Samsung 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

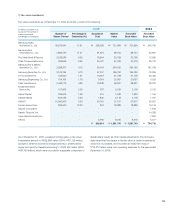

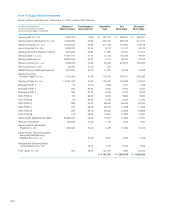

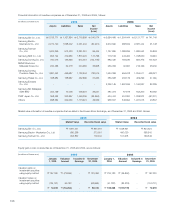

1) Fair-value investments

Fair-value investments as of December 31, 2005 and 2004, consist of the following:

(in millions of Korean won,

except for the number of

shares owned and

percentage of ownership)

2005 2004

Number of

Shares Owned

Percentage of

Ownership (%)

Acquisition

Cost

Market

Value

Recorded

Book Value

Recorded

Book Value

Samsung Heavy

Industries Co., Ltd. 40,675,641 17.61 \258,299 \ 721,993 \721,993 \262,765

Samsung Fine

Chemicals Co., Ltd. 2,969,730 11.51 61,375 98,744 98,744 52,861

The Shilla Hotel & Resorts 2,529,580 6.35 18,604 32,758 32,758 15,860

Cheil Communications Inc. 259,949 5.65 25,737 57,319 57,319 39,122

Samsung Fire & Marine

Insurance Co., Ltd. 2,298,377 4.70 90,443 294,192 294,192 187,318

Samsung Securities Co., Ltd. 3,143,194 4.70 57,347 195,192 195,192 78,894

S1 Corporation lnc. 725,060 1.91 16,207 31,758 31,758 26,465

Samsung Engineering Co., Ltd. 704,104 1.76 9,018 20,067 20,067 5,253

Cheil Industries lnc. 2,449,713 4.90 18,339 68,837 68,837 39,073

Korea Information

Service Inc. 107,603 2.26 797 2,109 2,109 2,120

Hanmi Capital 235,676 1.59 415 1,933 1,933 1,155

Saehan Media 973,738 2.33 1,840 2,118 2,118 1,197

SANYO 10,000,000 0.53 40,761 27,517 27,517 35,827

Tomen device Corp. 832,000 12.23 972 18,888 18,888 16,134

Dacom Corporation - - - - - 1,816

Hanaro Telecom, Inc. - - - - - 14,289

Hynix Semiconductor Inc. - - - - - 7,950

Others - 5,760 8,315 8,315 6,617

\605,914 \1,581,740 \1,581,740 \794,716

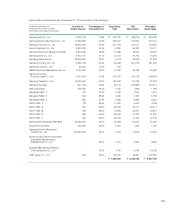

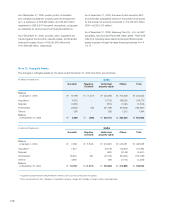

As of December 31, 2005, unrealized holding gains on fair-value

investments amount to \556,586 million (2004: \97,125 million),

except for deferred income tax charged directly to shareholders’

equity and minority interests amounting to \432,490 million (2004:

\60,769 million), which were recorded in a separate component of

shareholders’ equity as other capital adjustments. The Company

determined that the decline in the fair value of certain investments

would not recoverable, and recorded an impairment loss of

\13,316 million under non-operating expenses for the year ended

December 31, 2005.