Pizza Hut 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K66

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

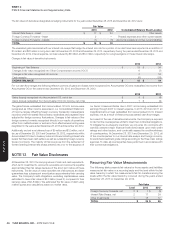

The Company believes it is reasonably possible its unrecognized tax

benefits may decrease by approximately $26 million in the next twelve

months, including approximately $20 million which, if recognized upon

audit settlement or statute expiration, would affect the 2014 effective tax

rate. Each of these positions is individually insignificant.

The Company’s income tax returns are subject to examination in the U.S.

federal jurisdiction and numerous foreign jurisdictions. The following table

summarizes our major jurisdictions and the tax years that are either currently

under audit or remain open and subject to examination:

Jurisdiction Open Tax Years

U.S. Federal 2004–2013

China 2010–2013

United Kingdom 2010–2013

Mexico 2006–2013

Australia 2009–2013

In addition, the Company is subject to various U.S. state income tax examinations, for which, in the aggregate, we had significant unrecognized tax

benefits at December 28, 2013, each of which is individually insignificant.

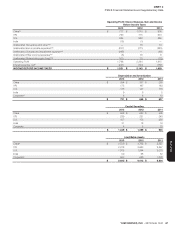

The accrued interest and penalties related to income taxes at December 28, 2013 and December 29, 2012 are set forth below:

2013 2012

Accrued interest and penalties $ 64 $ 50

During 2013, 2012 and 2011, a net expense of $18 million, net benefit

of $3 million and net benefit of $2 million, respectively, for interest and

penalties was recognized in our Consolidated Statements of Income as

components of its income tax provision.

Internal Revenue Service Proposed

Adjustments

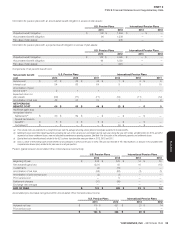

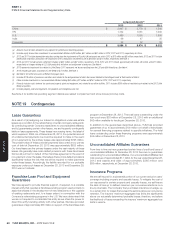

On June 23, 2010, the Company received a Revenue Agent Report (RAR)

from the Internal Revenue Service (the “IRS”) relating to its examination of

our U.S. federal income tax returns for fiscal years 2004 through 2006. The

IRS has proposed an adjustment to increase the taxable value of rights

to intangibles used outside the U.S. that YUM transferred to certain of its

foreign subsidiaries. The proposed adjustment would result in approximately

$700 million of additional taxes plus net interest to date of approximately

$255 million for fiscal years 2004-2006. On January 9, 2013, the Company

received an RAR from the IRS for fiscal years 2007 and 2008. As expected,

the IRS proposed an adjustment similar to their proposal for 2004-2006

that would result in approximately $270 million of additional taxes plus

net interest to date of approximately $40 million for fiscal years 2007 and

2008. Furthermore, the Company expects the IRS to make similar claims

for years subsequent to fiscal 2008. The potential additional taxes for 2009

through 2013, computed on a similar basis to the 2004-2008 additional

taxes, would be approximately $140 million plus net interest to date of

approximately $10 million.

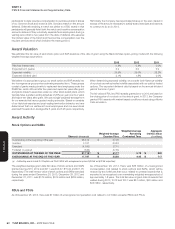

We believe we have properly reported our taxable income and paid taxes

consistent with all applicable laws and intend to vigorously defend our

position, including through litigation, if we are unable to settle with the IRS

through administrative proceedings. As the final resolution of the proposed

adjustments remains uncertain, there can be no assurance that payments

due upon final resolution of this issue will not exceed our currently recorded

reserve and such payments could have a material adverse effect on our

financial position. Additionally, if increases to our reserves are deemed

necessary due to future developments related to this issue, such increases

could have a material adverse effect on our results of operations as they are

recorded. The Company does not expect resolution of this matter within

twelve months and cannot predict with certainty the timing of such resolution.

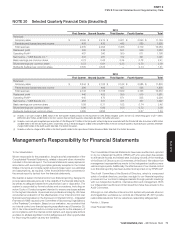

NOTE18 Reportable Operating Segments

We are principally engaged in developing, operating, franchising and

licensing the worldwide KFC, Pizza Hut and Taco Bell concepts. KFC, Pizza

Hut and Taco Bell operate in 118, 91, and 21 countries and territories,

respectively. Our five largest international markets based on Operating

Profit in 2013 are China, Asia Franchise, United Kingdom, Australia and

Latin America Franchise.

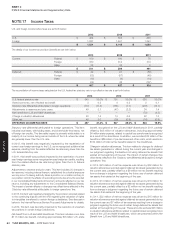

We identify our operating segments based on management responsibility.

The China Division includes mainland China and the India Division includes

India, Bangladesh, Mauritius, Nepal and Sri Lanka. YRI includes the

remainder of our international operations. We consider our KFC, Pizza Hut

and Taco Bell operating segments in the U.S. to be similar and therefore

have aggregated them into a single reportable operating segment. Our

U.S. and YRI segment results also include the operating results of our

LJS and A&W businesses prior to our disposal of those businesses in

December 2011.

Revenues

2013 2012 2011

China $ 6,905 $ 6,898 $ 5,566

YRI 3,099 3,281 3,192

U.S. 2,953 3,352 3,786

India 127 102 82

$ 13,084 $ 13,633 $ 12,626