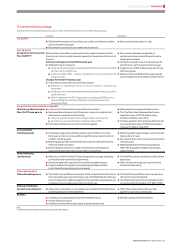

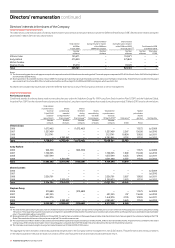

Pension benefits earned by the directors serving during the year ended 31 March 2010 were:

Transfer value Employer

Change in Change in of increase allocation/

Change in transfer value accrued in accrued contribution

Total accrued accrued Transfer Transfer over year less benefit in benefit net to defined

benefit at 31 benefit over value at 31 value at 31 member excess of of member contribution

March 2010(1) the year(1) March 2010(2) March 2009(2) contributions inflation contributions plans

£’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000

Vittorio Colao ––––––––

Andy Halford 17.8 (6.5) 628.0 543.6 80.6 (6.2) – –

Michel Combes ––––––––

Stephen Pusey ––––––––

Notes:

(1) Andy Halford took the opportunity to take early retirement from the pension scheme due to the closure of the scheme on 31 March 2010. In accordance with the scheme rules, his accrued pension at

this date was reduced with an early retirement factor for four years to reflect the fact that his pension is being paid before age 55 and is therefore expected to be paid out for a longer period of time. In

addition , Andy Halford e xchanged par t of h is early retire ment pens ion at 31 March 2010 for a tax-free cash lump sum of £118,660. The accrued benef it of £17,800 sh ow n above is A nd y Halford ’s p ension

after the application of an early retirement factor and after cash has been taken. There is therefore a negative change in accrued benefit over the year. The accrued pension benefits earned by the

directors are those which would be paid annually on retirement, based on service to the end of the year, at the normal retirement age. The increase in accrued pension excludes any increase for

inflation.

(2) The transfer values 31 March 2010 have been calculated on the basis and methodology set by the Trustees after taking actuarial advice. No director elected to pay additional voluntary contributions.

The transfer values disclosed above do not represent a sum paid or payable to the individual director. Instead they represent a potential liability of the pension scheme.

In respect of senior management, the Group has made aggregate contributions of £851,000 into defined contribution pension schemes and had a total service cost of

£360,000 for defined pension liabilities.