Samsung 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

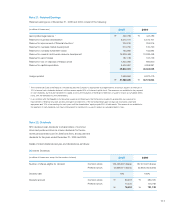

110

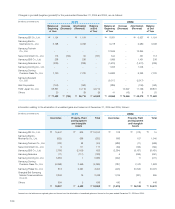

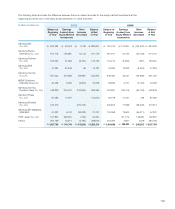

Certain bank deposits, inventories, and property, plant and

equipment are pledged as collaterals for the above borrowings

(notes 4, 7 and 11). In addition, SEC guarantees repayment of

substantially all short-term borrowings of overseas subsidiaries

(note 19).

In addition, the above short-term borrowings include those of

Samsung Card Co., Ltd., the consumer financing subsidiary,

amounting to \2,263,921 million (2004: \2,568,439 million)

and current maturities of long-term debts of \3,672,014 mil-

lion (2004: \4,870,356 million) as of December 31, 2005.

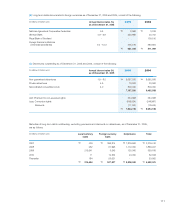

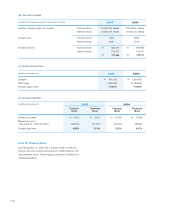

(in millions of Korean won) Reference 2005 2004

Korean won loans (A) \542,216 \337,186

Foreign currency loans, in Korean won equivalents (B) 631,344 511,099

Debentures (C) 7,304,732 9,554,196

8,478,292 10,402,481

Less: Current maturities (3,786,791) (4,957,052)

\ 4,691,501 \5,445,429

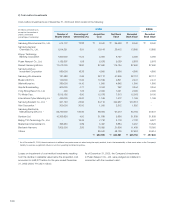

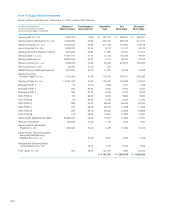

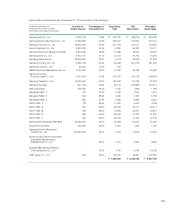

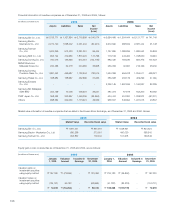

Note 15: Long-Term Debt

Long-term debts as of December 31, 2005 and 2004, consist of the following:

As of December 31, 2005, certain bank deposits, and property,

plant and equipment are pledged as collaterals for the above

long-term debts (notes 4 and 11). In addition, repayment of

certain long-term debts is guaranteed by various Korean

financial institutions and/or certain affiliated companies (note 19).

Included in the long-term debts are the borrowings of

Samsung Card Co., Ltd. in an aggregate amount of

\4,386,262 million (2004: \5,114,799 million) as of

December 31, 2005.

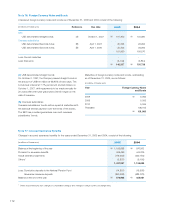

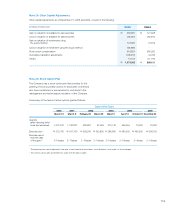

(in millions of Korean won) Annual interest rates (%)

as of December 31, 2005

2005 2004

Korea Energy Management Corporation 2.8 - 4.5 \921 \3,714

Samsung Life Insurance Co., Ltd. 6.9 320,000 320,000

Samsung Shinhan 4th Special Purpose Company - 215,346 -

Hana Bank Others 2.5 - 4.9 5,949 13,472

\542,216 \337,186

(A) Local currency loans as of December 31, 2005 and 2004, consist of the following: