Vodafone 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Vodafone Group Plc Annual Report 2010

Operating results continued

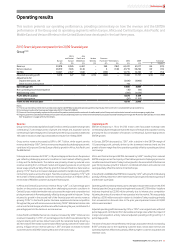

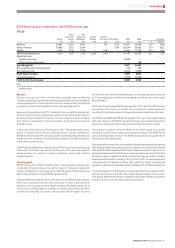

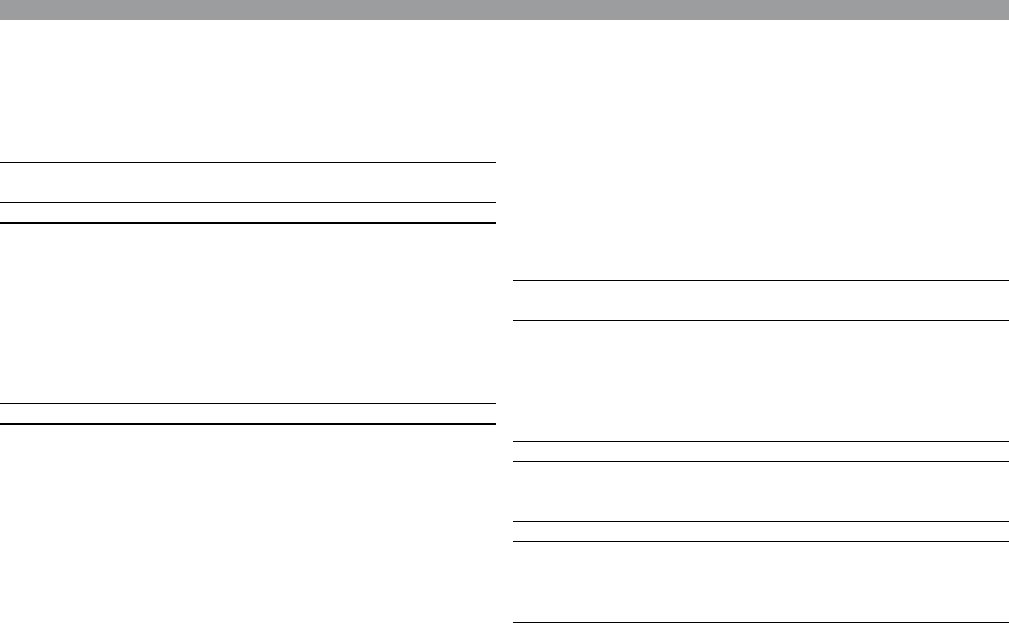

Net financing costs

2009 2008

£m £m

Investment income 795 714

Financing costs (2,419) (2,014)

Net financing costs (1,624) (1,300)

Analysed as:

Net financing costs before dividend

from investments (1,480) (823)

Potential interest charges arising on settlement

of outstanding tax issues(1) 81 (399)

Dividends from investments 110 72

Foreign exchange(2) 235 (7)

Equity put rights and similar arrangements(3) (570) (143)

(1,624) (1,300)

Notes:

(1) Includes release of a £317 million interest accrual relating to a favourable settlement of long

standing tax issues. See “Taxation” below.

(2) Comprises foreign exchange differences reflected in the income statement in relation to certain

intercompany balances and the foreign exchange differences on financial instruments received

as consideration in the disposal of Vodafone Japan to SoftBank in April 2006.

(3) Primarily represents foreign exchange movements and accretion expense. The amount for the

year ended 31 March 2008 also includes a charge of £333 million representing the initial fair

value of the put options granted over the Essar Group’s interest in Vodafone Essar, which was

recorded as an expense. Further details of these options are provided on page 44.

Net financing costs before dividends from investments increased by 79.8% to

£1,480 million, primarily due to mark-to-market losses in the 2009 financial year

compared with gains in the 2008 financial year and unfavourable exchange rate

movements impacting the translation into sterling. The interest charge resulting

from the 28.2% increase in average net debt was minimised due to changes in the

currency mix of debt and significantly lower interest rates for US dollar and euro

denominated debt. At 31 March 2009 the provision for potential interest charges

arising on settlement of outstanding tax issues was £1,635 million (31 March 2008:

£1,577 million).

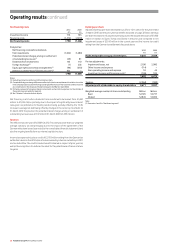

Taxation

The effective tax rate was 26.5% (2008: 24.9%). This rate was lower than our weighted

average statutory tax rate due to the structural benefit from the ongoing

enhancement to our internal capital structure and a benefit of £767 million following

the resolution of long standing tax issues related to the acquisition and subsequent

restructuring of the Mannesmann Group. This was offset by an increase in the rate

due to the impact of impairment losses for which no tax benefit is recorded.

Earnings per share

Adjusted earnings per share increased by 37.4% to 17.17 pence for the year ended

31 March 2009, resulting primarily from movements in exchange rates and the

benefit from a favourable tax settlement, as discussed to the left. Excluding these

factors, adjusted earnings per share rose by around 3%. Basic earnings per share

decreased by 53.5% to 5.84 pence including the impairment losses of £5.9 billion.

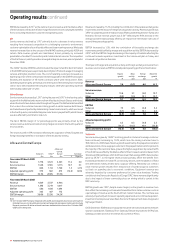

2009 2008

£m £m

Profit from continuing operations

attributable to equity shareholders 3,078 6,660

Adjustments:

Impairment losses 5,900 –

Other income and expense(1) –28

Non-operating income and expense(2) 44 (254)

Investment income and financing costs(3) 335 150

6,279 (76)

Foreign exchange on tax balances (155) –

Tax on the above items (145) 44

Adjusted profit attributable to equity shareholders 9,057 6,628

Weighted average number of shares outstanding Million Million

Basic 52,737 53,019

Diluted 52,969 53,287

Notes:

(1) The amount for the 2008 financial year represents a pre-tax charge offsetting the tax benefit

arising on recognition of a pre-acquisition deferred tax asset.

(2) The amount for the 2009 financial year includes a £39 million adjustment in relation to the broad

based black economic empowerment transaction undertaken by Vodacom. The amount for the

2008 f ina ncial year includes £250 mi llion rep resenting the prof it on disposal of our 5.60% direct

investment in Bharti Airtel Limited (‘Bharti Airtel’).

(3) See notes 2 and 3 in “Net financing costs”.