Pizza Hut 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2014Proxy Statement 41

Proxy Statement

EXECUTIVE COMPENSATION

Medical, Dental, Life Insurance and Disability Coverage

We also provide other benefits such as medical, dental, life

insurance and disability coverage to each NEO through

benefit plans, which are also provided to all eligible U.S.-

based salaried employees. Eligible employees can purchase

additional life, dependent life and accidental death and

dismemberment coverage as part of their employee benefits

package. Our broad-based employee disability plan limits

the annual benefit coverage to $300,000.

Perquisites

Mr. Novak is required to use the Company aircraft for personal

as well as business travel pursuant to the Company’s executive

security program established by the Board of Directors. The

Board’s security program also covers Mrs. Novak when

she accompanies Mr. Novak. The Board has considered

past instances of potential safety concerns for the CEO and

Mrs.Novak and consequently decided to require Mr. Novak to

use the corporate aircraft for personal travel. We do not provide

tax gross-ups on the personal use of the Company aircraft.

The Company pays for the cost of the transmission of home

security information from Mr. Novak’s home to our security

department.

Mr. Su receives perquisites related to his overseas assignment

which were part of his original compensation package and

ratified by the Committee. The Committee reviewed these

benefits during 2013 and has elected to continue to provide

them noting that this practice is consistent with how we treat

other executives on foreign assignment. Mr. Su’s agreement

stipulates that the following will be provided:

•Housing, commodities and utilities allowances

•Tax preparation services

•

Tax equalization to Hong Kong with respect to income

attributable to certain stock option and SAR exercises

and to distributions of deferred income

Upon retirement from the Company, Mr. Su will be required

to reimburse the Company for the tax reimbursements for

certain stock option and SAR exercises, if any, made within

six months of his retirement.

Compensation Policies & Practices

YUM’s Executive Stock Ownership Guidelines

The Committee has established stock ownership guidelines

for our top 600 employees, including the NEOs. If a NEO

or other executive does not meet his or her ownership

guidelines, he or she is not eligible for a long-term equity

incentive award. In 2013, all NEOs and all other employees

subject to guidelines met or exceeded their ownership

guidelines.

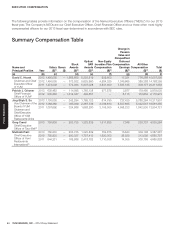

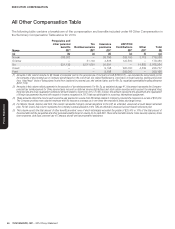

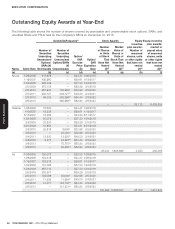

NEO Ownership Guidelines Shares Owned(1) Value of Shares(2) Multiple of Salary

Novak 336,000 2,741,863 $ 207,312,261 143

Grismer 30,000(3) 44,131 $ 3,336,745 5

Su 50,000 430,437 $ 32,545,342 30

Creed 50,000 110,772 $ 8,375,471 11

Pant 50,000 104,860 $ 7,928,465 11

(1) Calculated as of December 31, 2013 and represents shares owned outright and vested RSUs granted to Mr. Novak in 2008 and all RSUs awarded under the

Company’s Executive Income Deferral Program.

(2) Based on YUM closing stock price of $75.61 as of December 31, 2013.

(3) Mr. Grismer’s ownership guidelines will increase by 10,000 shares each of the next two years until 50,000 shares are reached.

Payments Upon Termination of Employment

The Company does not have agreements with its executives

concerning payments upon termination of employment

except in the case of a change in control of the Company.

The Committee believes these are appropriate agreements

for retaining NEOs and other executive officers to preserve

shareholder value in case of a potential change in control.

The Committee periodically reviews these agreements and

other aspects of the Company’s change in control program.