Samsung 2005 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

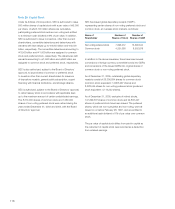

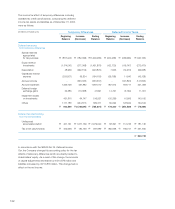

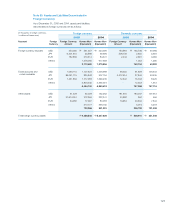

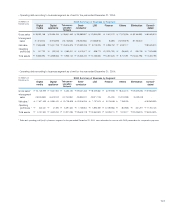

Significant transactions with related parties, which are not

subsidiaries or equity-method investees, for the years ended

December 31, 2005 and 2004, and the related receivables

and payables as of December 31, 2005 and 2004, are as follows:

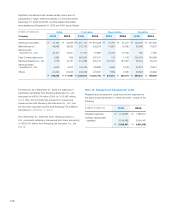

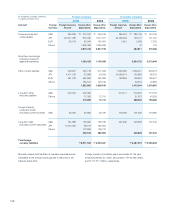

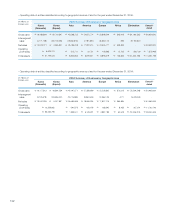

Furthermore, as of December 31, 2005, the balances of

beneficiary certificates from Samsung Securities Co., Ltd.

amounted to \904,314 million (2004: \1,312,462 million)

(note 5). Also, the Company has entered into a severance

insurance plan with Samsung Life Insurance Co., Ltd., and

fire and other insurance policies with Samsung Fire & Marine

Insurance Co., Ltd (notes 7, 11 and 17).

As of December 31, 2005 and 2004, Samsung Card Co.,

Ltd., a domestic subsidiary, has general term loans amounting

to \320,000 million from Samsung Life Insurance Co., Ltd.

(note 15).

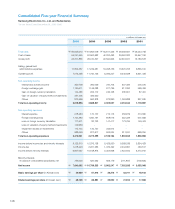

(in millions of Korean won) Sales Purchases Receivables Payables

Company 2005 2004 2005 2004 2005 2004 2005 2004

Samsung Corporation \42,164 \56,099 \1,647,112 \1,970,528 \37,791 \27,521 \402,303 \437,365

iMarketKorea Inc. 46,598 39,652 276,742 236,234 14,891 15,930 93,086 70,337

Samsung Life

Insurance Co., Ltd. 43,101 32,301 12,731 10,690 21,203 19,440 462 1,930

Cheil Communications Inc. 2,385 906 294,581 267,241 122 1,418 200,476 160,269

Samsung Everland Co., Ltd. 1,079 16,791 214,886 220,710 212,021 187,357 35,754 26,722

Samsung Heavy

Industries Co., Ltd. 6,920 5,912 145,553 138,889 6,950 8,183 32,873 18,951

Others 27,097 20,026 430,209 476,501 7,829 5,825 93,593 53,395

\169,344 \171,687 \ 3,021,814 \3,320,793 \300,807 \265,674 \858,547 \768,969

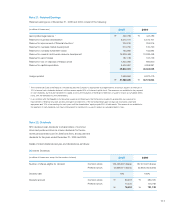

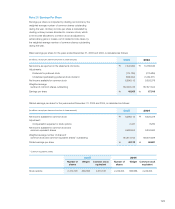

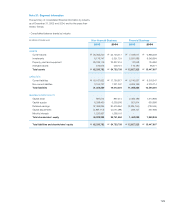

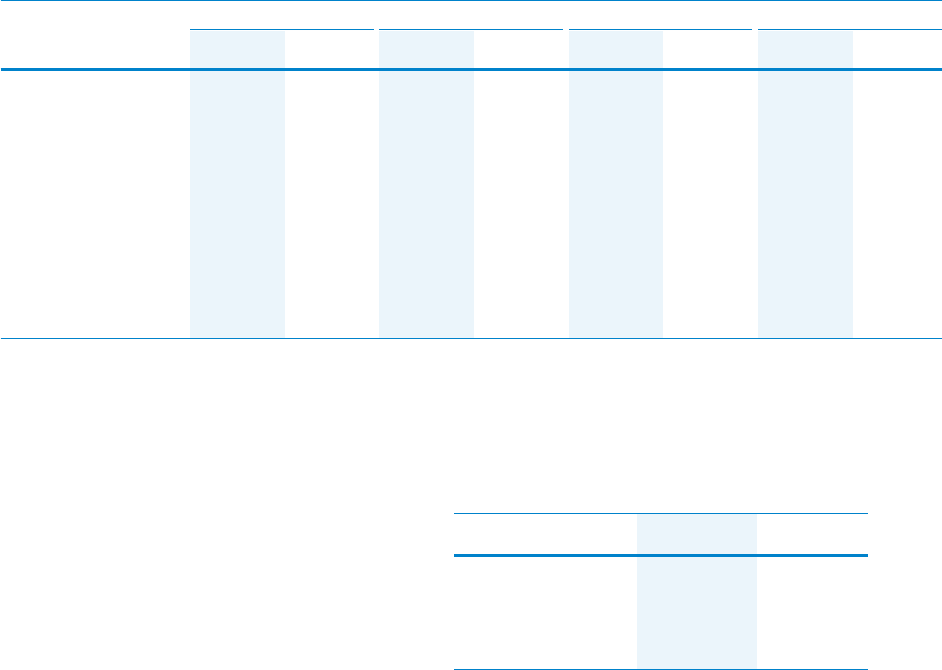

(in millions of Korean won) 2005 2004

Research expenses \2,179,981 \1,838,251

Ordinary development

expenses 3,319,966 3,064,447

\5,499,947 \ 4,902,698

Note 29: Research and Development Costs

Research and development costs incurred and expensed for

the years ended December 31, 2005 and 2004, consist of the

following: