Samsung 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

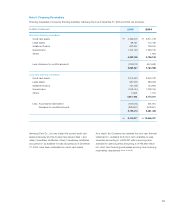

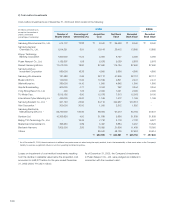

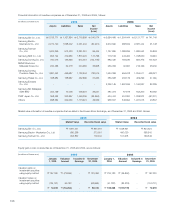

The outstanding balance of financing receivables sold to

financial institutions as of December 31, 2005 and 2004, are

as follows (note 19):

Samsung Card Co., Ltd. has agreements with various financial

institutions to sell certain eligible financing receivables, subject

to recourse. Remittances of the sold accounts receivables

are collected by the consumer financing subsidiaries and

transferred to the buyers of the receivables on predetermined

due dates. These transferred financing receivables amounting

to \17,395 million (2004: \57,257 million) have been

accounted for as sales of receivables and accordingly have

not been recognized on the accompanying consolidated

balance sheets as of December 31, 2005.

In addition, Samsung Card Co., Ltd. has entered into

agreements (“Receivables Sale Agreements”) with several

financial institutions, whereby they will sell certain eligible

financing receivables in accordance with the Act on Asset

Backed Securitization of the Republic of Korea (the “ABS

Act”). Pursuant to the Receivables Sale Agreements,

Samsung Card Co., Ltd. formed Special Purpose Entities

(“SPEs”) for the sole purpose of buying receivables generated

by the consumer financing subsidiary. Under the Receivables

Sale Agreements, Samsung Card Co., Ltd., irrevocably

and with limited recourse, transfer certain eligible financing

receivables to the SPEs. Under the accounting principles

generally accepted in the Republic of Korea, these SPEs

are not required to be included in the consolidated financial

statements.

These transactions are accounted for as a sale of receivables

and as a result, the related receivables in an aggregate

amount of \4,017,978 million (2004: \5,369,189 million)

have been excluded from the accompanying consolidated

balance sheets as of December 31, 2005.

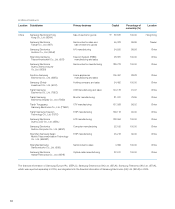

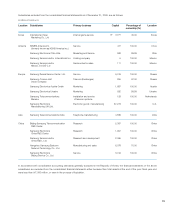

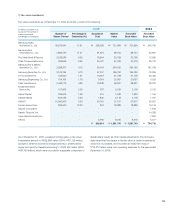

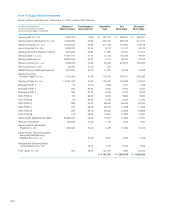

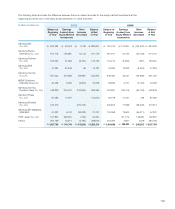

Note 9: Long-Term Available-For-Sale Securities and Long-Term Held-To-Maturity Securities

(1) Long-Term Available-For-Sale Securities

Long-term available-for-sale securities as of December 31, 2005 and 2004, consist of the following:

(in millions of Korean won) 2005 2004

Asset-backed securities

with limited recourse \4,017,978 \5,369,189

Financing receivables

with recourse 17,395 57,257

\4,035,373 \5,426,446

(in millions of Korean won) 2005 20041

Detail Recorded book

Value

Recorded book

Value

Fair-value investments (1) \ 1,581,740 \794,716

Cost-method investments (2) 645,150 457,800

Government and public bonds and others (3) 5,543 28,914

Funds 168 363

\2,232,601 \1,281,793

1 ClassⅡ beneficiary certificates accounted for as long-term available-for-sale securities as of December 31, 2004,

have been reclassified as long-term financing receivables (note 8).