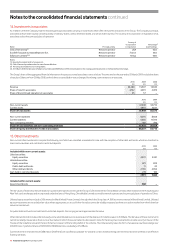

Vodafone 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

Vodafone Group Plc Annual Report 2010 103

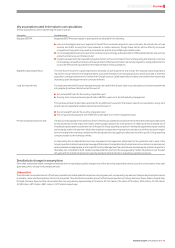

21. Capital and nancial risk management

Capital management

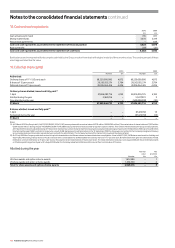

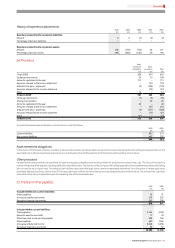

The following table summarises the capital of the Group:

2010 2009

£m £m

Cash and cash equivalents (4,423) (4,878)

Borrowings 39,795 41,373

Other financial instruments (2,056) (2,272)

Net debt 33,316 34,223

Equity 90,810 84,777

Capital 124,126 119,000

The Group’s policy is to borrow centrally using a mixture of long-term and short-term

capital market issues and borrowing facilities to meet anticipated funding

requirements. These borrowings, together with cash generated from operations, are

loaned internally or contributed as equity to certain subsidiaries. The Board has

approved three internal debt protection ratios being: net interest to operating cash

flow (plus dividends from associates); retained cash flow (operating cash flow plus

dividends from associates less interest, tax, dividends to minorities and equity

dividends) to net debt; and operating cash flow (plus dividends from associates) to

net debt. These internal ratios establish levels of debt that the Group should not

exceed other than for relatively short periods of time and are shared with the Group’s

debt rating agencies being Moody’s, Fitch Ratings and Standard & Poor’s. The Group

complied with these ratios throughout the financial year.

Financial risk management

The Group’s treasury function provides a centralised service to the Group for funding,

foreign exchange, interest rate management and counterparty risk management.

Treasury operations are conducted within a framework of policies and guidelines

authorised and reviewed annually by the Board, most recently on 28 July 2009.

A treasury risk committee comprising of the Group’s Chief Financial Officer,

Group General Counsel and Company Secretary, Corporate Finance Director

and Director of Financial Reporting meets at least annually to review treasury

activities and its members receive management information relating to treasury

activities on a quarterly basis. The Group accounting function, which does not report

to the Group Corporate Finance Director, provides regular update reports of treasury

activity to the Board. The Group’s internal auditors review the internal control

environment regularly.

The Group uses a number of derivative instruments for currency and interest rate risk

management purposes only that are transacted by specialist treasury personnel. In

light of the ongoing financial conditions within the banking sector the Group has

reviewed the types of financial risk it faces and continues to monitor these on an

ongoing basis. The Group considers that credit risk in the banking sector remains high

and has mitigated this risk by the adoption of collateral support agreements for the

majority of its bank counterparties.

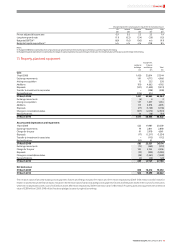

Credit risk

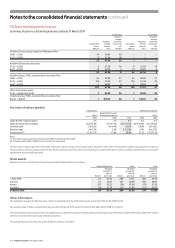

The Group considers its exposure to credit risk at 31 March to be as follows:

2010 2009

£m £m

Cash at bank and in hand 745 811

Cash held in restricted deposits 274 182

Government bonds 388 –

Repurchase agreements –648

Money market fund investments 3,678 3,419

Derivative financial instruments 2,128 2,707

Other investments – debt and bonds 2,366 2,114

Trade receivables 4,067 3,807

13,646 13,688

The Group has invested in index linked government bonds for the first time this year

on the basis that they generate a swap return in excess of £ LIBOR.

Money market investments are in accordance with established internal treasury

policies which dictate that an investment’s long-term credit rating is no lower than

single A. Additionally, the Group invests in AAA unsecured money market mutual

funds where the investment is limited to 10% of each fund.

The Group invests in repurchase agreements which are fully collateralised

investments. The collateral is sovereign and supranational debt of major EU countries

denominated in euros and US dollars and can be readily converted to cash. In the

event of any default, ownership of the collateral would revert to the Group. At

31 March 2010 the Group had no outstanding repurchase agreements (2009: £648

million). The value of the collateral held by the Group at 31 March 2009 is

shown below:

2010 2009

£m £m

Sovereign –544

Supranational –104

– 648

In respect of financial instruments used by the Group’s treasury function, the

aggregate credit risk the Group may have with one counterparty is limited by firstly,

reference to the long-term credit ratings assigned for that counterparty by Moody’s,

Fitch Ratings and Standard & Poor’s and secondly, as a consequence of collateral

support agreements introduced from the fourth quarter of 2008. Under collateral

support agreements the Group’s exposure to a counterparty with whom a collateral

support agreement is in place is reduced to the extent that the counterparty must

post cash collateral when there is value due to the Group under outstanding

derivative contracts that exceeds a contractually agreed threshold amount. When

value is due to the counterparty the Group is required to post collateral on identical

terms. Such cash collateral is adjusted daily as necessary.

In the event of any default, ownership of the cash collateral would revert to the

respective holder at that point. Detailed below is the value of the cash collateral,

which is reported within short-term borrowings, held by the Group at 31 March 2010:

2010 2009

£m £m

Cash collateral 604 691

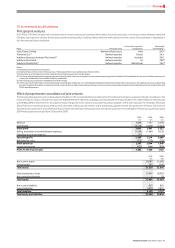

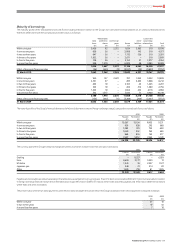

The majority of the Group’s trade receivables are due for maturity within 90 days and

largely comprise amounts receivable from consumers and business customers. At

31 March 2010 £2,111 million (2009: £1,987 million) of trade receivables were not yet

due for payment. Total trade receivables consisted of £2,506 million (2009: £2,798

million) relating to the Europe region, £997 million (2009: £561 million) relating to

the Africa and Central Europe region and £564 million (2009: £448 million) relating

to the Asia Pacific and Middle East region. Accounts are monitored by management

and provisions for bad and doubtful debts raised where it is deemed appropriate.

The following table presents ageing of receivables that are past due and are presented

net of provisions for doubtful receivables that have been established.

2010 2009

£m £m

30 days or less 1,499 1,430

Between 31 – 60 days 119 131

Between 61 – 180 days 155 121

Greater than 180 days 183 138

1,956 1,820

Concentrations of credit risk with respect to trade receivables are limited given that

the Group’s customer base is large and unrelated. Due to this management believes

there is no further credit risk provision required in excess of the normal provision for

bad and doubtful receivables. Amounts charged to administrative expenses during

the year ended 31 March 2010 were £465 million (2009: £423 million, 2008: £293

million) (see note 17).

The Group has other investments in preferred equity and a subordinated loan

received as part of the disposal of Vodafone Japan to SoftBank in the 2007 financial

year. The carrying value of those investments at 31 March 2010 was £2,288 million

(2009: £2,073 million). As discussed in notes 15 and 29 the Group has covenanted to

provide security in favour of the Trustee of the Vodafone Group UK Pension Scheme

in respect of the funding deficit in the scheme. The initial security takes the form of a

Japanese law share pledge over 400,000 class 1 preferred shares of ¥200,000 in BB

Mobile Corp, a subsidiary of SoftBank.