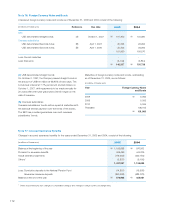

Samsung 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

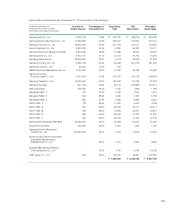

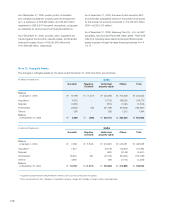

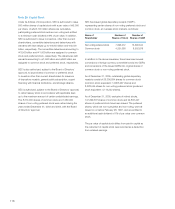

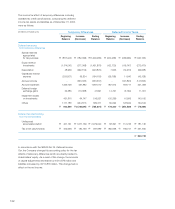

Note 18: Liability Provisions

The changes in main liability provisions for the year ended December 31, 2005, are as follows:

(in millions of Korean won) Reference January 1,

2005

Increase Decrease December 31,

2005

Warranty reserves (A) \ 237,758 \ 368,066 \ 403,376 \ 202,448

Royalty expenses (B) 700,052 349,513 227,767 821,798

Long-term incentives (C) - 133,579 - 133,579

(A) The Company accrues warranty reserves for estimated

costs of future service, repairs and recalls, based on historical

experience and terms of guarantees (1~4 years).

(B) The Company makes provisions for estimated royalty

expenses related to certain technical assistance agreements

that have not been renewed. The schedule of payment is still

under negotiation.

(C) The Company introduced long-term incentive plans for its

executives based on a three-year management performance

criteria and has made a provision for the estimated incentive cost

for the current year. The incentive is expected to be paid in 2008.

In addition, the Company’s domestic and overseas subsidiaries

accrue warranty reserves totaling \376,914 million.

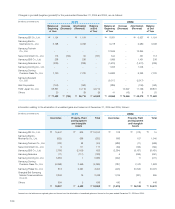

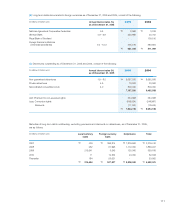

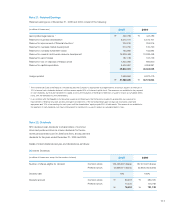

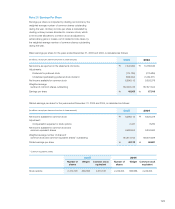

Note 19: Commitments and Contingencies

(A) As of December 31, 2005, the Company is contingently

liable for guarantees of indebtedness, principally for related

parties, approximating \8,307 million and US$885,918

thousand with a maximum limit of US$1,905,000 thousand.

In addition, as of December 31, 2005, the Company’s

overseas subsidiaries enter into “Cash Pooling Arrangement”

contracts and “Banking Facility” agreements with overseas

financial institutions for funds employment and provide mutual

guarantees of indebtedness.

(B) As of December 31, 2005, SEC and its domestic

subsidiaries are insured against future contract commitments

up to \137,079 million. In addition, Samsung Card Co.,

Ltd. is insured against future contract commitments relating

American Express from Woori Bank up to US$500 thousand.

(C) As of December 31, 2005, the Company has technical

assistance agreements with certain companies.

(D) As of December 31, 2005, SEC and its Korean subsi-

diaries have a bank overdraft facility agreement with various

Korean financial institutions with a combined maximum limit

of \718,500 million.

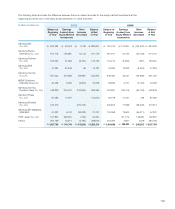

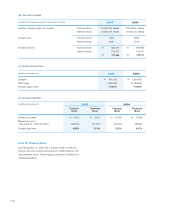

(E) The Company leases certain property, plant and equipment

under various capital lease arrangements. Assets recorded

under capitalized lease agreements are included in property,

plant and equipment with a total acquisition cost of \32,008

million. Depreciation expense for the capital lease assets

amounted to \1,917 million for the year ended December

31, 2005.

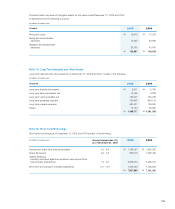

As of December 31, 2005, future minimum lease payments

under scheduled capital leases are as follows:

Area Participating

Subsidiaries

Financial

Institutions

Europe SEUK and 17 other subsidiaries Citibank and another bank

Asia SAPL and 6 other subsidiaries Bank of America

Asia SEMA and 2 other subsidiaries Standard Chartered bank

Year (in millions of Korean won)

2006 \4,346

2007 4,346

2008 4,346

2009 4,346

Thereafter 54,148

Total minimum payments 71,532

Amount representing interest (47,968)

Obligations

under capital leases \23,564