Samsung 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

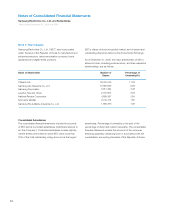

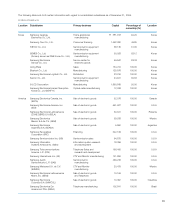

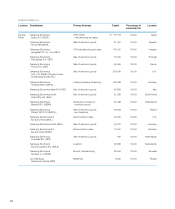

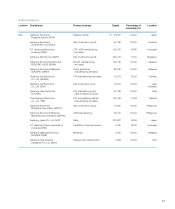

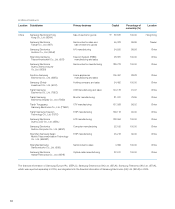

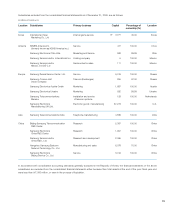

Changes in Subsidiaries Consolidated

(a) Details of subsidiaries newly included in the consolidated financial statements for the year ended December 31, 2005, are as follows:

Location Name of Subsidiaries Remark

Korea Samsung Electronics Hainan Fiberoptics Korea. Co., Ltd. (SEHF-K) Increase in assets

Asia Samsung Malaysia Electronics SDN BHD (SME) Increase in assets

Asia Samsung India Software Operations Pvt. Ltd. (SISO) Newly established

(b) The subsidiary excluded from the consolidated financial statements for the year ended December 31, 2005, is:

Area Name of subsidiaries Remark

Korea Novita Co., Ltd. Sold in 2005

Note 2: Summary of Significant Accounting Policies

The significant accounting policies followed by the Company

in the preparation of its consolidated financial statements are

summarized below:

Basis of Financial Statement Presentation

The Company maintains its accounting records in Korean

won and prepares statutory financial statements in the Korean

language in conformity with accounting principles generally

accepted in the Republic of Korea. Certain accounting

principles applied by the Company that conform with financial

accounting standards and accounting principles in the

Republic of Korea may not conform with generally accepted

accounting principles in other countries. Accordingly, these

financial statements are intended for use by those who are

informed about Korean accounting principles and practices.

The accompanying consolidated financial statements

have been condensed, restructured and translated into

English from the Korean language consolidated financial

statements. Certain information attached to the Korean

language consolidated financial statements, but not required

for a fair presentation of the Company’s financial position,

results of operations or cash flows, is not presented in the

accompanying consolidated financial statements.

Application of the Statements of Korean Financial

Accounting Standards

The Korean Accounting Standards Board has published a

series of Statements of Korean Financial Accounting Standards

(“SKFAS”), which will gradually replace the existing financial

accounting standards established by the Korean Financial

and Supervisory Board. SKFAS No.15 through No.17 became

applicable to the company in January 1, 2005. The Company

adopted these statements in its financial statements as of and

for the year ended December 31, 2005.

Use of Estimates

The preparation of the financial statements requires

management to make estimates and assumptions that affect

amounts reported therein. Although these estimates are

based on management’s best knowledge of current events

and actions that the Company may undertake in the future,

actual results may differ from those estimates.

Principles of Consolidation

All significant inter-company transactions and balances

have been eliminated in consolidation. The Company

records differences between the investment account and

corresponding capital account of subsidiaries as a goodwill

or a negative goodwill, and such differences are amortized

over five years using the straight-line method. However,

differences which occur from additional investments acquired

in consolidated subsidiaries are reported in a separate

component of shareholders’ equity, and are not included in

the determination of the results of operations. In accordance

with accounting principles generally accepted in the Republic

of Korea, minority interest in consolidated subsidiaries is

presented as a component of shareholders’ equity in the

consolidated balance sheet.