Vodafone 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35.5

41.0 44.5

201020092008

Vodafone Group Plc Annual Report 2010 7

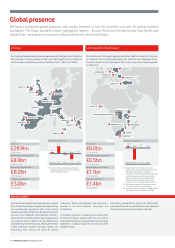

Towers, the world’s largest tower company with more than 100,000

towers under management. However the introduction of six additional

national mobile licences one year after our entry and the resulting

intense price competition have led to a £2.3 billion impairment charge.

In Australia our joint venture company with Hutchison continues to

perform in line with the merger plan with pro-forma revenue growth

of 8%. The EBITDA margin for the region declined by 2.2 percentage

points, primarily reflecting lower margins in India caused by the

competitive pricing environment and operating investment in

new circles.

Verizon Wireless posted another set of strong results for the financial

year. Ser vice revenue growth was 6.3%(*) driven by increased customer

penetration and data, although price competition has increased and

growth rates have slowed in the second half of the year. We have

established joint initiatives with Verizon Wireless around LTE

technology and enterprise customers during the year.

We maintained capital investment at a similar level to the previous

financial year and invested £6.2 billion, consistent with our guidance

in May 2009. Capital expenditure in Europe was slightly higher than in

the 2009 financial year as we took advantage of our strong cash

generation to accelerate investment in fixed and mobile broadband

networks, and in services to enterprise customers.

Adjusted earnings per share was 16.11 pence, lower than last year

primarily as the result of a one-off tax and associated interest benefit

in the prior year. Excluding this, adjusted earnings per share increased

by 6.6%.

Total dividends per share have increased by 7% to 8.31 pence with a

final dividend of 5.65 pence per share, up 9% reflecting the strong cash

performance of the Group.

Strategy

Cost reduction targets delivered a year ahead of plan.

Strong revenue growth from data and fixed line services.

Continued strong growth in emerging markets.

Enhanced shareholder returns – new three year

dividend target.

Vodafone continues to evolve towards being a total communications

provider, rebalancing mobile voice in mature economies with

increasing revenue from broadband data services. We have also

increased the proportion of revenue we generate from emerging

economies. In parallel we continued to reduce our cost base to finance

growth and commercial competitiveness primarily by leveraging our

Group scale.

1. Drive operational performance

We have reinforced the commercial focus of our operating companies

by emphasising relative market share of quality customers , e xploitation

of the data opportunity and expansion into converged services.

Progress in all areas has become more evident in the second half of

the year.

At the same time we accelerated our £1 billion cost reduction

programme, announced in 2008, and delivered its full benefits one

year ahead of plan. The majority of these savings were generated by

our European operations and from cost reductions in our central

functions. Despite growth in mobile voice minutes and a significant

increase in data usage, Europe’s overheads declined enabling

commercial investment to be increased.

In November we announced a further £1 billion cost saving programme

to be delivered by the 2013 financial year. This will help us to

offset inflationary pressures and the competitive environment and

enable us to invest in our revenue growth opportunities. Around half

of these savings will be available for commercial reinvestment or

margin enhancement.

We will continually update our programme to identify further ways in

which the Group can benefit from its regional scale and further reduce

costs in order to offset external pressures and competitor action and

to invest in growth.

2. Pursue growth opportunities in total communications

Data revenue grew by 19.3%(*) and is now over £4 billion. In addition to

driving continued growth in PC connectivity services, we have been

particularly successful in increasing smartphone penetration across

our customer base and in ensuring that smartphone customers

subscribed for additional data services.

Revenue (£bn)

Executive summary

“ We have improved

our commercial

focus and cost

efciency, with

visible results.”