Samsung 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

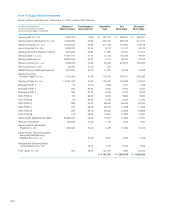

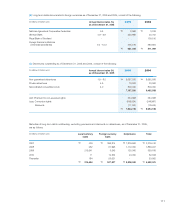

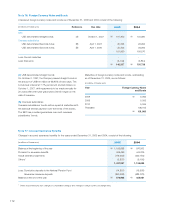

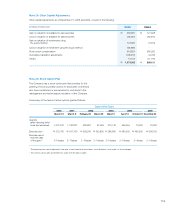

Note 16: Foreign Currency Notes and Bonds

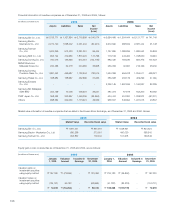

Unsecured foreign currency notes and bonds as of December 31, 2005 and 2004 consist of the following:

(in millions of Korean won) 2005 2004

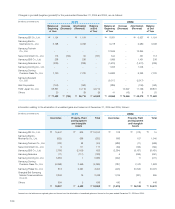

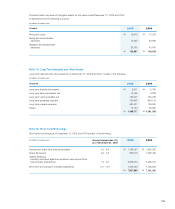

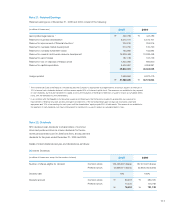

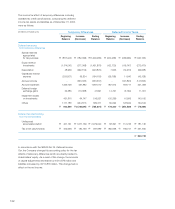

Balance at the beginning of the year \1,155,698 \970,832

Provision for severance benefits 459,499 444,206

Actual severance payments (179,363) (250,184)

Others 1 (3,837) (9,156)

1,431,997 1,155,698

Less: Cumulative deposits to the National Pension Fund (14,807) (16,638)

Severance insurance deposits (840,268) (683,079)

Balance at the end of the year \576,922 \455,981

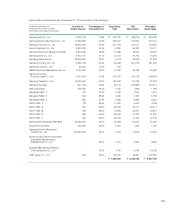

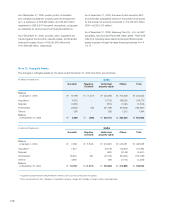

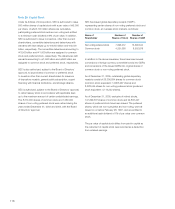

Year Foreign Currency Notes

and Bonds

2008 \ 5,065

2009 5,065

2010 5,065

Thereafter 136,755

\151,950

(in millions of Korean won)

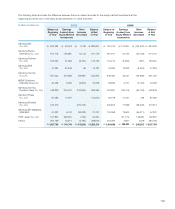

(A) US$ denominated straight bonds

On October 2, 1997, the Company issued straight bonds in

the amount of US$100 million at 99.85% of face value. The

bonds bear interest at 7.7% per annum and will mature on

October 1, 2027, with repayments to be made annually for

20 years after a ten-year grace period which began on the

date of issuance.

(B) Overseas subsidiaries

Overseas subsidiaries’ bonds will be repaid at maturities with

the biannual interest payment over the terms of the bonds.

The SEC has provided guarantees over such overseas

subsidiaries’ bonds.

Maturities of foreign currency notes and bonds, outstanding

as of December 31, 2005, are as follows:

(in millions of Korean won) Reference Due date 2005 2004

SEC

USD denominated straight bonds (A) October 1, 2027 \101,300 \104,380

Overseas subsidiaries

USD denominated fixed rate notes (B) April 1, 2027 25,325 26,095

USD denominated fixed rate notes (B) April 1, 2030 25,325 26,095

151,950 156,570

Less: Current maturities - -

Less: Discounts (5,743) (5,834)

\146,207 \150,736

1 Others include amounts from changes in consolidation category and changes in foreign currency exchange rates.

Note 17: Accrued Severance Benefits

Changes in accrued severance benefits for the years ended December 31, 2005 and 2004, consist of the following: