Pizza Hut 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K18

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

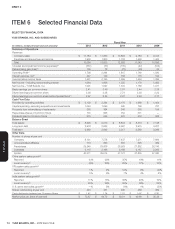

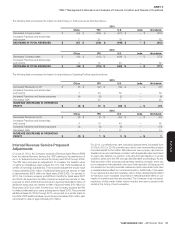

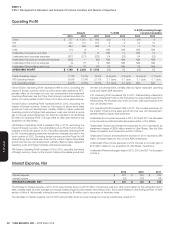

The table below details items classified as Special Items.

Year

2013 2012 2011

Detail of Special Items

U.S. Refranchising gain (loss) $ 91 $ 122 $ (17)

Pension settlement charges (10) (84) —

Little Sheep impairment (295) — —

Gain upon acquisition of Little Sheep — 74 —

Losses associated with the refranchising of the Pizza Hut UK dine-in business (1) (70) (76)

Losses and other costs relating to the LJS and A&W divestitures — — (86)

Other Special Items Income (Expense) (7) 16 (8)

Special Items Income (Expense) – Operating Profit (222) 58 (187)

Losses related to the extinguishment of debt – Interest Expense, net (118) — —

Special Items Income (Expense) before income taxes (340) 58 (187)

Tax Benefit (Expense) on Special Items(a) 41 1 123

Special Items Income (Expense), net of tax – including noncontrolling interests (299) 59 (64)

Special Items Income (Expense), net of tax – noncontrolling interests 19 — —

Special Items Income (Expense), net of tax – YUM! Brands, Inc. $ (280) $ 59 $ (64)

Average diluted shares outstanding 461 473 481

Special Items diluted EPS $ (0.61) $ 0.13 $ (0.13)

Reconciliation of Operating Profit Before Special Items

to Reported Operating Profit

Operating Profit before Special Items $ 2,020 $ 2,236 $ 2,002

Special Items Income (Expense) – Operating Profit (222) 58 (187)

REPORTED OPERATING PROFIT $ 1,798 $ 2,294 $ 1,815

Reconciliation of EPS Before Special Items to Reported EPS

Diluted EPS before Special Items $ 2.97 $ 3.25 $ 2.87

Special Items EPS (0.61) 0.13 (0.13)

REPORTED EPS $ 2.36 $ 3.38 $ 2.74

Reconciliation of Effective Tax Rate Before Special Items to Reported

Effective Tax Rate

Effective Tax Rate before Special Items 28.0% 25.8% 24.2%

Impact on Tax Rate as a result of Special Items(a) 3.4% (0.8)% (4.7)%

REPORTED EFFECTIVE TAX RATE 31.4% 25.0% 19.5%

(a) The tax benefit (expense) was determined based upon the impact of the nature, as well as the jurisdiction of the respective individual components within Special Items.

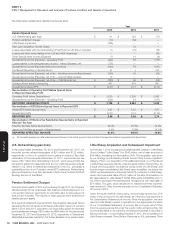

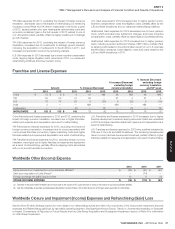

U.S. Refranchising gain (loss)

In the years ended December 28, 2013 and December 29, 2012, we

recorded pre-tax refranchising gains of $91 million and $122 million,

respectively, in the U.S. primarily due to gains on sales of Taco Bell

restaurants. In the year ended December 31, 2011, we recorded pre-tax

losses of $17 million from refranchising in the U.S., which were primarily the

net result of gains from restaurants sold and non-cash impairment charges

related to our offers to refranchise restaurants in the U.S., principally a

substantial portion of our Company-owned KFC restaurants. Refranchising

gains and losses are more fully discussed in Note 4 and the Store Portfolio

Strategy Section of the MD&A.

Pension Settlement Charges

During the fourth quarter of 2012 and continuing through 2013, the Company

allowed certain former employees with deferred vested balances in our

U.S. pension plans an opportunity to voluntarily elect an early payout of

their pension benefits. The majority of these payouts were funded from

existing pension assets.

As a result of settlement payments from the programs discussed above

exceeding the sum of service and interest costs within these U.S. pension

plans in 2013 and 2012, pursuant to our accounting policy we recorded

pre-tax settlement charges of $10 million and $84 million for the years ended

December 28, 2013 and December 29, 2012, respectively, in General and

administrative expenses. See Note 14 for further discussion of our pension plans.

Little Sheep Acquisition and Subsequent Impairment

On February 1, 2012 we acquired an additional 66% interest in Little Sheep

Group Limited (“Little Sheep”) for $540 million, net of cash acquired of

$44million, increasing our ownership to 93%.The acquisition was driven

by our strategy to build leading brands across China in every significant

category.Prior to our acquisition of this additional interest, our 27% interest

in Little Sheep was accounted for under the equity method of accounting.As

a result of the acquisition we obtained voting control of Little Sheep, and

thus we began consolidating Little Sheep upon acquisition.As required by

GAAP, we remeasured our previously held 27% ownership in Little Sheep,

which had a recorded value of $107 million at the date of acquisition, at

fair value based on Little Sheep’s traded share price immediately prior to

our offer to purchase the business and recognized a non-cash gain of

$74 million.This gain, which resulted in no related income tax expense,

was recorded in Other (income) expense on our Consolidated Statement

of Income in 2012.

Under the equity method of accounting, we previously reported our 27%

share of the net income of Little Sheep as Other (income) expense in

the Consolidated Statements of Income. Since the acquisition, we have

reported Little Sheep’s results of operations in the appropriate line items

of our Consolidated Statement of Income.We no longer report Other

(income) expense as we did under the equity method of accounting.Net

income attributable to our partner’s ownership percentage is recorded in

Net Income (loss) – noncontrolling interests. In 2012, the consolidation of

Little Sheep increased China Division Revenues by 4%, decreased China