Vodafone 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

Vodafone Group Plc Annual Report 2010 89

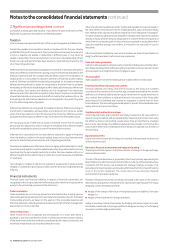

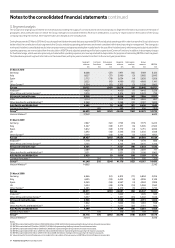

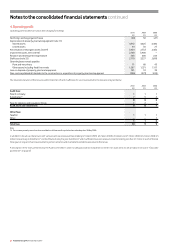

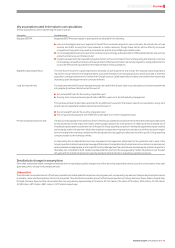

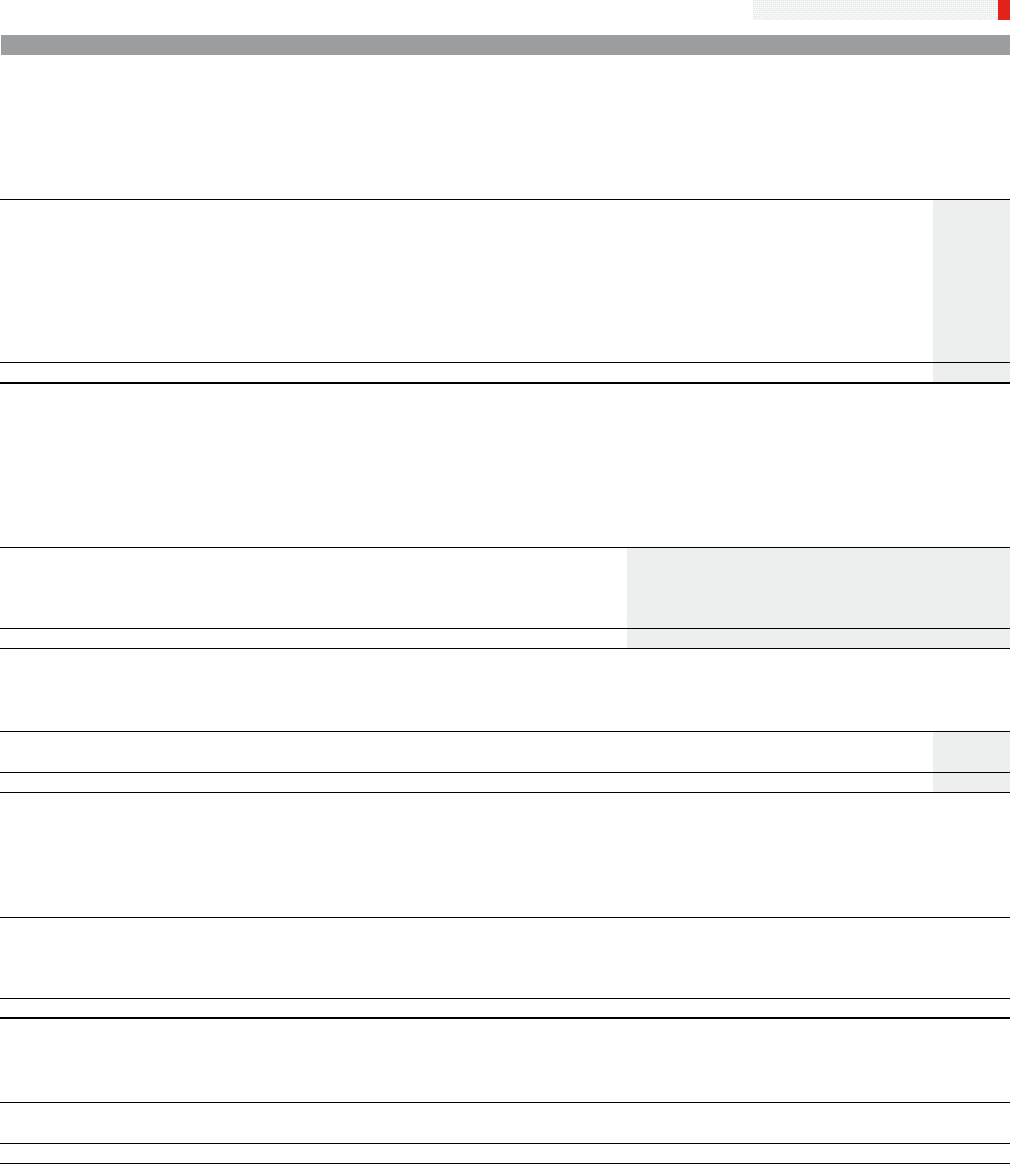

Deferred tax

Analysis of movements in the net deferred tax balance during the year:

