Pizza Hut 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K68

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

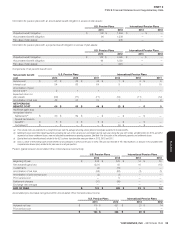

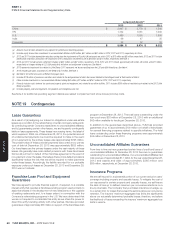

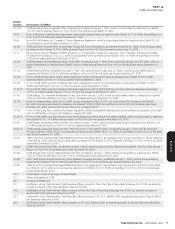

Long-Lived Assets(k)

201 3 2012 2011

China $ 2,667 $ 2,779 $ 1,546

YRI 1,732 1,561 1,600

U.S. 1,489 1,555 1,805

India 66 47 35

Corporate 32 32 36

$ 5,986 $ 5,974 $ 5,022

(a) Amounts have not been allocated to any segment for performance reporting purposes.

(b) Includes equity income from investments in unconsolidated affiliates of $26 million, $47 million and $47 million in 2013, 2012 and 2011, respectively, for China.

(c) 2012 and 2011 include depreciation reductions arising from the impairments of Pizza Hut UK restaurants we sold in 2012 of $13 million and $3 million, respectively. 2012 and 2011 include

depreciation reductions arising from the impairment of KFC restaurants we offered to sell of $3 million and $10 million, respectively. See Note 4.

(d) 2013 and 2012 include pension settlement charges of $22 million and $87 million, respectively. 2013, 2012 and 2011 include approximately $5 million, $5 million and $21 million,

respectively, of charges relating to U.S. G&A productivity initiatives and realignment of resources. See Note 4.

(e) 2013 represents impairment loss related to Little Sheep. 2011 represents net losses resulting from the LJS and A&W divestitures. See Note 4.

(f) 2012 includes gain upon acquisition of Little Sheep of $74 million. See Note 4.

(g) See Note 4 for further discussion of Refranchising gain (loss).

(h) Includes $118 million of premiums and other costs related to the extinguishment of debt. See Losses Related to the Extinguishment of Debt section of Note 4.

(i) China includes investments in 4 unconsolidated affiliates totaling $53 million, $72 million and $167 million for 2013, 2012 and 2011, respectively.

(j) Primarily includes cash, deferred tax assets and property, plant and equipment, net, related to our office facilities. 2011 includes $300 million of restricted cash related to the 2012 Little

Sheep acquisition.

(k) Includes property, plant and equipment, net, goodwill, and intangible assets, net.

See Note 4 for additional operating segment disclosures related to impairment and store closure (income) costs.

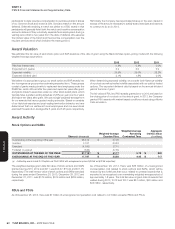

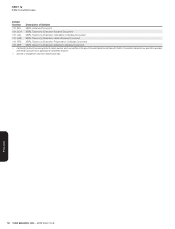

NOTE19 Contingencies

Lease Guarantees

As a result of (a) assigning our interest in obligations under real estate

leases as a condition to the refranchising of certain Company restaurants;

(b) contributing certain Company restaurants to unconsolidated affiliates;

and (c) guaranteeing certain other leases, we are frequently contingently

liable on lease agreements. These leases have varying terms, the latestof

which expires in 2066. As of December 28, 2013, the potential amount

of undiscounted payments we could be required to make in the event

of non-payment by the primary lessee was approximately $725 million.

The present value of these potential payments discounted at our pre-tax

cost of debt at December 28, 2013 was approximately $625 million.

Our franchisees are the primary lessees under the vast majority of these

leases. We generally have cross-default provisions with these franchisees

that would put them in default of their franchise agreement in the event of

non-payment under the lease. We believe these cross-default provisions

significantly reduce the risk that we will be required to make payments

under these leases. Accordingly, the liability recorded for our probable

exposure under such leases at December 28, 2013 and December 29,

2012 was not material.

Franchise Loan Pool and Equipment

Guarantees

We have agreed to provide financial support, if required, to a variable

interest entity that operates a franchisee lending program used primarily to

assist franchisees in the development of new restaurants or the upgrade

of existing restaurants and, to a lesser extent, in connection with the

Company’s refranchising programs in the U.S. We have determined that

we are not required to consolidate this entity as we share the power to

direct this entity’s lending activity with other parties. We have provided

guarantees of approximately $35 million in support of the franchisee loan

program at December 28, 2013. The total loans outstanding under the

loan pool were $38 million at December 28, 2013 with an additional

$42 million available for lending at December 28, 2013.

In addition to the guarantees described above, YUM has provided

guarantees of up to approximately $100 million on behalf of franchisees

for several financing programs related to specific initiatives. The total

loans outstanding under these financing programs were approximately

$44 million at December 28, 2013.

Unconsolidated Affiliates Guarantees

From time to time we have guaranteed certain lines of credit and loans of

unconsolidated affiliates. At December 28, 2013 there are no guarantees

outstanding for unconsolidated affiliates. Our unconsolidated affiliates had

total revenues of approximately $1.1 billion for the year ended December 28,

2013 and assets and debt of approximately $365 million and

$85 million, respectively, at December 28, 2013.

Insurance Programs

We are self-insured for a substantial portion of our current and prior years’

coverage including property and casualty losses. To mitigate the cost of

our exposures for certain property and casualty losses, we self-insure

the risks of loss up to defined maximum per occurrence retentions on a

line-by-line basis. The Company then purchases insurance coverage, up

to a certain limit, for losses that exceed the self-insurance per occurrence

retention. The insurers’ maximum aggregate loss limits are significantly

above our actuarially determined probable losses; therefore, we believe

the likelihood of losses exceeding the insurers’ maximum aggregate loss

limits is remote.