Pizza Hut 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2014Proxy Statement30

Proxy Statement

EXECUTIVE COMPENSATION

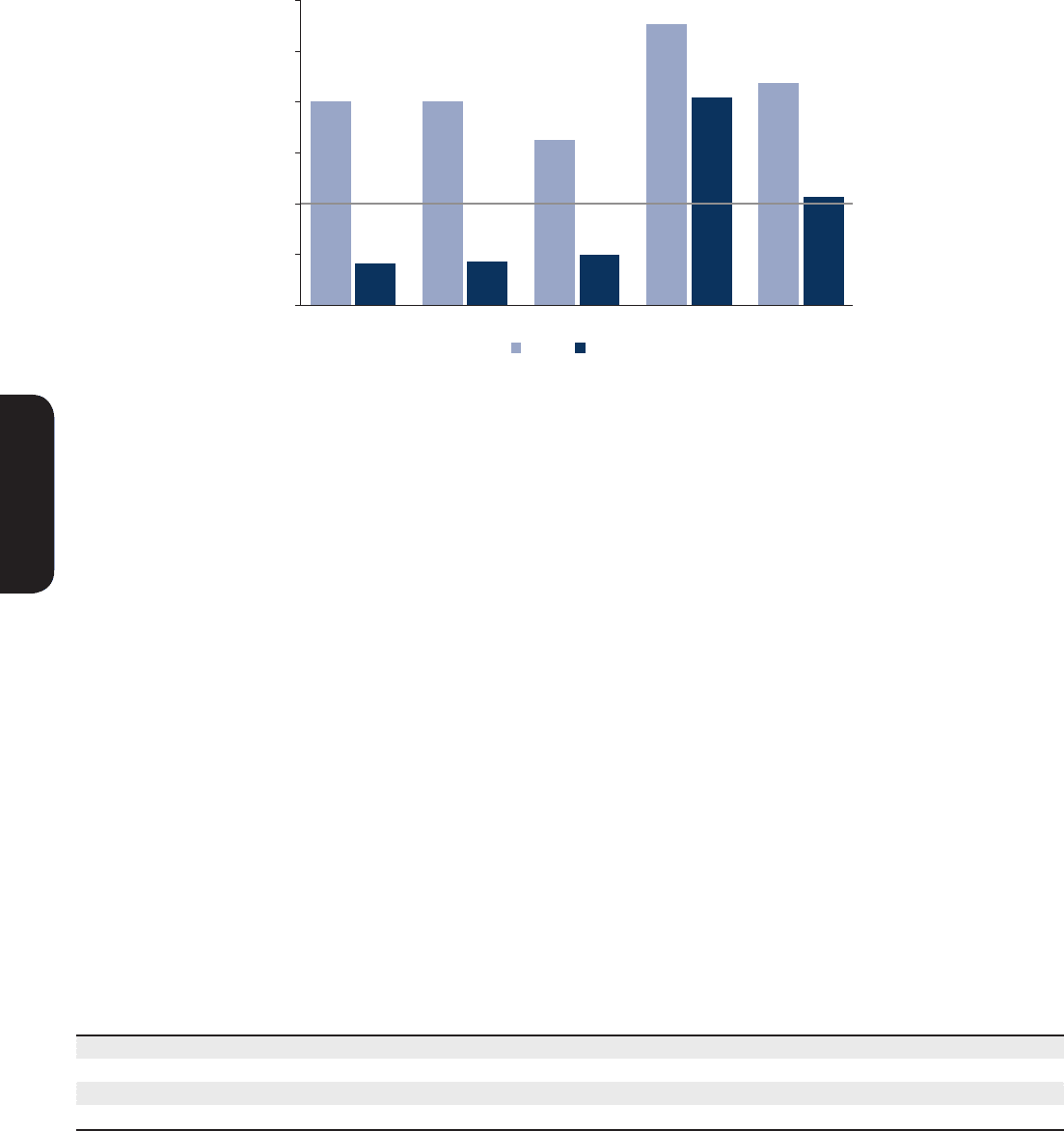

As indicated below, three out of the five NEOs had below target bonus payouts in 2013 as they did not achieve target performance

levels.

NEO TARGET BONUS VS. ACTUAL(1)

GRISMER

Target

Bonus

SU CREED PANTNOVAK

198% 198%

161%

41% 43% 49%

273%

202% 216%

105%

(1) Bonus payout as percentage of target

Actual (%)

0

50

100

150

200

250

300

20132012

Long-term incentive payouts also decreased under our Performance Share Plan. 2011 PSU awards were not paid out to

our NEOs since the earnings per share average during the 2011-2013 performance cycle did not reach the required

minimum average growth threshold of seven percent.

These results reflect our commitment to pay-for-performance.

2013 Compensation Changes

As discussed in last year’s CD&A, as a result of our 2012

shareholder vote and feedback, the following changes were

made to our compensation program for 2013:

•

Updated the Company’s Executive Peer Group to better

align the size of the peer group companies with YUM.

•

Eliminated use of similar metrics in short-term incentive

(“STI”) and long-term incentive (“LTI”) programs by re-

designing our 2013-2015 performance share plan to

measure relative total shareholder return vs. the S&P 500.

•

Increased use of performance shares in our LTI program

by changing the CEO’s mix from 90% SARs and 10%

PSUs to 75% SARs and 25% PSUs.

•

Replaced our CEO’s nonqualified pension benefits under

the Pension Equalization Plan (“PEP”) with a benefit in

the Leadership Retirement Plan (“LRP”). As a result of

this change, Mr. Novak will receive a long-term benefit

that is similar to what he would have received under PEP,

assuming historically normal interest rates, without the

fluctuation from interest rate volatility that is inherent in

the PEP.

•

Consistent with the dominant governance model, eliminated

excise tax gross-ups upon a change in control for current

and future agreements and implemented double trigger

vesting upon a change in control of the Company for

equity awards made in 2013 and beyond.

Executive Compensation Governance Practices

We employ key compensation governance practices that provide a foundation for our pay for performance program.

We Do We Don’t Do

✓Executive Stock Ownership Guidelines ✗Employment agreements

✓Compensation recovery (i.e., “clawback”) ✗Re-pricing of SARs or stock options

✓Limited future severance agreements ✗Excise tax gross-ups upon change in control

✓Double trigger vesting of equity awards upon change in control ✗Hedging or pledging of Company stock

The philosophies, actions and practices described above reinforce our longstanding commitment to an executive

compensation program that emphasizes performance and shareholder alignment.