Samsung 2005 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

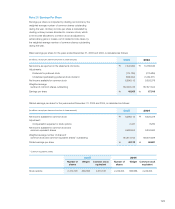

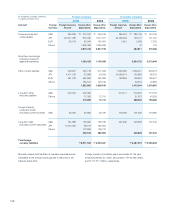

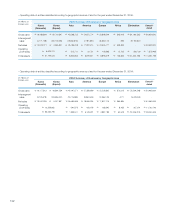

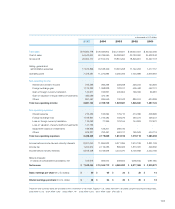

Note 32: Significant transactions not affecting cash

flows for the years ended December 31, 2005 and

2004, are as follows:

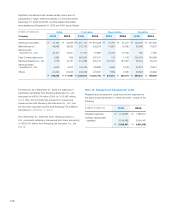

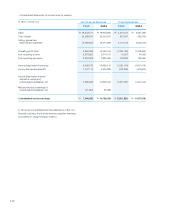

Note 33: Subsequent Event

Subsequent to December 31, 2005, Samsung Card Co., Ltd.

issued unguaranteed bonds amounting to \370,000 million

at face value.

Note 34: Approval of Consolidated Financial

Statements

The audited consolidated financial statements as of and for

the year ended December 31, 2005, will be approved by the

Board of Directors on March 3, 2006.

Note 35: Reclassification of Prior Year Financial

Statement Presentation

Certain amounts in the financial statements as of and for

the year ended December 31, 2004, have been reclassified

to conform to the December 31, 2005 financial statement

presentation. These reclassifications have no effect on

previously reported net income or shareholders’ equity.

(in millions of Korean won) 2005 2004

Write-off of accounts receivables

and financing receivables \ 1,846,815 \ 2,739,035

Gain on valuation of available-for-sale securities 818,877 42,882

Loss on valuation of available-for-sale securities (7,551) 27,622

Decrease in gain on valuation of available-for-sale

securities due to disposal 19,319 17,377

Decrease in loss on valuation of available-for-sale-

securities due to disposal 1,618 5,952

Deferred tax effects applicable to gain on valuation

of investment securities 276,552 -

Deferred tax effects applicable to loss on valuation

of investment securities 8,924 -

Reclassification of long-term available-for-sale

securities to short-term available-for-sale securities 13,679 495,612

Reclassification of long-term held-to-maturity

securities to short-term held-to-maturity securities 127,631 102,255

Reclassification of held-to-maturity securities to

available-for-sale securities - 117,895

Reclassification of construction-in-progress and machinery

in transit to other property, plant and equipment accounts 9,845,250 7,219,656

Current maturities of other long-term liabilities 4,001,569 3,111,035

Decrease in retained earnings arising from

retirement of treasury stock - 3,025,129