Pizza Hut 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K 65

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

Other.This item primarily includes the impact of permanent differences

related to current year earnings as well as U.S. tax credits and deductions.

In 2013, this item was negatively impacted by the $222 million non-cash

impairment of Little Sheep goodwill, which resulted in no related tax benefit.

In 2012, this item was positively impacted by a one-time pre-tax gain of

$74 million, with no related income tax expense, recognized on our

acquisition of additional interest in, and consolidation of Little Sheep.

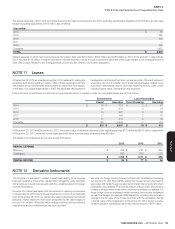

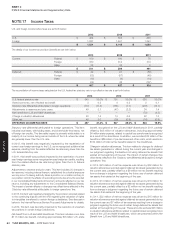

The details of 2013 and 2012 deferred tax assets (liabilities) are set forth below:

2013 2012

Operating losses and tax credit carryforwards $ 310 $ 337

Employee benefits 182 251

Share-based compensation 118 108

Self-insured casualty claims 48 50

Lease-related liabilities 120 115

Various liabilities 88 82

Property, plant and equipment 42 39

Deferred income and other 58 57

Gross deferred tax assets 966 1,039

Deferred tax asset valuation allowances (203) (200)

Net deferred tax assets $ 763 $ 839

Intangible assets, including goodwill $ (233) $ (256)

Property, plant and equipment (93) (95)

Other (55) (48)

Gross deferred tax liabilities $ (381) $ (399)

NET DEFERRED TAX ASSETS (LIABILITIES) $ 382 $ 440

Reported in Consolidated Balance Sheets as:

Deferred income taxes – current $ 123 $ 127

Deferred income taxes – long-term 399 467

Accounts payable and other current liabilities (2) (5)

Other liabilities and deferred credits (138) (149)

$ 382 $ 440

We have investments in foreign subsidiaries where the carrying values for

financial reporting exceed the tax basis. We have not provided deferred

tax on the portion of the excess that we believe is essentially permanent

in duration. This amount may become taxable upon an actual or deemed

repatriation of assets from the subsidiaries or a sale or liquidation of

the subsidiaries. We estimate that our total temporary difference upon

which we have not provided deferred tax is approximately $2.6 billion at

December 28, 2013. A determination of the deferred tax liability on this

amount is not practicable.

At December 28, 2013, the Company has foreign operating and capital loss

carryforwards of $0.6 billion and U.S. state operating loss, capital loss and

tax credit carryforwards of $1.2 billion and U.S. federal capital loss and tax

credit carryforwards of $0.2 billion. These losses are being carried forward in

jurisdictions where we are permitted to use tax losses from prior periods to

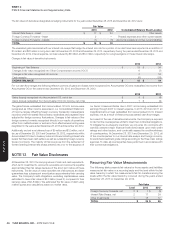

reduce future taxable income and will expire as follows:

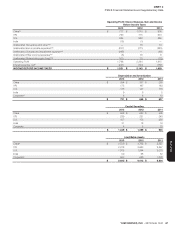

Year of Expiration

Total2014 2015-2018 2019-2033 Indefinitely

Foreign $ 38 $ 132 $ 91 $ 325 $ 586

U.S. state 16 105 1,040 — 1,161

U.S. federal — 90 64 — 154

$ 54 $ 327 $ 1,195 $ 325 $ 1,901

We recognize the benefit of positions taken or expected to be taken in

tax returns in the financial statements when it is more likely than not that

the position would be sustained upon examination by tax authorities. A

recognized tax position is measured at the largest amount of benefit that

is greater than fifty percent likely of being realized upon settlement.

The Company had $243 million and $309 million of unrecognized tax benefits

at December 28, 2013 and December 29, 2012, respectively, $170 million

and $184 million of which, if recognized, would impact the effective income

tax rate. A reconciliation of the beginning and ending amount of unrecognized

tax benefits follows:

2013 2012

Beginning of Year $ 309 $ 348

Additions on tax positions - current year 19 50

Additions for tax positions - prior years 55 23

Reductions for tax positions - prior years (102) (90)

Reductions for settlements (23) (6)

Reductions due to statute expiration (16) (16)

Foreign currency translation adjustment 1 —

END OF YEAR $ 243 $ 309