Pizza Hut 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2014Proxy Statement 53

Proxy Statement

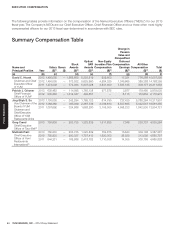

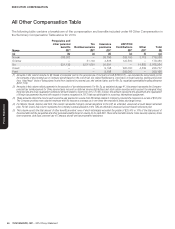

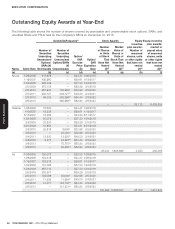

EXECUTIVE COMPENSATION

(4) Present Value of Accumulated Benefits

For all plans, the Present Value of Accumulated Benefits

(determined as of December 31, 2013) is calculated assuming

that each participant is eligible to receive an unreduced benefit

payable in the form of a single lump sum at age 62. This is

consistent with the methodologies used in financial accounting

calculations. In addition, the economic assumptions for

the lump sum interest rate, post retirement mortality, and

discount rate are also consistent with those used in financial

accounting calculations at each measurement date.

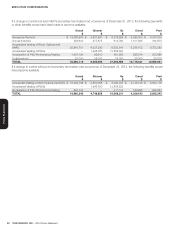

Nonqualified Deferred Compensation

Amounts reflected in the Nonqualified Deferred Compensation

table below are provided for under the Company’s Executive

Income Deferral (“EID”) Program, Leadership Retirement

Plan (“LRP”) and Third Country National Plan (“TCN”). These

plans are unfunded, unsecured deferred, account-based

compensation plans. For each calendar year, participants

are permitted under the EID Program to defer up to 85%

of their base pay and up to 100% of their annual incentive

award. As discussed beginning at page 40, Messrs. Novak,

Grismer and Pant are eligible to participate in the LRP. The

LRP provides an annual allocation to the accounts of Messrs.

Novak and Grismer equal to 9.5% of each of his salary

plus target bonus and to Mr. Pant’s account equal to 20%

of his salary plus target bonus. As discussed beginning at

page 40, Mr. Creed is eligible to participate in the TCN. The

TCN provides for an annual allocation to Mr. Creed’s account

equal to 15% of his salary plus target bonus.

EID Program

Deferred Investments under the EID Program. Amounts deferred

under the EID Program may be invested in the following phantom

investment alternatives (12 month investment returns are shown

in parentheses):

•YUM! Stock Fund (16.26%*)

•YUM! Matching Stock Fund (16.26%*)

•S&P 500 Index Fund (32.32%)

•Bond Market Index Fund (-2.12%)

•Stable Value Fund (1.58%)

All of the phantom investment alternatives offered under the

EID Program are designed to match the performance of actual

investments; that is, they provide market rate returns and do

not provide for preferential earnings. The S&P 500 index fund,

bond market index fund and stable value fund are designed

to track the investment return of like-named funds offered

under the Company’s 401(k) Plan. The YUM! Stock Fund

and YUM! Matching Stock Fund track the investment return

of the Company’s common stock. Participants may transfer

funds between the investment alternatives on a quarterly basis

except (1) funds invested in the YUM! Stock Fund or YUM!

Matching Stock Fund may not be transferred once invested

in these funds and (2) a participant may only elect to invest

into the YUM! Matching Stock Fund at the time the annual

incentive deferral election is made. In the case of the Matching

Stock Fund, participants who defer their annual incentive into

this fund acquire additional phantom shares (called restricted

stock units (“RSUs”)) equal to 33% of the RSUs received with

respect to the deferral of their annual incentive into the YUM!

Matching Stock Fund (the additional RSUs are referred to

as “matching contributions”). The RSUs attributable to the

matching contributions are allocated on the same day the

RSUs attributable to the annual incentive are allocated, which

is the same day we make our annual stock appreciation right

grants. Amounts attributable to the matching contribution

under the YUM! Matching Stock Fund are reflected in column

(c) below as contributions by the Company (and represent

amounts actually credited to the NEO’s account during 2013)�

Beginning with their 2009 annual incentive award, NEOs are

no longer eligible to participate in the Matching Stock Fund�

RSUs attributable to annual incentive deferrals into the YUM!

Matching Stock Fund and matching contributions vest on

the second anniversary of the grant (or upon a change of

control of the Company, if earlier) and are payable as shares

of YUM common stock pursuant to the participant’s deferral

election� Unvested RSUs held in a participant’s YUM! Matching

Stock Fund account are forfeited if the participant voluntarily

terminates employment with the Company within two years

of the deferral date� If a participant terminates employment

involuntarily, the portion of the account attributable to the

matching contributions is forfeited and the participant will

receive an amount equal to the amount of the original amount

deferred� If a participant dies or becomes disabled during

the restricted period, the participant fully vests in the RSUs�

Dividend equivalents are accrued during the restricted period

but are only paid if the RSUs vest� RSUs held by a participant

who has attained age 65 with five years of service vest

immediately. In the case of a participant who has attained age

55 with 10 years of service, RSUs attributable to pre-2009

bonus deferrals into the YUM! Matching Stock Fund vest

immediately and RSUs attributable to the matching contribution

vest on a pro rata basis during the period beginning on the

date of grant and ending on the first anniversary of the grant

and are fully vested on the first anniversary.

* Assumes dividends are not reinvested.