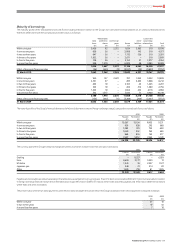

Vodafone 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 Vodafone Group Plc Annual Report 2010

Notes to the consolidated nancial statements continued

21. Capital and nancial risk management continued

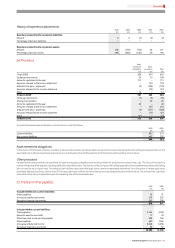

Liquidity risk

At 31 March 2010 the Group had US$9.1 billion committed undrawn bank facilities

and US$15 billion and £5 billion commercial paper programmes, supported by the

US$9.1 billion committed bank facilities, available to manage its liquidity. The Group

uses commercial paper and bank facilities to manage short-term liquidity and

manages long-term liquidity by raising funds on capital markets.

US$4.1 billion of the committed facility has a maturity date of 28 July 2011 and

the remaining US$5 billion has a maturity of 22 June 2012. Both facilities have

remained undrawn throughout the financial year and since year end and provide

liquidity support.

The Group manages liquidity risk on long-term borrowings by maintaining a varied

maturity profile with a cap on the level of debt maturing in any one calendar year,

therefore minimising refinancing risk. Long-term borrowings mature between one

and 27 years.

Liquidity is reviewed daily on at least a 12 month rolling basis and stress tested on the

assumption that all commercial paper outstanding matures and is not reissued. The

Group maintains substantial cash and cash equivalents which at 31 March 2010

amounted to £4,423 million (2009: £4,878 million).

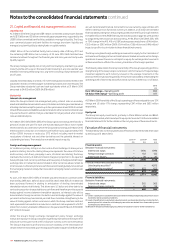

Market risk

Interest rate management

Under the Group’s interest rate management policy, interest rates on monetary

assets and liabilities denominated in euros, US dollars and sterling are maintained on

a floating rate basis except for periods up to four years when at least 20% of net debt

is fixed. Where assets and liabilities are denominated in other currencies interest rates

may also be fixed. In addition, fixing is undertaken for longer periods when interest

rates are statistically low.

At 31 March 2010 36% (2009: 43%) of the Group’s gross borrowings were fixed for a

period of at least one year. For each one hundred basis point fall or rise in market

interest rates for all currencies in which the Group had borrowings at 31 March 2010

there would be a reduction or increase in profit before tax by approximately £165

million (2009: increase or reduce by £175 million) including mark-to-market

revaluations of interest rate and other derivatives and the potential interest on

outstanding tax issues. There would be no material impact on equity.

Foreign exchange management

As Vodafone’s primary listing is on the London Stock Exchange its share price is

quoted in sterling. Since the sterling share price represents the value of its future

multi-currency cash flows, principally in euro, US dollars and sterling, the Group

maintains the currency of debt and interest charges in proportion to its expected

future principal multi-currency cash flows and has a policy to hedge external foreign

exchange risks on transactions denominated in other currencies above certain de

minimis levels. As the Group’s future cash flows are increasingly likely to be derived

from emerging markets it is likely that more debt in emerging market currencies will

be drawn.

As such, at 31 March 2010 120% of net debt was denominated in currencies other

than sterling (49% euro, 46% US dollar and 25% other) while 20% of net debt had

been purchased forward in sterling in anticipation of sterling denominated

shareholder returns via dividends. This allows euro, US dollar and other debt to be

serviced in proportion to expected future cash flows and therefore provides a partial

hedge against income statement translation exposure, as interest costs will be

denominated in foreign currencies. Yen debt is used as a hedge against the value of

yen assets as the Group has minimal yen cash flows. A relative strengthening in the

value of sterling against certain currencies in which the Group maintains cash and

cash equivalents has resulted in a reduction in cash and cash equivalents of £257

million from currency translation differences in the year ended 31 March 2010 (2009:

£371 million increase).

Under the Group’s foreign exchange management policy foreign exchange

transaction exposure in Group companies is generally maintained at the lower of €5

million per currency per month or €15 million per currency over a six month period.

The Group is exposed to profit and loss account volatility on the retranslation of

certain investments received upon the disposal of Vodafone Japan to SoftBank which

are yen denominated financial instruments but are owned by legal entities with

either a sterling or euro functional currency. In addition, a US dollar denominated

financial liability arising from the put rights granted over the Essar Group’s interests

in Vodafone Essar in the 2008 financial year and discussed on page 44, were granted

by a legal entity with a euro functional currency. A 19%, 8% or 12% (2009: 23%, 10%

or 15%) change in the ¥/£, ¥/€ or US$/€ exchange rates would have a £146 million,

£122 million or £393 million (2009: £164 million, £136 million and £496 million)

impact on profit or loss in relation to these financial instruments.

The Group recognises foreign exchange movements in equity for the translation of

net investment hedging instruments and balances treated as investments in foreign

operations. However there is no net impact on equity for exchange rate movements

as there would be an offset in the currency translation of the foreign operation.

The following table details the Group’s sensitivity of the Group’s operating profit to a

strengthening of the Group’s major currencies in which it transacts. The percentage

movement applied to each currency is based on the average movements in the

previous three annual reporting periods. Amounts are calculated by retranslating the

operating profit of each entity whose functional currency is either euro or US dollar.

2010

£m

Euro 12% change – Operating profit 804

US dollar 15% change – Operating profit 617

At 31 March 2009 sensitivity of the Group’s operating profit was analysed for euro 12%

change and US dollar 17% change, representing £347 million and £632 million

respectively.

Equity risk

The Group has equity investments, primarily in China Mobile Limited and Bharti

Infotel Private Limited, w hich are subject to equit y risk . See note 15 to th e consolidated

financial statements for further details on the carrying value of these investments.

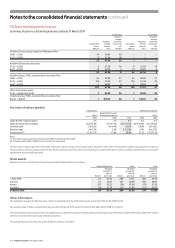

Fair value of nancial instruments

The table below sets out the valuation basis of financial instruments held at fair value

by the Group at 31 March 2010.

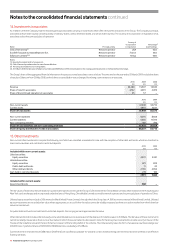

Level 1(1) Level 2(2) Total

£ m £ m £ m

Financial assets:

Derivative financial instruments:

Interest rate swaps – 1,996 1,996

Foreign exchange contracts – 132 132

Interest rate futures – 20 20

– 2,148 2,148

Financial investments available-for-sale:

Listed equity securities(3) 4,072 – 4,072

Unlisted equity securities(3) – 623 623

4,072 623 4,695

4,072 2,771 6,843

Financial liabilities:

Derivative financial instruments:

Interest rate swaps – 365 365

Foreign exchange contracts – 95 95

– 460 460

Notes:

(1) Level 1 classif icat ion is used w her e fair value i s deter mi ne d by unadjusted quoted prices in a cti ve

markets for identical assets or liabilities.

(2) Level 2 classification is used where valuation inputs are observable directly or indirectly from

quoted prices. Fair values for unlisted equity securities are derived from observable quoted

market prices for similar items.

(3) Details of listed and unlisted equity securities are included in note 15 “Other Investments”.