Pizza Hut 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K50

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

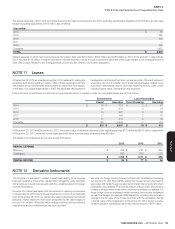

Losses Related to the Extinguishment of Debt

During the fourth quarter of 2013, we completed a cash tender offer to

repurchase $550 million of our Senior Unsecured Notes due either March

2018 or November 2037. This transaction resulted in $120 million of losses

as a result of premiums paid and other costs, $118 million of which was

classified as Interest expense, net in our Consolidated Statement of Income.

The repurchase of the Senior Unsecured Notes was funded primarily

by proceeds of $599 million received from the issuance of new Senior

Unsecured Notes. See Note 10 for further discussion on the issuance of

Senior Unsecured Notes.

Pension Settlement Charges

During the fourth quarter of 2012 and continuing through 2013, the Company

allowed certain former employees with deferred vested balances in our

U.S. pension plans an opportunity to voluntarily elect an early payout of

their pension benefits. The majority of these payouts were funded from

existing pension plan assets.

As a result of settlement payments exceeding the sum of service and interest

costs within these U.S. pension plans in 2013 and 2012, pursuant to our

accounting policy we recorded pre-tax settlement charges of $30 million

and $89 million for the years ended December 28, 2013 and December 29,

2012, respectively, in General and administrative expenses. These

amounts included settlement charges of $10 million and $84 million in the

years ended December 28, 2013 and December 29, 2012, respectively,

related to the programs discussed above that were not allocated for

performance reporting purposes. See Note 14 for further discussion of

our pension plans.

U.S. Business Transformation

As part of our plan to transform our U.S. business we took several measures

in 2013, 2012 and 2011 (“the U.S. business transformation measures”).

These measures included: continuation of our U.S. refranchising; G&A

productivity initiatives and realignment of resources (primarily severance

and early retirement costs).

For information on our U.S. refranchising, see the Refranchising (Gain)

Loss section below.

In connection with our G&A productivity initiatives and realignment of

resources (primarily severance and early retirement costs), we recorded

pre-tax charges of $5 million, $5 million and $21 million in the years

ended December 28, 2013, December 29, 2012 and December 31,

2011, respectively. The unpaid current liability for the severance portion

of these charges was $1 million and $5 million as of December 28, 2013

and December 29, 2012, respectively. Severance payments in the years

ended December 28, 2013, December 29, 2012 and December 31, 2011

totaled approximately $4 million, $14 million and $4 million respectively.

We are not including the impacts of these U.S. business transformation

measures in our U.S. segment for performance reporting purposes as we

do not believe they are indicative of our ongoing operations.

LJS and A&W Divestitures

In 2011 we sold the Long John Silver’s and A&W All American Food

Restaurants brands to key franchise leaders and strategic investors in

separate transactions.

We recognized $86 million of pre-tax losses and other costs primarily in

Closures and impairment (income) expenses during 2011 as a result of

these transactions. Additionally, we recognized $104 million of tax benefits

related to tax losses associated with the transactions.

We are not including the pre-tax losses and other costs in our U.S. and

YRI segments for performance reporting purposes as we do not believe

they are indicative of our ongoing operations. In 2012, System sales and

Franchise and license fees and income in the U.S. were negatively impacted

versus 2011 by 5% and 6%, respectively, due to these divestitures while

YRI’s system sales and Franchise and license fees and income were both

negatively impacted by 1%. While these divestitures negatively impacted

both the U.S. and YRI segments’ Operating Profit by 1% in 2012, the

impact on our consolidated Operating Profit was not significant.

Refranchising (Gain) Loss

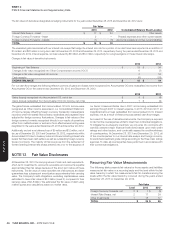

The Refranchising (gain) loss by reportable segment is presented below.

We do not allocate such gains and losses to our segments for performance

reporting purposes.

Refranchising (gain) loss

2013 2012 2011

China $ (5) $ (17) $ (14)

YRI(a) (4) 61 69

U.S.(b) (91) (122) 17

India — — —

WORLDWIDE $ (100) $ (78) $ 72

(a) During the fourth quarter of 2012, we refranchised our remaining 331 Company-owned Pizza Hut dine-in restaurants in the United Kingdom (“UK”). The franchise agreement for these stores

allows the franchisee to pay continuing franchise fees in the initial years of the agreement at a reduced rate. We agreed to allow the franchisee to pay these reduced fees in part as consideration

for their assumption of lease liabilities related to underperforming stores that we anticipate they will close that were part of the refranchising. We recognize the estimated value of terms in

franchise agreements entered into concurrently with a refranchising transaction that are not consistent with market terms as part of the upfront refranchising (gain) loss. Accordingly, upon the

closing of this refranchising we recognized a loss of $53 million representing the estimated value of these reduced continuing fees. The associated deferred credit is being amortized into YRI’s

Franchise and license fees and income through 2016. This upfront loss largely contributed to a $70 million Refranchising loss we recognized during 2012 as a result of this refranchising. Also

included in that loss was the write-off of $14 million in goodwill allocated to the Pizza Hut UK reporting unit. The remaining carrying value of goodwill allocated to our Pizza Hut UK business of

$87 million, immediately subsequent to the aforementioned write-off, was determined not to be impaired as the fair value of the Pizza Hut UK reporting unit exceeded its carrying amount. For the

year ended December 28, 2013, the refranchising of the Pizza Hut UK dine-in restaurants decreased Company sales by 18% and increased Franchise and license fees and income and Operating

Profit by 2% and 3%, respectively, for the YRI Division versus 2012.

During 2011, we recorded a $76 million charge in Refranchising (gain) loss as a result of our decision to refranchise or close all of our remaining Company-owned Pizza Hut UK dine-in

restaurants, primarily to write down these restaurants’ long-lived assets to their then estimated fair value. Impairment charges of Pizza Hut UK long-lived assets incurred as a result of this decision,

including the charge mentioned in the previous sentence, reduced depreciation expense versus what would have otherwise been recorded by $13 million and $3 million for the years ended

December 29, 2012 and December 31, 2011, respectively. These depreciation reductions were not allocated to the YRI segment resulting in depreciation expense in the YRI segment results

continuing to be recorded at the rate which it was prior to the impairment charges being recorded for these restaurants.

(b) U.S. Refranchising (gain) loss in the years ended December 28, 2013 and December 29, 2012 is primarily due to gains on sales of Taco Bell restaurants. U.S. Refranchising (gain) loss in

the year ended December 31, 2011 is primarily due to losses on sales of and offers to refranchise KFCs in the U.S. The non-cash impairment charges that were recorded related to our

offers to refranchise these Company-owned KFC restaurants in the U.S. decreased depreciation expense versus what would have otherwise been recorded by $3 million and $10 million in

the years ended December 29, 2012 and December 31, 2011, respectively. These depreciation reductions were not allocated to the U.S. segment resulting in depreciation expense in the

U.S. segment results continuing to be recorded at the rate at which it was prior to the impairment charges being recorded for these restaurants.

See Note 2 for our policy for writing off goodwill in a refranchising transaction.