Pizza Hut 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K 29

Form 10-K

PART II

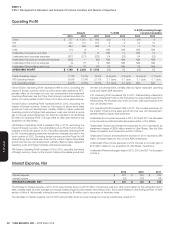

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

Income Taxes

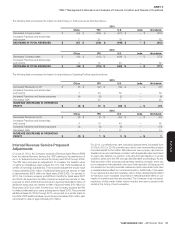

The reconciliation of income taxes calculated at the U.S. federal tax statutory rate to our effective tax rate is set forth below:

2013 2012 2011

U.S. federal statutory rate $ 543 35.0% $ 751 35.0% $ 580 35.0%

State income tax, net of federal tax benefit 3 0.2 4 0.2 2 0.1

Statutory rate differential attributable to foreign operations (177) (11.4) (165) (7.7) (218) (13.1)

Adjustments to reserves and prior years 49 3.1 (47) (2.2) 24 1.4

Net benefit from LJS and A&W divestitures — — — — (72) (4.3)

Change in valuation allowances 23 1.5 14 0.6 22 1.3

Other, net 46 3.0 (20) (0.9) (14) (0.9)

INCOME TAX PROVISION $ 487 31.4% $ 537 25.0% $ 324 19.5%

Statutory rate differential attributable to foreign operations. This itemincludes

local taxes, withholding taxes, and shareholder-level taxes, net of foreign

tax credits. The favorable impact is primarily attributable to a majority of

our income being earned outside the U.S. where tax rates are generally

lower than the U.S. rate.

In 2012, this benefit was negatively impacted by the repatriation of

current year foreign earnings to the U.S. as we recognized additional tax

expense, resulting from the related effective tax rate being lower than the

U.S. federal statutory rate.

In 2011, this benefit was positively impacted by the repatriation of current

year foreign earnings as we recognized excess foreign tax credits, resulting

from the related effective tax rate being higher than the U.S. federal

statutory rate.

Adjustments to reserves and prior years. This item includes: (1) changes in

tax reserves, including interest thereon, established for potential exposure

we may incur if a taxing authority takes a position on a matter contrary to

our position; and (2) the effects of reconciling income tax amounts recorded

in our Consolidated Statements of Income to amounts reflected on our tax

returns, including any adjustments to the Consolidated Balance Sheets.

The impact of certain effects or changes may offset items reflected in the

‘Statutory rate differential attributable to foreign operations’ line.

In 2013, this item was negatively impacted by the provision recorded to

the continuing dispute with the IRS regarding the valuation of rights to

intangibles transferred to certain foreign subsidiaries. See Internal Revenue

Service Proposed Adjustments section of Note 17.

In 2012, this item was favorably impacted by the resolution of uncertain

tax positions in certain foreign jurisdictions.

Net benefit from LJS and A&W divestitures. This item includes a one-time

$117 million tax benefit, including approximately $8 million state benefit,

recognized on the LJS and A&W divestitures in 2011, partially offset by

$45 million of valuation allowance, including approximately $4 million state

expense related to capital loss carryforwards recognized as a result of

the divestitures. In addition, we recorded $32 million of tax benefits on

$86million of pre-tax losses and other costs which resulted in $104 million

of total net tax benefits related to the divestitures.

Change in valuation allowances. This item relates to changes for deferred

tax assets generated or utilized during the current year and changes in

our judgment regarding the likelihood of using deferred tax assets that

existed at the beginning of the year. The impact of certain changes may

offset items reflected in the ‘Statutory rate differential attributable to foreign

operations’ line.

In 2013, $23 million of net tax expense was driven by $32 million for

valuation allowances recorded against deferred tax assets generated during

the current year, partially offset by a $9 million net tax benefit resulting

from a change in judgment regarding the future use of certain deferred

tax assets that existed at the beginning of the year.

In 2012, $14 million of net tax expense was driven by $16 million for

valuation allowances recorded against deferred tax assets generated during

the current year, partially offset by a $2 million net tax benefit resulting

from a change in judgment regarding the future use of certain deferred

tax assets that existed at the beginning of the year.

In 2011, $22 million of net tax expense was driven by $15 million for

valuation allowances recorded against deferred tax assets generated during

the current year and $7 million of tax expense resulting from a change in

judgment regarding the future use of certain foreign deferred tax assets that

existed at the beginning of the year. These amounts exclude $45 million

in valuation allowance additions related to capital losses recognized as a

result of the LJS and A&W divestitures, which are presented within ‘Net

Benefit from LJS and A&W divestitures’.

Other. This item primarily includes the impact of permanent differences

related to current year earnings as well as U.S. tax credits and deductions.

In 2013, this item was negatively impacted by the $222 million non-cash

impairment of Little Sheep goodwill, which resulted in no related tax benefit.

In 2012, this item was positively impacted by a one-time pre-tax gain

of $74million, with no related income tax expense, recognized on our

acquisition of additional interest in, and consolidation of Little Sheep.

Consolidated Cash Flows

Net cash provided by operating activities was $2,139 million in 2013

compared to $2,294 million in 2012. The decrease was primarily due to

lower Operating Profit before Special Items and higher income taxes paid.

In 2012, net cash provided by operating activities was $2,294 million

compared to $2,170 million in 2011. The increase was primarily driven

by higher Operating Profit before Special Items, partially offset by timing

of cash payments for operating expenses and higher income taxes paid.

Net cash used in investing activities was $886 million in 2013 compared

to $1,005 million in 2012. The decrease was primarily driven by lapping

the acquisition of Little Sheep and release of related restricted cash. See

Little Sheep Acquisition and Subsequent Impairment section of Note 4.

In 2012, net cash used in investing activities was $1,005 million compared

to $1,006 million in 2011. The acquisition of Little Sheep, increased capital

spending in China and the lapping of proceeds from the 2011 divestitures

of LJS and A&W were offset by the release of restricted cash related to the

Little Sheep acquisition and higher proceeds from refranchising in 2012.