Vodafone 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Governance

Vodafone Group Plc Annual Report 2010 57

Dear Shareholder

This year the work of the Remuneration Committee took place against a background

of very challenging business conditions in the global economy. In this environment

the Committee maintained its focus on ensuring that the Company’s remuneration

policies in general, and the packages of the executive directors in particular, were

designed to allow the Company to recruit, retain and motivate its talented people and

to ensure those people were fully incentivised to maximise shareholder value.

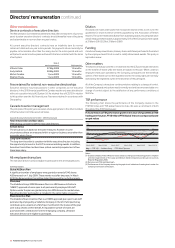

At the start of the year a key focus for the Company was the generation of cash flow.

This was reflected in the weighting applied to this measure in the short-term plan. As

the focus now moves more to growing revenue and market share the weightings

have been modified for the coming year to appropriately reflect this change.

The structure of the long-term plan has also been reviewed and the Committee

believes that the current design remains appropriate with its strong continued focus

on both cash flow and total shareholder return.

As well as considering the current package, the Remuneration Committee continues

to monitor how well incentive awards made in previous years align with the

Company’s performance. In this regard, the Committee is confident that there is a

strong link between performance and reward.

The Remuneration Committee has appreciated the dialogue and feedback from

investors and has taken account of their views when reviewing the incentive designs.

This has been seen in two ways: i) in the alignment of the senior leadership population

with the Board and the Executive Committee through the cascading down of the free

cash flow performance condition in the long-term plan; and ii) in the greater

differentiation that has been built into both short and long-term plans with individual

performance being more rigorously measured and directly affecting award sizes. The

Committee will continue to take an active interest in investors’ views and the voting

on the remuneration report. As such, it hopes to receive your support at the AGM on

27 July 2010.

Luc Vandevelde

Chairman of the Remuneration Committee

18 May 2010

Contents

The detail of this remuneration report is set out over the following pages, as follows:

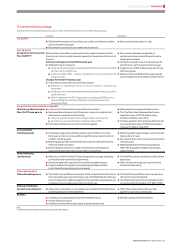

Page 57 – Remuneration Committee

Page 58 – Overview of remuneration philosophy

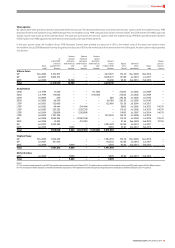

Page 59 – The remuneration package

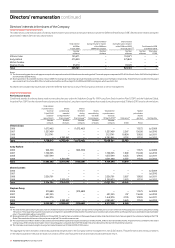

Page 61 – Awards made to executive directors during the 2010 financial year

Page 61 – Amounts executive directors will actually receive in the 2011 financial year

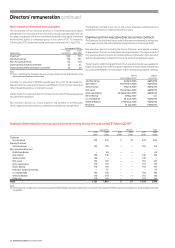

Page 62 – Other considerations

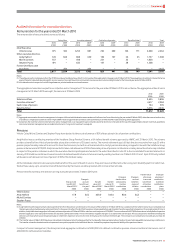

Page 63 – Audited information for executive directors

Page 66 – Non-executive directors remuneration

Page 66 – Audited information for non-executive directors’ serving during the year

ended 31 March 2010

Page 67 – Beneficial interests

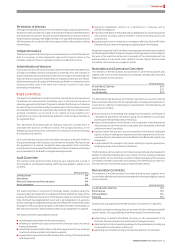

Remuneration Committee

The Remuneration Committee is comprised to exercise independent judgement and

consists only of independent non-executive directors. For further details, the terms

of reference can be found on page 53.

Remuneration Committee

Chairman Luc Vandevelde

Committee members Simon Murray

Anthony Watson

Philip Yea

Management attendees

Chief Executive Vittorio Colao

Group HR Director Ronald Schellekens

Group Reward Director Tristram Roberts (until 31 October 2009)

Head of Group Reward Adam Parsons (1 November 2009 to 31 March 2010)

External advisors

During the year Towers Watson supplied market data and advice on market practice

and governance. PricewaterhouseCoopers LLP provided performance analysis and

advice on plan design and performance measures. Both advisors were appointed by

the Remuneration Committee in 2007.

The advisors also provided advice to the Company on general human resource and

compensation related matters. In addition, PricewaterhouseCoopers LLP also

provided a broad range of tax, share scheme and advisory services to the Group

during the 2010 financial year.

As noted in his biographical details on page 49 of this annual report, during the year

Philip Yea joined an advisory board for PricewaterhouseCoopers LLP. In light of their

role as advisor to the Remuneration Committee on remuneration matters, this

appointment was considered by the Committee and it was determined that there is

no conflict or potential conflict arising.

Meetings

The Remuneration Committee had five meetings during the year.

Directors’ remuneration