Samsung 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

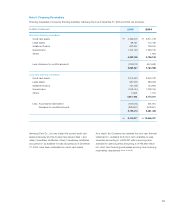

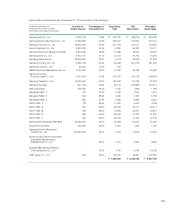

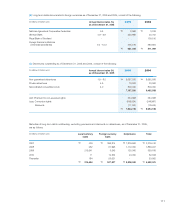

3) Government and public bonds and others

As of December 31, 2005, the difference between acquisition

cost and fair value of government and public bonds and

others amounting to a loss of \284 million (2004: gain of

\227 million), except for deferred income tax charged directly

to other shareholders’ equity amounting to a gain of \114

million (2004: loss of \204 million), was recorded in a separate

component of shareholders’ equity as other capital adjustments.

In relation to government and public bonds and others, an

impairment loss of \11,838 million was recorded as non-

operating expense for the year ended December 31, 2004.

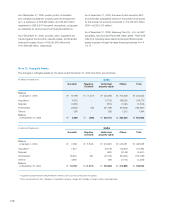

(in millions of Korean won) 2005 2004

Face Value Recorded

Book Value

Face Value Recorded

Book Value

Government and public bonds \ 520 \ 520 \ 706 \706

ABS subordinated securities \1,071,097 \221,318 \1,351,227 \966,613

\1,071,617 \221,838 \1,351,933 \967,319

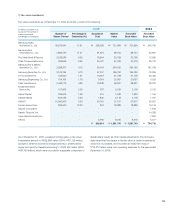

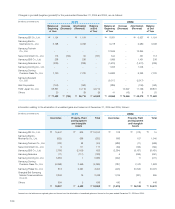

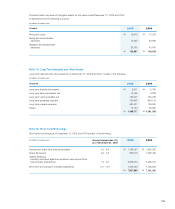

(2) Long-Term Held-To-Maturity Securities

Long-term held-to-maturity securities as of December 31, 2005 and 2004, consist of the following:

As of December 31, 2005, the subsidiaries determined

that the decline in the value of certain ABS subordinated

securities would not be recoverable, and charged the related

impairment losses of \90,557 million (2004: \109,267

million), to current operations as non-operating expenses for

the year ended December 31, 2005.

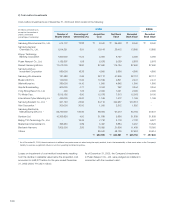

(in millions of Korean won) Recorded book value

Maturity Government and

public bonds

ABS subordinated

securities

Total

From one year to five years \ 459 \ 221,318 \221,777

More than five years to ten years \61 - \61

\520 \221,318 \221,838

The maturities of long-term held-to-maturity securities as of December 31, 2005, consist of the following: