Samsung 2005 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

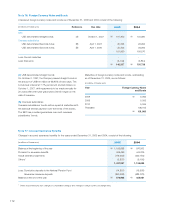

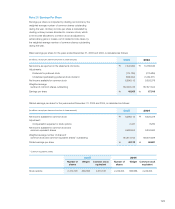

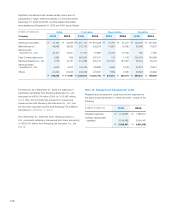

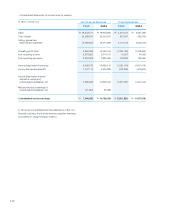

The income tax effect of temporary differences, including

available tax credit carryforwards, comprising the deferred

income tax assets and liabilities as of December 31, 2004,

were as follows:

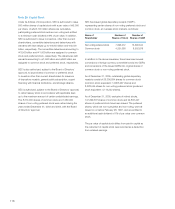

In accordance with the SKFAS No.16, Deferred Income

Tax, the Company changed its accounting policy for the tax

effects of temporary differences which are directly related to

shareholders’ equity. As a result of this change, the amounts

of capital adjustments decreased by \210,876 million and

liabilities increased by \210,876 million. This change had no

effect on the net income.

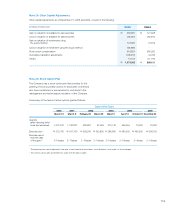

(in millions of Korean won) Temporary Differences Deferred Income Taxes

Beginning

Balance

Increase

(Decrease)

Ending

Balance

Beginning

Balance

Increase

(Decrease)

Ending

Balance

Deferred tax arising

from temporary differences

Special reserves

appropriated

for tax purposes \(818,423) \(782,066) \(1,600,489) \(200,488) \(239,665) \(440,153)

Equity-method

investments (1,174,510) (277,368) (1,451,878) (152,723) (119,747) (272,470)

Depreciation 48,939 (292,814) (243,875) 7,955 (74,613) (66,658)

Capitalized interest

expense (203,927) 39,824 (164,103) (56,768) 11,640 (45,128)

Accrued income - (533,337) (533,337) - (147,843) (147,843)

Accrued expenses 1,469,128 497,882 1,967,010 367,672 183,711 551,383

Deferred foreign

exchange gains 52,385 (10,388) 41,997 14,761 (3,760) 11,001

Impairment losses

on investments 451,810 64,747 516,557 132,299 10,806 143,105

Others 1,117,188 (434,871) 682,317 65,592 128,942 194,534

\942,590 \(1,728,391) \(785,801) \178,300 \(250,529) \(72,229)

Deferred tax assets arising

from the carryforwards

Undisposed

accumulated deficit \ 401,761 \1,677,759 \2,079,520 \68,397 \112,733 \181,130

Tax credit carryforwards \405,696 \182,193 \587,889 \365,098 \166,747 \531,845

\640,746