Vodafone 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 Vodafone Group Plc Annual Report 2010

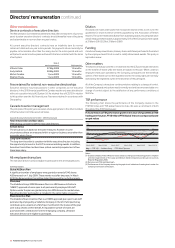

Directors’ remuneration continued

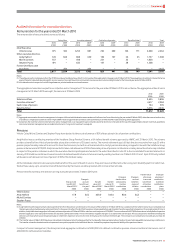

Details of the GLTI performance shares

The number of shares vesting depends on the performance of two measures: free cash flow and relative TSR. This section sets out how the performance of each of the two

measures is calculated.

Underlying operational performance – adjusted free cash flow

The free cash flow performance is based on a three year cumulative adjusted free cash flow figure. The definition of adjusted free cash flow is reported free cash

flow excluding:

Verizon Wireless additional distributions;

Foreign exchange movements over the performance period; and

Material one-off tax settlements.

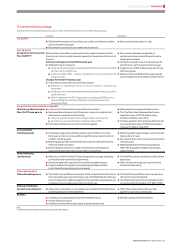

The cumulative adjusted free cash flow target and range for awards in the 2011, 2010 and 2009 financial years are set out in the table below:

2011 2010 2009

Vesting Vesting Vesting

Performance £bn percentage £bn percentage £bn percentage

Threshold 17.50 50% 15.50 50% 15.50 50%

Target 20.50 100% 18.00 100% 17.50 100%

Superior 21.75 150% 19.25 150% 18.50 150%

Maximum 23.00 200% 20.50 200% 19.50 200%

The target free cash flow level is set by reference to the Company’s three year plan and market expectations. The Remuneration Committee consider the 2011, 2010 and

2009 targets to be stretching ones.

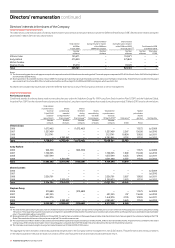

TSR out-performance of a peer group median

We have a limited number of appropriate peers and this makes the measurement of a relative ranking system volatile. As such, the out-performance of the median of a peer

group is felt to be the most appropriate TSR measure. The peer group for the performance condition for the 2011, 2010 and 2009 financial years is:

BT Group;

Deutsche Telekom;

France Telecom;

Telecom Italia;

Telefonica; and

Emerging market composite (consists of the average TSR performance of Bharti, MTN and Turkcell).

The relative TSR position will determine the performance multiplier. This will be applied to the free cash flow vesting percentage. There will be no multiplier until TSR

performance exceeds median. Above median the following table will apply to the 2011, 2010 and 2009 financial years (with linear interpolation between points):

Out-

performance

of peer group

median Multiplier

Median 0.0% p.a. No increase

65th percentile 4.5% p.a. 1.5 times

80th percentile (upper quintile) 9.0% p.a. 2.0 times

The performance measure has been calibrated using statistical techniques.

Combined vesting matrix

The combination of the two performance measures gives a combined vesting matrix as follows:

TSR performance

Free cash flow measure Up to median 65th 80th

Threshold 50% 75% 100%

Target 100% 150% 200%

Superior 150% 225% 300%

Maximum 200% 300% 400%

The combined vesting percentages are applied to the target number of shares granted.

The free cash flow performance is externally verified and approved by the Remuneration Committee. The performance assessment in respect of the TSR out-performance

of a peer group median is undertaken by PricewaterhouseCoopers LLP.