Pizza Hut 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K20

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

from suppliers. As a result of increased product testing and additional

regulatory scrutiny, instances of supplier noncompliance are identified

from time to time, leading to related actions by us and regulatory

authorities, including the termination of certain suppliers in accordance

with our policies.

KFC China sales were further negatively impacted beginning in April of

2013 by the intense media surrounding avian flu in China. The combined

impacts of the media attention surrounding the SFDA investigation and

avian flu resulted in a 13% decline in China Division same-store sales

for the full year. Operating Profit for 2013 declined 26%, prior to foreign

currency translation, due primarily to sales de-leverage at KFC.

As the extensive publicity in 2013 around these two events subsided, KFC

China’s sales began to recover, and same-store sales improved in each

consecutive month during China Division’s fourth quarter. KFC China’s

fourth quarter same-store sales declined 4% compared to same store

sales declines of 15% for the full year.

Given the momentum of the KFC business and the continued strength of

Pizza Hut Casual Dining, China Division 2014 Operating Profit is expected

to return to 2012 levels of more than $1 billion.

In light of increased attention on food safety issues in China generally,

and on poultry supply in particular, as well as recent reports of avian flu in

China, further reports relating to either issue could have a material adverse

effect on our sales and results of operations for our China Division. See

Item IA “Risk Factors” on page 6 for a discussion of risks relating to food

safety and avian flu.

Extra Week in 2011

Our fiscal calendar results in a 53

rd

week every five or six years. Fiscal year

2011 included a 53

rd

week in the fourth quarter for all our U.S. businesses

and certain of our YRI businesses that report on a period, as opposed to

a monthly, basis. Our China and India Divisions report on a monthly basis

and thus did not have a 53rdweek in 2011.

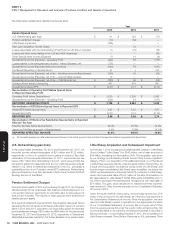

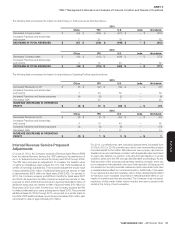

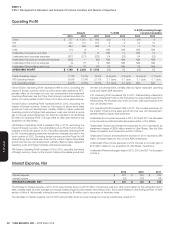

See the System Sales Growth section within our MD&A for further discussion on the impact of 53rdweek in 2011 on system sales. The following table

summarizes the estimated impact of the 53rdweek in 2011 on revenues and Operating Profit:

U.S. YRI Unallocated Total

Revenues

Company sales $ 43 $ 29 $ — $ 72

Franchise and license fees 13 6 — 19

Total Revenues $ 56 $ 35 $ — $ 91

Operating Profit

Franchise and license fees $ 13 $ 6 $ — $ 19

Restaurant profit 9 6 — 15

General and administrative expenses (4) (4) (1) (9)

Operating Profit(a) $ 18 $ 8 $ (1) $ 25

(a) The $25 million benefit was offset throughout 2011 by investments, including franchise development incentives, as well as higher-than-normal spending, such as restaurant closures in the

U.S. and YRI.

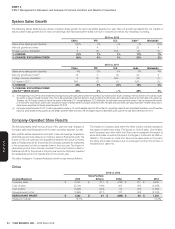

Store Portfolio Strategy

From time to time we sell Company restaurants to existing and new

franchisees where geographic synergies can be obtained or where

franchisees’ expertise can generally be leveraged to improve our overall

operating performance, while retaining Company ownership of strategic

U.S. and international markets in which we choose to continue investing

capital. We refranchised 214, 468 and 404 Company restaurants in the

U.S. in the years ended December 28, 2013, December 29, 2012 and

December 31, 2011, respectively. Additionally, in December 2012 we

refranchised 331 remaining Company-owned dine-in restaurants in the

Pizza Hut UK business.

The following table summarizes our worldwide refranchising activities,

including amounts characterized as Special Items:

2013 2012 2011

Number of units refranchised 286 897 529

Refranchising proceeds, pre-tax $ 260 $ 364 $ 246

Refranchising (gain) loss,

pre-tax $ (100) $ (78) $ 72

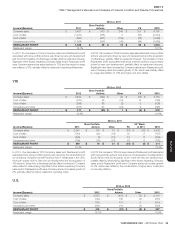

Refranchisings reduce our reported revenues and restaurant profits and

increase the importance of system sales growth as a key performance

measure. Additionally, G&A expenses will decline and franchise and

license expense can increase over time as a result of these refranchising

activities. The timing of G&A declines will vary and often lag the actual

refranchising activities as the synergies are typically dependent upon

the size and geography of the respective deals. G&A expenses included

in the tables below reflect only direct G&A expenses that we no longer

incurred as a result of stores that were operated by us for all or a portion

of the respective previous year and were no longer operated by us as of

the last day of the respective current year.

The impact on Operating Profit arising from refranchising is the net of

(a)the estimated reductions in restaurant profit and G&A expenses and

(b) the increase in franchise fees and expenses from the restaurants that

have been refranchised. The tables presented below reflect the impacts

on Total revenues and on Operating Profit from stores that were operated

by us for all or some portion of the respective previous year and were no

longer operated by us as of the last day of the respective current year.

In these tables, Decreased Company sales and Decreased Restaurant

profit represents the amount of Company sales or restaurant profit earned

by the refranchised restaurants during the period we owned them in the

prior year but did not own them in the current year. Increased Franchise

and license fees and income represents the franchise and license fees

and rent income from the refranchised restaurants that were recorded by

the Company in the current year during periods in which the restaurants

were Company stores in the prior year. Increased Franchise and license

expenses represent primarily rent and depreciation where we continue

to own or lease the underlying property for the refranchised restaurants

that were recorded by the Company in the current year during periods in

which the restaurants were Company stores in the prior year.