Pizza Hut 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2014Proxy StatementA-2

Proxy Statement

APPENDIX

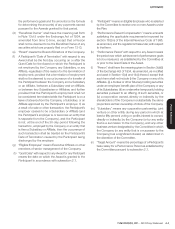

(b) In the sole discretion of the Committee, the Award for

each Participant may be limited to the Participant’s

Target Amount multiplied by the percent attainment

(determined in accordance with the applicable Award

Schedule), subject to the following:

(i) Subject to Section 3 and the provisions of this

subsection 2.2, the Committee may adjust such

Award for individual performance on the basis

of such quantitative and qualitative performance

measures and evaluations as it deems appropriate.

The Committee may make such adjustments as it

deems appropriate in the case of any Participant

whose position with the Company has changed

during the applicable Performance Period.

(ii) The Committee shall have the discretion to adjust

performance goals and the methodology used

to measure the determination of the degree of

attainment of such goals; provided, however, that, to

the extent required by the requirements applicable

to Performance-Based Compensation, any Award

designated as intended to satisfy the requirements

for Performance-Based Compensation may not be

adjusted under this paragraph (b) or otherwise in

a manner that increases the value of such Award.

Except as otherwise provided by the Committee,

the Committee shall retain the discretion to adjust

such Awards in a manner that does not increase

such Awards.

(c) Notwithstanding any other provision of the Plan, in no

event will a Participant become eligible for payment for an

Award for any calendar year in excess of $10,000,000.

(d) No segregation of any moneys or the creation of any

trust or the making of any special deposit shall be

required in connection with any Awards made or to

be made under the Plan.

2.3 Payment of Awards. Subject to Sections 2.5 and 3, the

amount earned with respect to any Award shall be paid

in cash at such time as is determined by the Committee;

provided, however, that unless otherwise provided by

the Committee, such payment shall be made no later

than the fifteenth day of the third month of the calendar

year following the calendar year in which the applicable

Performance Period ends. If a Participant to whom

an Award has been made dies prior to the payment

of the Award, such payment shall be delivered to the

Participant’s legal representative or to such other person

or persons as shall be determined by the Committee.

The Company shall have the right to deduct from all

amounts payable under the Plan any taxes required

by law to be withheld with respect thereto; provided,

however, that to the extent provided by the Committee,

any payment under the Plan may be deferred and to

the extent deferred, may be credited with an interest

or earnings factor as determined by the Committee.

2.4 Return of Overpayments. If the amount paid with

respect to an Award granted after December 31,

2008 is based on the attainment of a level of objective

performance goals that is later determined to have been

inaccurate, such inaccuracy was caused by misconduct

by an employee of the Company or a Subsidiary, and

as a result the amount paid with respect to the Award

is greater than it should have been, then:

(1) The Participant (regardless of whether then employed)

whose misconduct caused the inaccuracy will be

required to repay the excess.

(2) The Committee administering the Plan may require

an active or former Participant (regardless of whether

then employed) to repay the excess previously received

by that Participant if the Committee concludes that

the repayment is necessary to prevent the Participant

from unfairly benefiting from the inaccuracy. However,

repayment under this paragraph (2) shall apply to an

active or former Participant only if the Committee

reasonably determines that, prior to the time the amount

was paid (or, if payment of the amount is electively

deferred by the Participant, at the time the amount

would have been paid in the absence of the deferral),

such Participant knew or should have known that

the amount was greater than it should have been

by reason of the inaccuracy. Further, the amount to

be repaid by the Participant may not be greater than

the excess of (i) the amount paid to the Participant

over (ii) the amount that would have been paid to a

Participant in the absence of the inaccuracy, provided

that, in determining the amount under this clause (ii), the

Committee may take into account only the inaccuracy

of which the Participant knew or should have known,

and which the Participant knew or should have known

was caused by misconduct.

Instead of (or in addition to) requiring repayment, the

Committee may adjust a Participant’s future compensation

and the Company and/or Subsidiary shall be entitled to set-

off against the amount of any such gain any amount owed

to the Participant by the Company and/or Subsidiary. For

this purpose, the term “misconduct” means fraudulent or

illegal conduct or omission that is knowing or intentional.

However, the foregoing provisions of this subsection 2.4

shall not apply to any reductions in Awards made after a

Change in Control (as defined in the Yum! Brands, Inc.

Long Term Incentive Plan) to the extent that Awards were

granted before a Change in Control.