Samsung 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

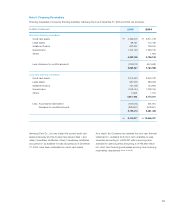

A portion of the accrued severance benefits of domestic

companies is funded through a group severance insurance

plan with Samsung Life Insurance Co., Ltd. and Samsung

Fire & Marine Insurance Co., Ltd., and the amounts funded

under this insurance plan are presented as a deduction to the

accrued severance benefits liability. Subsequent accruals are

to be funded at the discretion of the companies.

In accordance with the National pension Act, a certain por-

tion of the accrued severance benefits is deposited with the

National Pension Fund and deducted from the accrued sever-

ance benefits liability.

Revenue Recognition

Sales of products and merchandise are recognized upon

delivery when the significant risks and rewards of ownership

of the goods are transferred to the buyer. Revenue from

installation service contracts is recognized using the percentage-

of-completion method.

Foreign Currency Translation

Assets and liabilities denominated in foreign currencies are

translated into Korean won at the rate of exchange in effect as

of the balance sheet date. Gains and losses resulting from the

translation are reflected in income for the year.

Foreign currency convertible debentures are translated at the

exchange rate that will be used at the time of conversion as

prescribed in the terms of such debentures.

Translation of Foreign Operations

Accounts of foreign subsidiaries are maintained in the

currencies of the countries in which they operate. In translating

the foreign currency financial statements of these subsidiaries

into Korean won, income and expenses are translated

at the average rate for the year and assets and liabilities

are translated at the rate prevailing on the balance sheet

date. Resulting translation gains or losses are recorded as

a cumulative translation adjustment presented as part of

shareholders’ equity.

Deferred income tax assets and liabilities

Deferred income tax assets and liabilities are recognized for

the estimated future tax consequences attributable to the

differences between the financial statement carrying amounts

of existing assets and liabilities and their respective tax bases,

and operating loss and tax credit carry-forwards.

Deferred income tax assets and liabilities are computed on such

temporary differences by applying statutory tax rates applicable

to the years when such differences are expected to be reversed.

Tax assets related to tax credit and exemptions are recognized

to the extent of the Company’s certain taxable income.

The balance sheet distinguishes the current and non-current

portions of the deferred tax assets and liabilities, whose bal-

ances are offset against each other.

In accordance with SKFAS No.16, Deferred Income Tax,

which became effective January 1, 2005, the Company

classified deferred income tax assets and liabilities into current

portion and non-current portion based on net amount.

The balance sheet as of December 31, 2004, has not been

restated to reflect such change.

Long-Term Receivables and Payables

Long-term receivables and payables that have no stated

interest rate or whose interest rate is different from the market

rate are recorded at their present values. The difference

between the nominal value and present value of the long-term

receivables and payables is amortized using the effective

interest rate method with interest income or expense adjusted

accordingly.

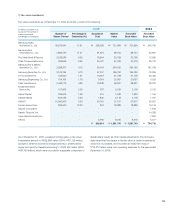

Stock-Based Compensation

The Company uses the fair-value method in determining

compensation costs of stock options granted to its

employees and directors. The compensation cost is

estimated using the Black-Scholes option pricing model and

is accrued as a charge to expense over the vesting period,

with a corresponding increase in a separate component of

shareholders’ equity as other capital adjustments.

Earnings Per Share

Basic earnings per share is calculated by dividing net income

available to common shareholders by the weighted-average

number of common shares outstanding during the period.

Diluted earnings per share is calculated by using the

weighted-average number of common shares outstanding

adjusted to include the potentially dilutive effect of convertible

bonds.

Product Warranties

The Company accrues the estimated cost of warranty includ-

ing future repairs and other services at the time of sale.

Derivative Instruments

Derivative financial instruments for trading or hedging purpose

are valued at estimated market price with the resulting unre-

alized gains or losses recognized in the current operations,

except for the effective portion of derivative transactions

entered into for the purpose of cash-flow hedges, which is

recorded as an adjustment to shareholders’ equity.