£m

1 April 2009 (6,012)

Exchange movements (15)

Credited to the profit for the financial year 639

Debited to other comprehensive income (137)

Credited directly to equity 10

Reclassification from current tax 2

Arising on acquisition (853)

Change in consolidation status 22

31 March 2010 (6,344)

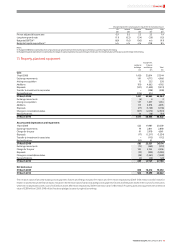

Deferred tax assets and liabilities before offset of balances within countries, are as follows:

Amount Net

credited/ recognised

(charged) Gross Gross Less deferred tax

in income deferred deferred tax amounts asset/

statement tax asset liability unrecognised (liability)

£m £m £m £m £m

Accelerated tax depreciation (577) 627 (2,881) (1) (2,255)

Tax losses 493 27,816 –(27,185) 631

Deferred tax on overseas earnings (22) –(4,086) –(4,086)

Other short-term timing differences 745 4,796 (3,135) (2,295) (634)

31 March 2010 639 33,239 (10,102) (29,481) (6,344)

Analysed in the balance sheet, after offset of balances within countries, as:

£m

Deferred tax asset 1,033

Deferred tax liability (7,377)

31 March 2010 (6,344)

Amount Net

credited/ recognised

(charged) Gross Gross Less deferred tax

in income deferred deferred tax amounts asset/

statement tax asset liability unrecognised (liability)

£m £m £m £m £m

Accelerated tax depreciation (330) 765 (2,488) (52) (1,775)

Tax losses (366) 23,538 −(23,386) 152

Deferred tax on overseas earnings 26 −(4,052) −(4,052)

Other short-term timing differences 288 3,927 (2,416) (1,848) (337)

31 March 2009 (382) 28,230 (8,956) (25,286) (6,012)

Analysed in the balance sheet, after offset of balances within countries, as:

£m

Deferred tax asset 630

Deferred tax liability (6,642)

31 March 2009 (6,012)

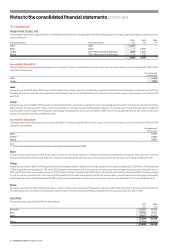

Factors affecting the tax charge in future years

Factors that may affect the Group’s future tax charge include the impact of corporate restructurings, the resolution of open issues, future planning opportunities, corporate

acquisitions and disposals, the use of brought forward tax losses and changes in tax legislation and tax rates.

Vodafone is routinely subject to audit by tax authorities in the territories in which it operates, and the items discussed below have reached litigation. Provisions are held in

respect of the potential tax liability that may arise, however the amount ultimately paid may differ materially from the amount accrued and could therefore affect our overall

profitability and cash flows in future periods.

Following the conclusion of our legal challenge to the UK Controlled Foreign Company (‘CFC’) rules (see the legal proceedings section of note 29), HMRC are enquiring into

the establishment and activities of certain Group holding companies in Luxembourg to determine whether they constitute ‘wholly artificial arrangements’, which the Group

maintains that they do not. The Group carries provisions of £2.2 billion in relation to the potential tax exposure at 31 March 2010 (2009: £ 2.2 billion).

A Spanish subsidiary, Vodafone Holdings Europe SL (‘VHESL’), is in disagreement with the Spanish tax authorities regarding the tax treatment of interest expenses claimed

by VHESL in the accounting periods ended 31 March 2003 and 31 March 2004. In October 2009 the first tier Spanish court ruled against VHESL. VHESL has appealed and

the legal process is expected to continue for a number of years.