Samsung 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

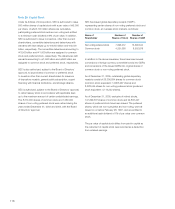

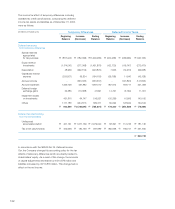

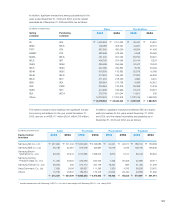

The fair value of each option grant was estimated using the

Black-Scholes option-pricing model based on the date of the

grant using the following assumptions:

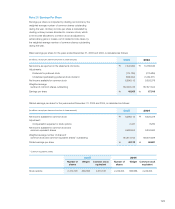

The compensation expense related to stock options

amounted to \59,439 million for the year ended December

31, 2005, and is estimated to be \18,224 million for the

periods thereafter.

Samsung Card Co. Ltd., a domestic subsidiary, has

granted 375,000 shares in stock options over two periods.

The exercise price and the number of shares granted to

employees and directors of Samsung Capital Co., Ltd. as

part of the merger in 2004 have been adjusted by 227,395

shares using the ratio of merger. The compensation expense

recognized by Samsung Card Co., Ltd. is \2 million (2004:

\111 million) for the year ended December 31, 2005. The

stock options of \1,231 million according to the SEC’s

ownership ratio are included in a separate component of

shareholders’ equity as other capital adjustments.

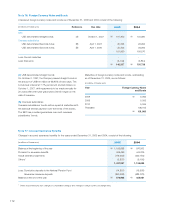

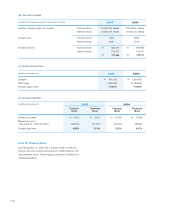

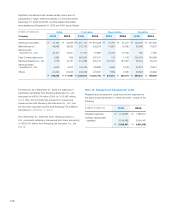

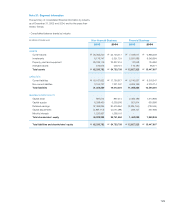

Note 26: Income Tax

The statutory income tax rate applicable to the Company,

including resident surtax, is approximately 27.5%.

Income tax expense for the years ended December 31, 2005

and 2004, consists of the following:

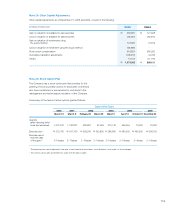

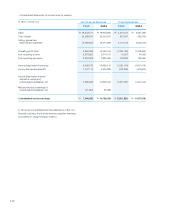

The following table reconciles the expected amount of income

tax expense based on Korean normal income tax rates to

the actual amount of taxes recorded by the Company for the

years ended December 31, 2005 and 2004:

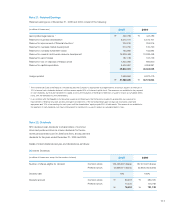

(in millions of Korean won) 2005 2004

Current income tax \1,586,753 \2,271,972

Increase (decrease) in

deferred income taxes (358,394) (54,132)

Items charged directly to

shareholders’ equity (10,113) (10,555)

\1,218,246 \2,207,285

(in millions of Korean won) 2005 2004

Income before taxes \8,125,313 \12,376,158

Statutory tax rate 27.5% 29.7%

Expected taxes

at statutory rate 2,234,461 3,675,719

Tax credit (1,292,932) (1,680,419)

Others, net 276,717 211,985

Actual taxes \1,218,246 \2,207,285

Effective tax rate 15.0% 17.8%

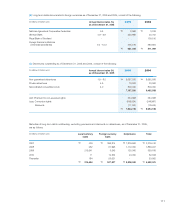

Date of the Grant

2000 2001 2002 2003 2004 2005

March 16 March 9 February 28 March 25 March 7 April 16 October 15 December 20

Risk-free

interest rates 9.08% 6.04% 5.71% 6.44% 4.62% 4.60% 3.56% 4.95%

Expected stock

price volatility 69.48% 74.46% 64.97% 64.90% 60.08% 43.09% 42.46% 32.71%

Expected life 4 years 4 years 3 years 3 years 3 years 3 years 3 years 3 years

Expected

dividend yield 0.39% 0.89% 0.73% 0.74% 1.25% 0.73% 0.99% 1.14%