Samsung 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.115

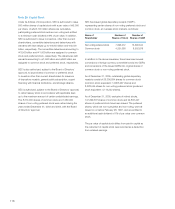

monthly basis from January 1, 2001. In addition, the Creditors

claimed further damages for delays (calculated at 19% per

annum on \2,450 billion) from December 1, 2005 until settle-

ment.

As of the balance sheet date, the outcome of this litigation is

uncertain and accordingly, the ultimate effect of this matter

on the financial position of the Company cannot presently be

determined.

(L) As of December 31, 2005, SEC has been named as the

defendant in nine foreign legal actions filed by Matsushita

Electric Industrial Co., Ltd., International Rectifier Corporation,

Commissariat A L’Energie Atomique, ITT Manufacturing

Inc., 02 Micro International Limited, St.Clair Intellectual

Property Consultants, Inc., Tadahiro Ohmi, Lavaflow, LLP.,

and Rambus Inc. for alleged patent infringements, and as a

plaintiff in four foreign legal actions against Quanta Computer,

Compal Electronics Inc., Matsushita Electric Industrial Co.,

Ltd, and Rambus Inc. for alleged patent infringements.

In addition, the Company is involved in two legal actions as

the defendant against the creditors of SONICblue Inc. and

Getronics Wang Co., LLC. for collection of certain debts.

Domestic legal actions involving SEC include 4 cases as

the plaintiff with total claims amounting to approximately

\6,504 million and 26 cases as the defendant, excluding

the Samsung Motors Inc. case, mentioned above in (K),

with a total claims amounting to approximately \96,007

million. In addition, its subsidiaries have been sued relating to

alleged patent infringements and collection of certain debts in

domestic and foreign countries with total claims amounting to

approximately \237,751 million as plaintiff and total claims

amounting to approximately \81,700 million as defendant.

Considering the legal cases mentioned above and various

other claims and proceedings pending as of December 31,

2005, the Company’s management believes that, although

the outcome of these matters is uncertain, the conclusion of

these matters will not have a material adverse effect on the

operations or financial position of the Company.

(M) As of December 31, 2005, SEA and five other overseas

subsidiaries have agreements with financial institutions to sell

certain eligible trade accounts receivable under which, on an

ongoing basis, a maximum of US$1,595 million can be sold.

The Company has trade notes receivable discounting facilities

with various Korean banks, including Korea First Bank with

a combined limit of up to \200,000 million; a credit sales

facility agreement with five Korean banks, including Woori

Bank; and an accounts receivable factoring agreement with

Korea Exchange Bank for up to \150,000 million. In relation

to the credit sales facility agreement with Woori Bank (up to

\70,000 million) and Kookmin Bank (up to \200,000 million),

the Company has recourse obligations on the receivables

where the due date extension have been granted. In addition,

the Company also has collateral loan facilities on accounts

receivables with four banks, including Woori Bank for up to

\1,311,000 million.

(N) As of December 31, 2005, Samsung Card Co., Ltd. has

credit loan facilities up to \3,000 billion and collateral loan

facilities up to \2,000 billion with Samsung Life Insurance

Co., Ltd. In addition, S-LCD and two other domestic

subsidiaries have general term loan facilities up to \480

billion with Korean banks, including Woori Bank.

(O) As of December 31, 2005, SEC and its domestic

subsidiaries have provided six blank notes and two notes

amounting to \30,000 million, to financial institutions as

collaterals for bank borrowings and for the fulfillment of certain

contracts, which would not have a direct adverse effect on

the operations or financial position of the Company.

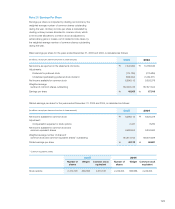

(P) In 2002, the United States Department of Justice Antitrust

Division (the Justice Department) initiated an investigation

into alleged anti-trust violations by the sellers of Dynamic

Random Access Memory (“DRAM”) in the United States,

including Samsung Semiconductor Inc. (SSI), a US subsidiary

of the Company. The Company and SSI entered into a plea

agreement with the US Department of Justice on November

30, 2005 and agreed to pay US$300 million in five equal

installments over the next five years. As of the balance sheet

date, SSI has established a provision amounting to US$300

million in relation to the agreement.

Following the announcement of the Justice Department

investigation, several civil class action suits were filed against

the Company and SSI. Accordingly, SSI has established a

further provision amounting to US$67 million for any potential

losses. The Company’s management believes that, although

the outcome of these matters is uncertain and could differ

from the current estimation, the conclusion of the matters

will not have a material adverse effect on the operations or

financial position of the Company.