Vodafone 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 Vodafone Group Plc Annual Report 2010

Notes to the consolidated nancial statements continued

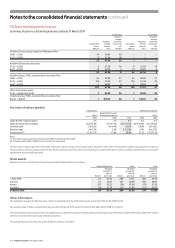

The carrying amounts of trade and other payables approximate their fair value. The fair values of the derivative financial instruments are calculated by discounting the future

cash flows to net present values using appropriate market interest and foreign currency rates prevailing at 31 March.

2010 2009

£m £m

Included within “Derivative financial instruments”:

Fair value through the income statement (held for trading):

Interest rate swaps 330 381

Foreign exchange swaps 95 37

425 418

Fair value hedges:

Interest rate swaps 35 17

460 435

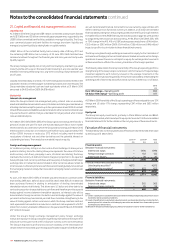

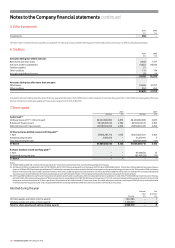

26. Acquisitions

The aggregate cash consideration in respect of purchases of interests in subsidiaries and joint ventures, net of cash acquired, is as follows:

£m

Cash consideration paid:

Vodacom Group Limited 1,577

Other acquisitions completed during the year 26

Acquisitions of non-controlling interests 150

Acquisitions completed in previous years (20)

1,733

Net overdrafts acquired 44

1,777

Total goodwill acquired was £1,185 million and included £1,193 million in relation to Vodacom, £27 million in relation to other acquisitions completed during the year and a

reduction of £35 million resulting from amendments to provisional purchase price allocations on acquisitions completed in previous periods. In addition, there was a

reduction of £102 million in relation to the merger of Vodafone Hutchison Australia.

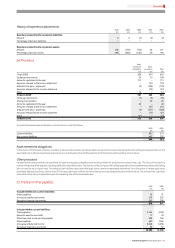

Vodacom Group Limited (‘Vodacom’)

On 20 April 2009 the Group acquired an additional 15% stake in Vodacom for cash consideration of ZAR 20.6 billion (£1.6 billion). On 18 May 2009 Vodacom became a

subsidiary following the listing of its shares on the Johannesburg Stock Exchange and concurrent termination of the shareholder agreement with Telkom SA Limited, the

seller and previous joint venture partner. During the period from 20 April 2009 to 18 May 2009 the Group continued to account for Vodacom as a joint venture, proportionately

consolidating 65% of the results of Vodacom.

The results of the acquired entity have been consolidated in the income statement from 18 May 2009. From 18 May 2009 the acquired entity contributed £90 million to the

profit attributable to equity shareholders of the Group.

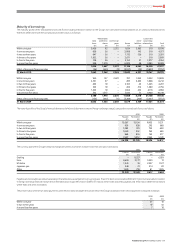

The purchase price allocation is set out in the table below:

Fair value

Book value adjustments Fair value

£m £m £m

Net assets acquired:

Identifiable intangible assets(1) 271 2,931 3,202

Property, plant and equipment 1,603 –1,603

Other investments 25 –25

Inventory 56 –56

Trade and other receivables 870 –870

Cash and cash equivalents 58 –58

Current and deferred taxation liabilities (140) (834) (974)

Short and long-term borrowings (1,312) –(1,312)

Trade and other payables (897) 8(889)

Net identifiable assets acquired 534 2,105 2,639

Goodwill(2) 1,193

Total asset acquired 3,832

Non-controlling interests (973)

Revaluation gain (860)

Value of investment held prior to acquisition (422)

Total consideration(3) 1,577

Notes:

(1) Identifiable intangible assets of £3,202 million consist of licences and spectrum fees of £1,454 million and other intangible assets of £1,748 million.

(2) The goodwill is attributable to the expected profitability of the acquired business and the synergies expected to arise after the Group’s acquisition of Vodacom.

(3) Includes £5 million of directly attributable costs.