Samsung 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

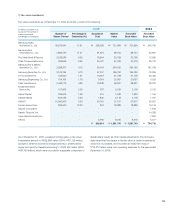

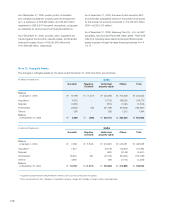

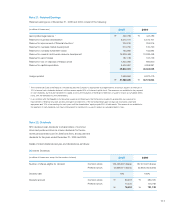

Note 12: Intangible Assets

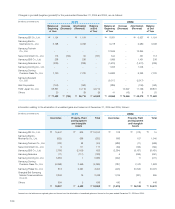

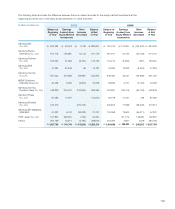

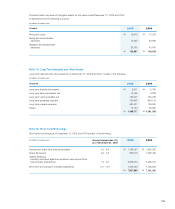

The changes in intangible assets for the years ended December 31, 2005 and 2004, are as follows:

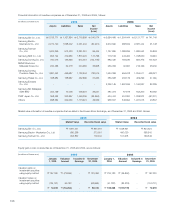

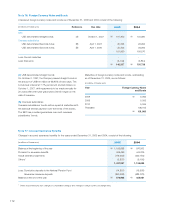

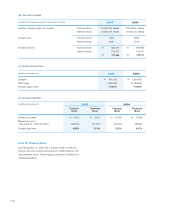

As of December 31, 2005, certain portion of domestic

and overseas subsidiaries’ property, plant and equipment,

up to a maximum of \

19,645 million, and \

5,620 million

(equivalent to US$ 5,547 thousand), respectively, is pledged

as collaterals for various loans from financial institutions.

As of December 31, 2005, property, plant, equipment are

insured against fire and other casualty losses, and business

interruption losses of up to \

55,261,920 million and

\

21,298,026 million, respectively.

As of December 31, 2005, the value of land owned by SEC

and its Korean subsidiaries based on the posted price issued

by the Korean tax authority amounted to \

2,743,672 million

(2004: \

2,051,313 million).

As of December 31, 2005, Samsung Card Co., Ltd., an SEC

subsidiary, has recorded \

432,958 million (2004: \

297,538

million) of operating lease assets and prepaid finance lease

assets acquired through the lease financing business (notes 8

and 19).

1 Acquisitions include amounts transferred from other accounts such as construction-in-progress.

2 Others include amounts from changes in consolidation category, merger and changes in foreign currency exchange rates.

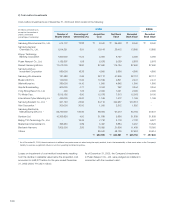

(in millions of Korean won) 2004

Goodwill Negative

Goodwill

Intellectual

property rights

Others Total

Balance

at January 1, 2004 \7,969 \(1,842) \213,920 \245,281 \465,328

Acquisition 11,821 - 53,748 145,823 201,392

Disposal - - (352) (3,149) (3,501)

Amortization (3,941) 621 (47,516) (65,353) (116,189)

Others 2 4,950 - 286 (7,744) (2,508)

Balance

at December 31, 2004 \10,799 \(1,221) \220,086 \314,858 \544,522

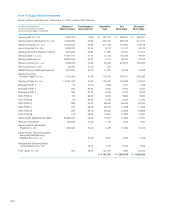

(in millions of Korean won) 2005

Goodwill Negative

Goodwill

Intellectual

property rights

Others Total

Balance

at January 1, 2005 \10,799 \(1,221) \220,086 \314,858 \544,522

Acquisition 14,518 - 73,702 166,050 244,270

Disposal (1,063) - (810) (1,430) (3,303)

Amortization (4,623) 622 (52,168) (97,828) (153,997)

Others 2208 - (56) 1,212 1,364

Balance

at December 31, 2005 \9,839 \(599) \240,754 \382,862 \632,856