Pizza Hut 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K16

Form 10-K

PART II

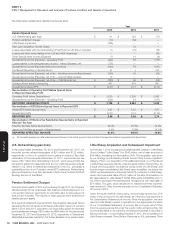

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

As of and through December 28, 2013, YUM’s business consists of

four reporting segments: YUM China (“China” or “China Division”), YUM

Restaurants International (“YRI” or “International Division”), United States

(“U.S.”) and YUM Restaurants India (“India” or “India Division”). The China

Division includes mainland China and the India Division includes India,

Bangladesh, Mauritius, Nepal and Sri Lanka. YRI includes the remainder

of our international operations. The China Division, YRI and Taco Bell

U.S. represent approximately 90% of the Company’s operating profits,

excluding Corporate and unallocated income and expenses.

In the first quarter of 2014, we will combine our YRI and U.S. businesses

and begin reporting segment information for three global divisions: KFC,

Pizza Hut and Taco Bell. China and India will remain separate reporting

segments due to their strategic importance and growth potential. This

new structure is designed to drive greater global brand focus, enabling

us to more effectively share know-how and accelerate growth. While our

consolidated results will not be impacted, we will restate our historical

segment information during 2014 for consistent presentation.

In 2012, our India Division began being reported as a standalone reporting

segment separate from YRI as a result of changes to our management

reporting structure. While our consolidated results are not impacted, our

historical segment information has been restated to be consistent with

the current period presentation.

In December of 2011 we sold our Long John Silver’s (“LJS”) and A&W All

American Food Restaurants (“A&W”) brands to key franchise leaders and

strategic investors in separate transactions. The results for these businesses

through the sale dates are included in the Company’s results for 2011.

Strategies

The Company has historically focused on the following four key strategies:

Build Leading Brands in China in Every Significant Category– The

Company has developed the KFC and Pizza Hut brands into the leading

quick service and casual dining restaurant brands, respectively, in mainland

China.Additionally, the Company owns and operates the distribution

system for its restaurants in China which we believe provides a significant

competitive advantage.Given this strong competitive position, a growing

economy and a population of 1.4 billion in mainland China, the Company is

rapidly adding KFC and Pizza Hut Casual Dining restaurants, beginning to

develop Pizza Hut Home Service (home delivery) and testing the additional

restaurant concept of East Dawning (Chinese food).Additionally, on

February 1, 2012 we acquired an additional 66% interest in Little Sheep

Group Ltd. (“Little Sheep”), a leading casual dining concept in China.

This acquisition brought our total ownership to approximately 93% of

the business. Our ongoing earnings growth model in China includes low

double-digit percentage unit growth, mid-single digit same-store sales

growth and moderate margin improvement, which we expect to drive

Operating Profit growth of 15%.

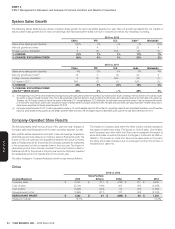

Drive Aggressive International Expansion and Build Strong Brands

Everywhere– Outside the U.S. and China the Company and its franchisees

opened over 1,200 new restaurants in 2013, representing 14 straight years

of opening over 700 restaurants, and the Company is one of the leading

international retail developers in terms of units opened.The Company

expects to continue to experience strong growth by building out existing

markets and growing in new markets including India, France, Germany,

Russia and across Africa.The International Division’s Operating Profit has

experienced a 10-year compound annual growth rate of approximately

12%.Our ongoing earnings growth model for YRI includes Operating

Profit growth of 10% driven by 3-4% unit growth, system sales growth

of 6%, at least 2-3% same-store sales growth, margin improvement and

leverage of our G&A infrastructure.

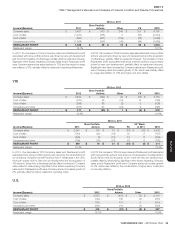

Dramatically Improve U.S. Brand Positions, Consistency and

Returns– The Company continues to focus on improving its U.S. position

through differentiated products and marketing and an improved customer

experience.The Company also strives to provide industry-leading new

product innovation which adds sales layers and expands day parts.We

continue to evaluate our returns and ownership positions with an earn-

the-right-to-own philosophy on Company-owned restaurants.Our ongoing

earnings growth model for the U.S. calls for Operating Profit growth of 5%

driven by same-store sales growth of at least 2%, margin improvement

and leverage of our G&A infrastructure.

Drive Industry-Leading, Long-Term Shareholder and Franchisee Value–

The Company is focused on delivering high returns and returning substantial

cash flows to its shareholders via dividends and share repurchases.The

Company has one of the highest returns on invested capital in the QSR

industry.The Company’s dividend and share repurchase programs have

returned over $3.3 billion and $8.5 billion to shareholders, respectively,

since 2004.The Company targets an annual dividend payout ratio of

35% to 40% of net income and has increased the quarterly dividend at

a double-digit percentage rate each year since first initiating a dividend

in 2004.Shares are repurchased opportunistically as part of our regular

capital structure decisions.

Our ongoing earnings growth model, including the components above,

is expected to generate EPS growth of at least 10% annually. However,

due primarily to poor performance in our China Division, the Company’s

2013 EPS prior to Special Items declined 9%. Our 2014 EPS prior to

Special Items is expected to grow at least 20% due in large part to our

expectations that China Division Operating Profit for 2014 will grow at a

rate significantly above the ongoing growth rate of 15% indicated above.

2013 Highlights

•

KFC China sales and profits were significantly impacted by the effects

of the December 2012 poultry supply incident, as well as subsequent

news of avian flu.

•

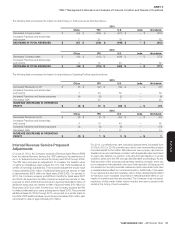

Worldwide system sales grew 2%, prior to foreign currency translation,

including 5% growth at YRI and 1% growth in the U.S. System sales

declined 4% in China.

•

Same-store sales declined 13% in China. Same-store sales grew 1%

at YRI and were flat in the U.S.

•Total international development was 1,952 new restaurants.

•

Worldwide restaurant margin declined 1.6 percentage points to 15.0%,

including a decline of 2.7 percentage points in China. Restaurant margin

was even at YRI and increased 0.6 percentage points in the U.S.

•

Worldwide operating profit declined 10%, prior to foreign currency

translation, including a decline of 26% in China. Operating profit grew

10% at YRI and 3% in the U.S.

•

Worldwide effective tax rate increased to 28.0% from 25.8%, driven

primarily by a tax reserve adjustment in the third quarter. The tax rate

increase negatively impacted 2013 EPS results by 3 percentage points.

•

A non-cash, Special Items net charge of $258 million related to the

write-down of Little Sheep intangible assets was recorded in the third

quarter. This charge impacted reported EPS by 16 percentage points

for the full year.

•

The Company repurchased $550 million of outstanding debt in the

fourth quarter and recorded a Special Items net charge of approximately

$75 million, primarily due to premiums paid related to this transaction. This

charge impacted reported EPS by 5 percentage points for the full year.

All preceding comparisons are versus the same period a year ago

and exclude the impact of Special Items unless otherwise noted. See

the Significant Known Events, Trends or Uncertainties Impacting or

Expected to Impact Comparisons of Reported or Future Results section

of this MD&A for a description of Special Items.