Samsung 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

In 2005, the world economy suffered due to the surge in the

price of oil and the cost of raw materials. Also, the slowdown

of US and Chinese economic growth added downward

pressure on the world economy. Domestically, despite

positive elements shown in the fourth quarter such as income

growth, improvement in the employment rate and the good

performance of the local stock market, the sharp appreciation

of the Korean Won against the US dollar had a negative affect

on exports.

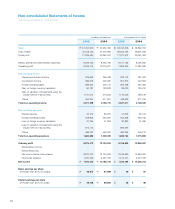

Amid this challenging business environment domestic and

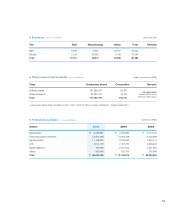

overseas, Samsung Electronics posted a solid performance

in 2005: The company generated sales of 80.6 trillion won

and net income of 7.6 trillion won in 2005. Furthermore, the

company posted record-high quarterly sales of 15 trillion won

in the fourth quarter ended December 31.

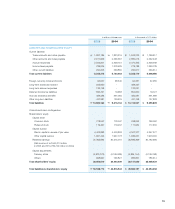

As for the financial structure, Samsung Electronics posted a

debt/asset ratio of 27%, equity/asset ratio of 78%, and ROE

of 21% for the year 2005. Furthermore, Samsung Electronics’

brand continued to be one of the world’s fastest growing

brands with its brand value increasing from $12.6 billion in 2004

to $15 billion in 2005. Considering the fact that the company’s

brand value was $5.2 billion in 2000, Samsung Electronics has

shown an exceptional improvement in its brand value.

All this splendid performance is largely attributed to our

shareholders’ support and trust, as well as to the employees’

commitment and efforts.

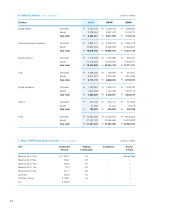

In fiscal 2005, our company’s semiconductor, LCD, and

handset businesses - Samsung Electronics’ key business

units - further strengthened their market-dominant positions

based on the cutting-edge technologies.

The Semiconductor Business posted an operating margin

of 30% thanks to the improved profitability of the DRAM

and NAND Flash businesses. As for the LCD Business, it

strengthened its dominant position in the LCD panel market

through the operation of the 7G line. The Telecommunication

Business posted a record-high shipment of 100 million units

by introducing high performing products such as multi-media

phones and by expanding production lines of the 3G phones.

Also, our Digital Media/Appliance businesses posted the

world’s highest sales figure in the TV market including LCD

TV, PDP TV, and CRT TV. This reaffirms Samsung Electronics’

industry leadership in the TV market and also enhances its

position as a world premier company.

In 2006, the global economy may settle into a period of

slower growth due to high oil prices, a weak US dollar, and

the possible economic slowdown of the U.S and Chinese

economies. Domestically, we cautiously expect local demand

to pick up in 2006. However, uncertainties over oil prices,

fluctuations in the exchange rate, and the possible risk of a

hard landing of the Chinese economy may make competition

among the companies more intense.

Semiconductor Business Leads the Industry with Its

Core Technologies.

In 2005, there was an oversupply of DRAM products due

to manufacturers’ capacity increase while production of

high density NAND Flash accelerated thanks to the soaring

demand for NAND products from MP3 player manufacturers.

Our memory business outpaced the industry market growth

by reinforcing its competitiveness through the introduction of

differentiated premium products such as high density NAND

flash, High-Speed DRAM, and MCP products.

The System LSI business maintained its No.1 position in

Display-Driver IC (DDI) and also established the foundations

for future growth by introducing to the market products such

as CMOS image sensor, mobile CPU, chip card IC, and

media player SoC., sources of future profits.

In 2006, we expect the markets for MP3 players and digital

cameras to expand, providing solid growth momentum for

NAND flash products. This will help our Semiconductor

business post a strong year in 2006. Samsung Electronics

will maintain its strong profit structure in 2006 by

strengthening its market leadership in NAND flash, a major

product of the company. The System LSI division also

plans to boost its competitiveness by making technological

advancements in high-definition and high-speed I/F.

LCD Business Paves the Way for Next-Generation

Display Market.

Our LCD business has maintained its uncontestable No.1

position in terms of LCD panel shipments and sales since

Business Overview

From January 1, 2005 to December 31, 2005