Samsung 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

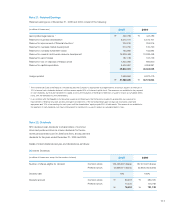

(F) As of December 31, 2005, the Company has various

lease agreements that are recognized as operating leases.

Related rental payments are charged to current operations as

incurred. Future rental expenses under these non-cancelable

operating lease agreements amounted to \228,951 million

as of December 31, 2005.

(G) Samsung Card Co., Ltd. maintains a lease financing

business with lease receivables related chips to such business

recorded as short-term and long-term financing receivables

(notes 8 and 11). Scheduled future lease revenue from these

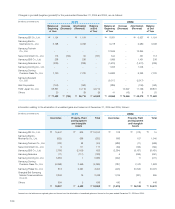

operating lease arrangements are as follows:

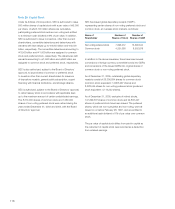

(H) As of December 31, 2005, the Company holds a contract

to supply NAND Flash Memory chips to Apple Computer, Inc.

from 2007 to 2009. The Company received \505,950 million

as advance for the contract, and has recognized this amount

as long-term advances received.

(I) As of December 31, 2005, the Company maintains credit

insurance against its approved foreign customers on behalf

of its affiliates and subsidiary companies with Korea Export

Insurance Co.

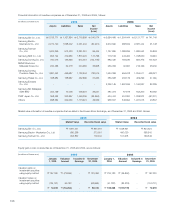

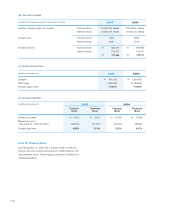

(J) As of December 31, 2005, the Company has forward

exchange contracts to manage the exposure to changes

in currency exchanges rates in accordance with its foreign

currency risk management policy. The use of foreign currency

forward contracts allows the Company to reduce its exposure

to the risk that it may be adversely affected by changes in

exchange rates.

In addition, the Company has interest rate swap contracts

and foreign currency swap contract to reduce the impact of

changes in floating rates on long-term debt and borrowings,

and interest rate swap contracts and foreign currency swap

contracts to reduce the impact of changes in the fair-value

risk on fixed rate long-term debt.

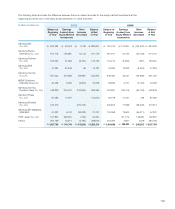

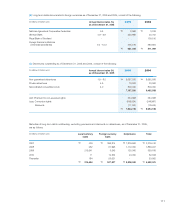

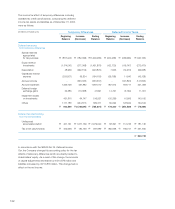

A summary of derivative transactions as of and for the year

ended December 31, 2005 and 2004, follows:

Of the amounts charged to capital adjustments from the

valuation of interest rate swap contracts, a loss of

\19 million will be realized by December 31, 2006.

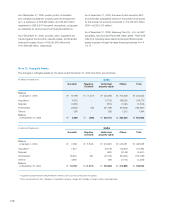

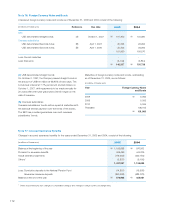

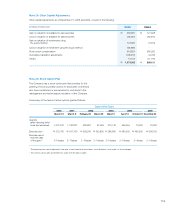

(K) SEC and 30 other Samsung Group affiliates

(the “Affiliates”) entered into an agreement with the institutional

creditors (the “Creditors”) of Samsung Motors Inc. (“SMI”) in

September 1999. In accordance with this agreement, SEC

and the Affiliates agreed to sell 3,500,000 shares of Samsung

Life Insurance Co., Ltd., which were previously transferred

to the Creditors in connection with the petition for court

receivership of SMI by December 31, 2000. In the event that

the sales proceeds fall short of \2,450 billion, SEC and the

Affiliates have agreed to compensate the Creditors for the

shortfall by other means, including the participation in any

equity offering or subordinated debentures issued by the

Creditors. Any excess proceeds over \2,450 billion are to be

distributed to SEC and the Affiliates. In the event of delays,

interest on the agreed sales proceed amount of \2,450 billion

has been agreed to be paid to the Creditors by SEC and

the Affiliates. As of the balance sheet date, these transferred

shares of Samsung Life Insurance Co., Ltd. have not yet been

sold. As a result, on December 9, 2005, the Creditors filed a

civil lawsuit against Mr. Lee Kun-Hee the chairman of SEC,

SEC and 27 other Samsung Group Companies, for losses

arising from breach of this agreement.

The Creditors are claiming for the agreed sales proceed

amount of \2,450 billion and damages for delays amounting

to \2,287.9 billion, both with interest of 6% per annum from

January 1, 2001 until the date SEC was served with court

papers and 20% per annum thereafter until settlement. The

interest on the damages for delays has been calculated on a

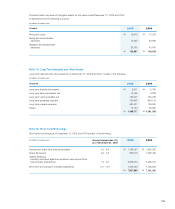

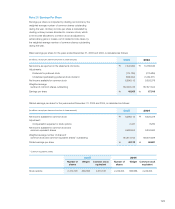

Year (in millions of Korean won)

2006 \166,600

2007 117,352

2008 45,736

Thereafter 939

\330,627

2005 2004

Type Asset

Liability

Gain (loss) on

Valuation (I/S)

Gain (loss) on

Valuation (B/S)

Asset

Liability

Forward

exchange

\ 5,704 \ 6,255 - \ 4,859

(7,361) (7,519) - (10,228)

Interest rate

swap

9,228 - 8,386 8,009

(6,202) (112) (5,249) (23,087)

Currency

swap

- - - 868

(5,480) (5,480) - (19,621)

(in millions of Korean won)