Samsung 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

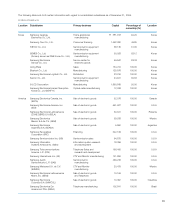

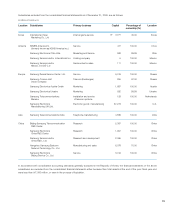

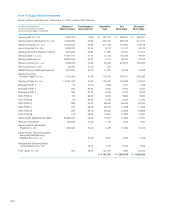

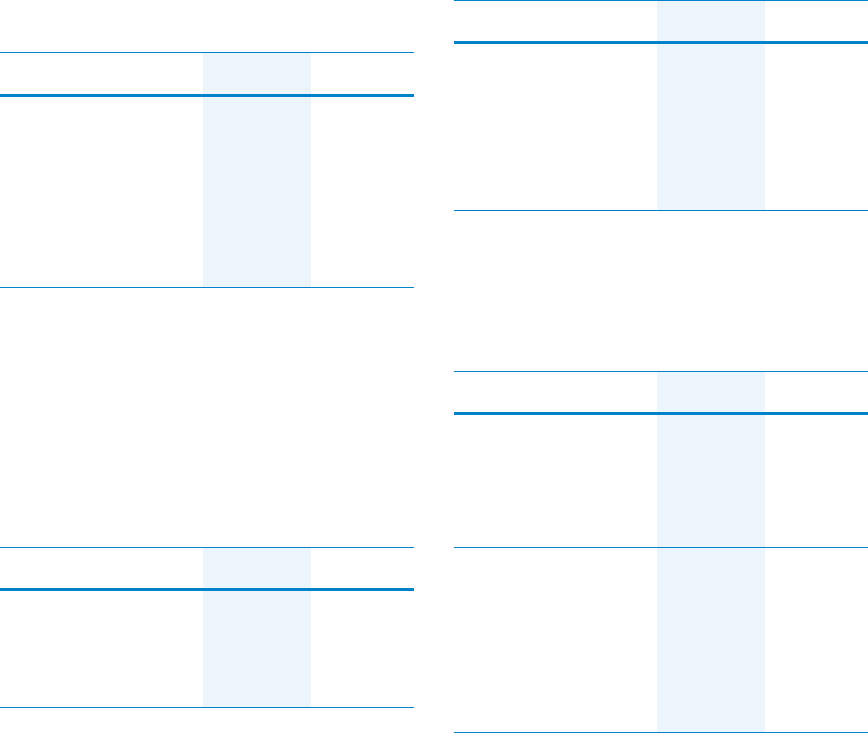

Note 5: Short-Term Available-For-Sale Securities and

Short-Term Held-To-Maturity Securities

Short-term available-for-sale securities as of December 31,

2005 and 2004, consist of the following:

1 ClassⅡ beneficiary certificates accounted for as short-term available-for-

sale securities as of December 31, 2004, have been reclassified as short-

term financing receivables (note 8).

2 Interest income amounting to \

3,551 million (2004: \

2,787 million) and

calculated based on documentation sent by the financial institutions is

included in financial institution bonds.

3 The Company holds 3,190,000 shares of SK Corp. which represents a

percentage of ownership of 2.45%.

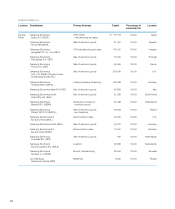

4 Beneficiary certificates as of December 31, 2005 and 2004, consist of the

following:

As of December 31, 2005, unrealized holding losses on short-

term available-for-sale securities amounting to \19,961 million

(2004: \6,099 million) are recorded in a separate component

of shareholders’ equity as other capital adjustments. As of

December 31, 2005, deferred income tax charged directly to

shareholders’ equity amounts to \7,571 million.

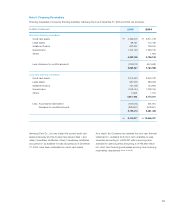

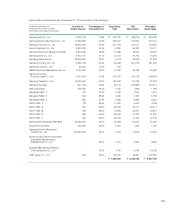

Short-term held-to-maturity securities as of December 31,

2005 and 2004, consist of the following:

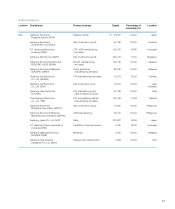

Note 6: Accounts and Notes Receivable

Accounts and notes receivable, and their allowance for doubtful

accounts as of December 31, 2005 and 2004, are as follows:

(in millions of Korean won) 2005 20041

Financial institution bonds 2\585,225 \592,485

Fair-value investments 3166,199 181,511

Beneficiary certificates 41,114,543 1,463,199

ABS senior securities - 510

ABS subordinated securities 13,680 186,745

Others 51,155 52,170

\1,930,802 \2,476,620

(in millions of Korean won) 2005 2004

Call loan \26,170 \6,776

Time deposit - 40,667

Certificate of deposit 179,851 298,996

Bonds 913,842 1,100,638

(in millions of Korean won) 2005 2004

Government and

public bonds \178 \152

Financial institution

bonds - 29,593

Subordinated securities 898 53,294

\1,076 \83,039

(in millions of Korean won) 2005 2004

Trade accounts and

notes receivable \ 7,451,467 \6,812,457

Less: Allowance for doubtful

accounts (54,114) (38,065)

\7,397,353 \6,774,392

Other accounts and

notes receivable \1,118,869 \1,171,451

Less: Allowance for doubtful

accounts (16,222) (28,027)

Discounts on

present value (27) -

\1,102,620 \1,143,424