Pizza Hut 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2014Proxy Statement 31

Proxy Statement

EXECUTIVE COMPENSATION

Chief Executive Officer Pay

Our compensation program is designed to support our

long-term Company growth model, while holding our

executives accountable to achieve key annual results year

over year. As discussed on page 29, our CEO’s pay is tied

to performance, as 89% of Mr. Novak’s 2013 target pay

is at-risk. As demonstrated below, our Company has

continued to experience growth under the leadership and

strategic vision of Mr. Novak since he was named CEO in

2000. Mr. Novak is compensated in accordance with this

long-term perspective.

485%

Market Capitalization Growth

YUM’S LONG-TERM GROWTH UNDER MR. NOVAK’S LEADERSHIP

2000 2013

$5.7b

market capitalization $33.7b

market capitalization

(1) Restaurant count includes licensed units

Build powerful brands

• KFC is #1 brand in China;

• Pizza Hut China Casual Dining is #1

western casual dining chain with a

6:1 advantage;

• Taco Bell named marketer of the year

in the U.S.

Drive aggressive expansion

• Increased global restaurant counts by

33% to over 40,000(1) in 128 countries,

giving us almost a 2:1 advantage in

emerging markets

Create industry leading returns

• Achieved 13 year 855% total

shareholder return

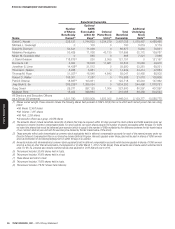

Every January the Committee makes decisions about the CEO’s target compensation based on performance and market

competitiveness. For 2013, the Committee determined that our CEO’s target cash compensation, consisting of base

salary and target bonus, was competitive compared to our Executive Peer Group and did not increase these elements.

In regards to actual cash compensation for 2013, our CEO’s pay decreased by 60% compared to the prior year, largely

due to an 80% decline in annual bonus. His annual bonus reflects below target performance. As demonstrated at page 32,

our CEO’s cash compensation correlates with earnings per share growth, which is our primary business performance

metric.