Samsung 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

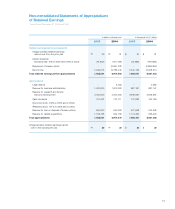

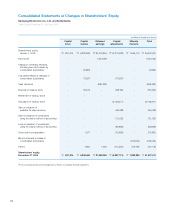

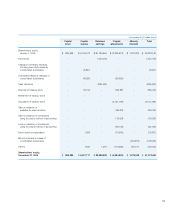

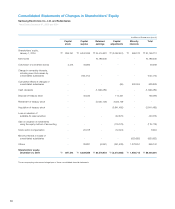

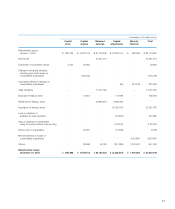

81

in thousands of U.S. dollars (note 3)

Capital

stock

Capital

surplus

Retained

earnings

Capital

adjustments

Minority

interests

Total

Shareholders’ equity,

January 1, 2004 $ 883,752 $ 6,162,161 $ 24,102,350 $ (2,036,131) $ 660,535 $ 29,772,667

Net income - - 10,651,071 - - 10,651,071

Conversion of convertible bonds 2,244 46,392 - - - 48,636

Change in ownership interests,

including new stock issues by

consolidated subsidiaries - (153,418) - - - (153,418)

Cumulative effects of changes of

consolidated subsidiaries - - - (64) 621,919 621,855

Cash dividends - - (1,575,797) - - (1,575,797)

Disposal of treasury stock - 44,951 - 113,081 - 158,032

Retirement of treasury stock - - (2,986,307) 2,986,307 - -

Acquisition of treasury stock - - - (3,792,187) - (3,792,187)

Loss on valuation of

available-for-sale securities - - - (22,384) - (22,384)

Gain on valuation of investments

using the equity method of accounting - - - (118,242) - (118,242)

Stock option compensation - 20,057 - (11,869) - 8,188

Minority interests in losses of

consolidated subsidiaries - - - - (612,697) (612,697)

Others - 39,369 (6,762) (347,029) 1,261,847 947,425

Shareholders’ equity,

December 31, 2004 $885,996 $6,159,512 $30,184,555 $(3,228,518) $1,931,604 $35,933,149