Pizza Hut 2013 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K 59

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

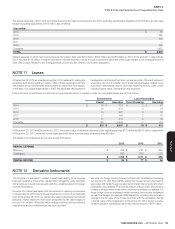

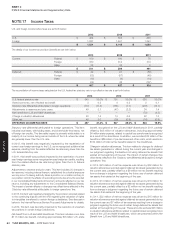

Information for pension plans with an accumulated benefit obligation in excess of plan assets:

U.S. Pension Plans International Pension Plans

2013 2012 2013 2012

Projected benefit obligation $ 102 $ 1,290 $ — $ —

Accumulated benefit obligation 94 1,239 — —

Fair value of plan assets — 945 — —

Information for pension plans with a projected benefit obligation in excess of plan assets:

U.S. Pension Plans International Pension Plans

2013 2012 2013 2012

Projected benefit obligation $ 102 $ 1,290 $ — $ —

Accumulated benefit obligation 94 1,239 — —

Fair value of plan assets — 945 — —

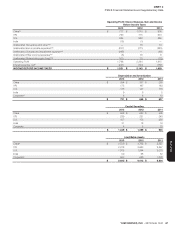

Components of net periodic benefit cost:

Net periodic benefit

cost

U.S. Pension Plans International Pension Plans

2013 2012 2011 2013 2012 2011

Service cost $ 21 $ 26 $ 24 $ 1 $ 2 $ 5

Interest cost 54 66 64 8 8 10

Amortization of prior

service cost(a) 2 1 1 — — —

Expected return on

plan assets (59) (71) (71) (12) (11) (12)

Amortization of net loss 48 63 31 1 1 2

NET PERIODIC

BENEFIT COST $ 66 $ 85 $ 49 $ (2

)

$—$ 5

Additional (gain) loss

recognized due to:

Settlements(b) $ 30 $ 89 $ — $ — $ — $ —

Special termination

benefits(c) $ 5 $ 3 $ 5 $ — $ — $ —

Curtailment(d) $ — $ — $ — $ (5) $ — $ —

(a) Prior service costs are amortized on a straight-line basis over the average remaining service period of employees expected to receive benefits.

(b) Settlement losses result from benefit payments exceeding the sum of the service cost and interest cost for each plan during the year. $10 million and $84 million for 2013 and 2012,

respectively of these settlement losses, were not allocated for performance reporting purposes. See Note 4 for discussion of the settlement payments and settlement losses.

(c) Special termination benefits primarily related to the U.S. business transformation measures taken in 2013, 2012 and 2011.

(d) Gain is a result of terminating future service benefits for all participants in one of our UK plans in 2013. The gain was recorded in YRI’s G&A expenses, as amounts in Accumulated other

comprehensive income (loss) related to this plan were in a net gain position.

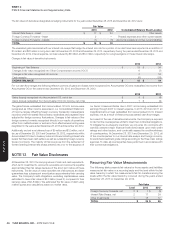

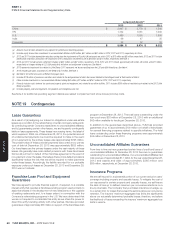

Pension (gains) losses in Accumulated other comprehensive income (loss):

U.S. Pension Plans International Pension Plans

2013 2012 2013 2012

Beginning of year $ 428 $ 543 $ 14 $ 30

Net actuarial (gain) loss (221) 43 10 (15)

Curtailments (3) (10) — —

Amortization of net loss (48) (63) (1) (1)

Amortization of prior service cost (2) (1) — —

Prior service cost — 5 — —

Settlement charges (30) (89) — —

Exchange rate changes — — — —

END OF YEAR $ 124 $ 428 $ 23 $ 14

Accumulated pre-tax losses recognized within Accumulated Other Comprehensive Income:

U.S. Pension Plans International Pension Plans

2013 2012 2013 2012

Actuarial net loss $ 119 $ 421 $ 23 $ 14

Prior service cost 5 7 — —

$ 124 $ 428 $ 23 $ 14